Ethereum price target raised at Standard Chartered. Here’s the new forecast

What Forex Target Traders See: We are currently sitting at 1.3009 . We got the break out to the upside and now waiting for a correction before going long. We are looking for a continuation to the R5/ resistance at 1.3129. The next major target above is the -01.270 fib extension at 1.3238s. The average (14 day) daily true range (ATR) for the pair currently is 102 pips.

——————————————————————————–

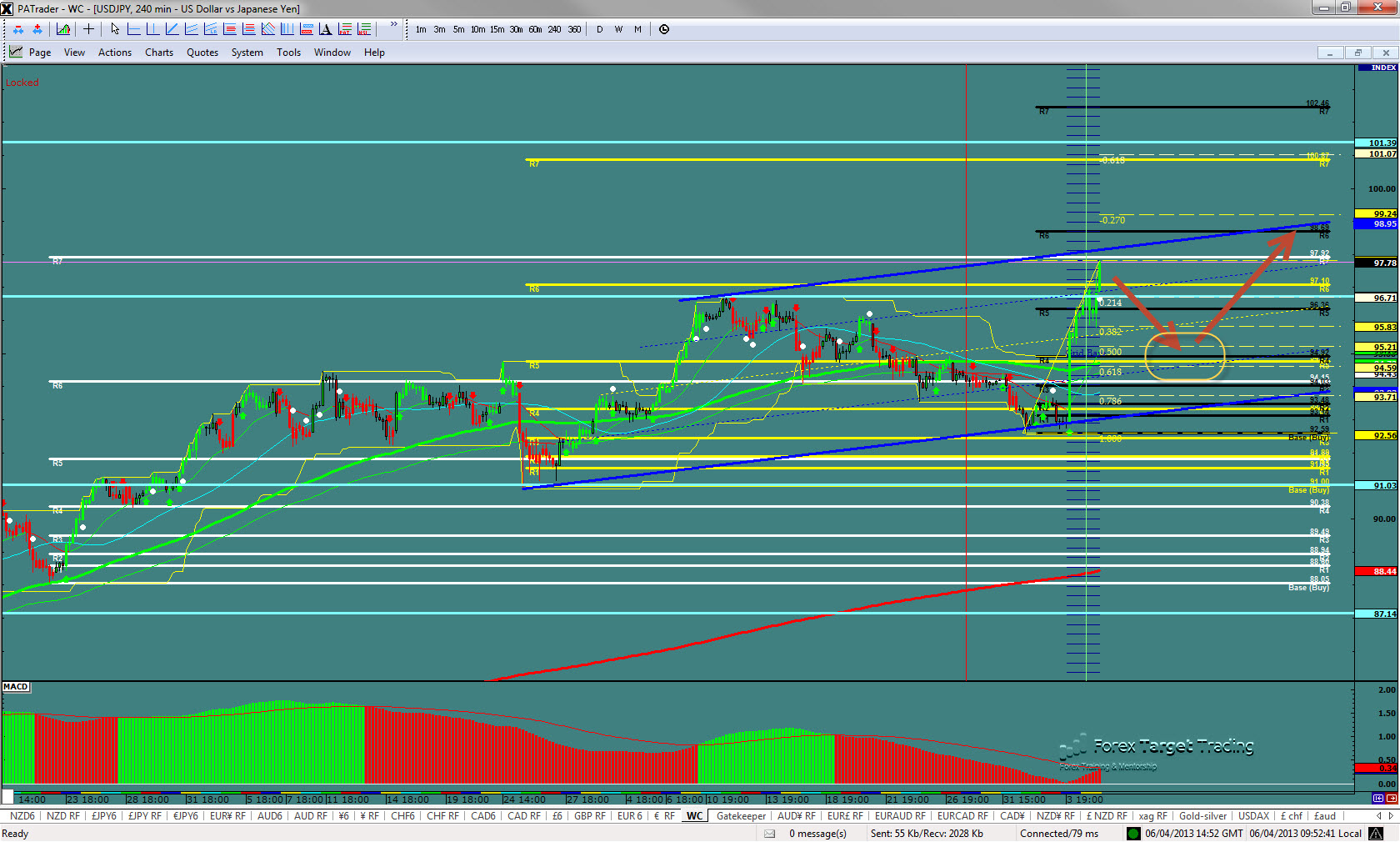

USD/JPY

What Forex Target Traders See: We are currently at 97.78 and near the top of the trend wall after an explosive move to the upside. We will need to get a pullback hopefully to the .500 fibo at 95.20 and then the longs should get in place. If the market corrects and bounces near the 95.20 area, we will look to going long to the 3rd wave R6 resistance at 98.70 and maybe to the 1.270 Fib Extension at 99.24. The average (14 day) daily true range (ATR) for the pair currently is 119 pips.

——————————————————————————–

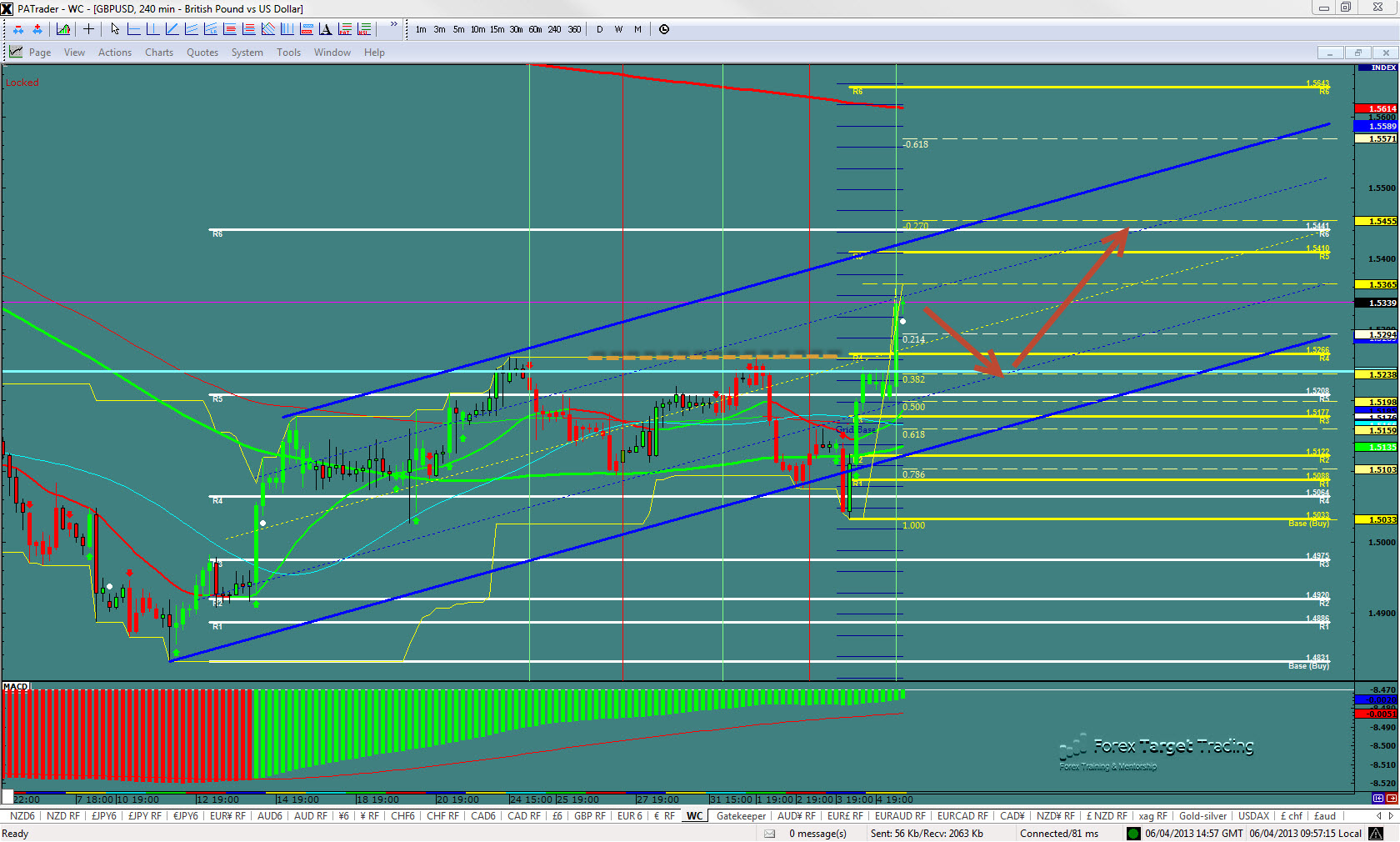

GBP/USD

What Forex Target Traders See: Cable is currently at 1.5339. We are looking for a continuation to the R6 resistance at 1.5441 after a shallow correction (.382 at 1.5238). It may not get that low and bounce on the R4 at 1.5266. The average (14 day) daily true range (ATR) for the pair currently is 100 pips.

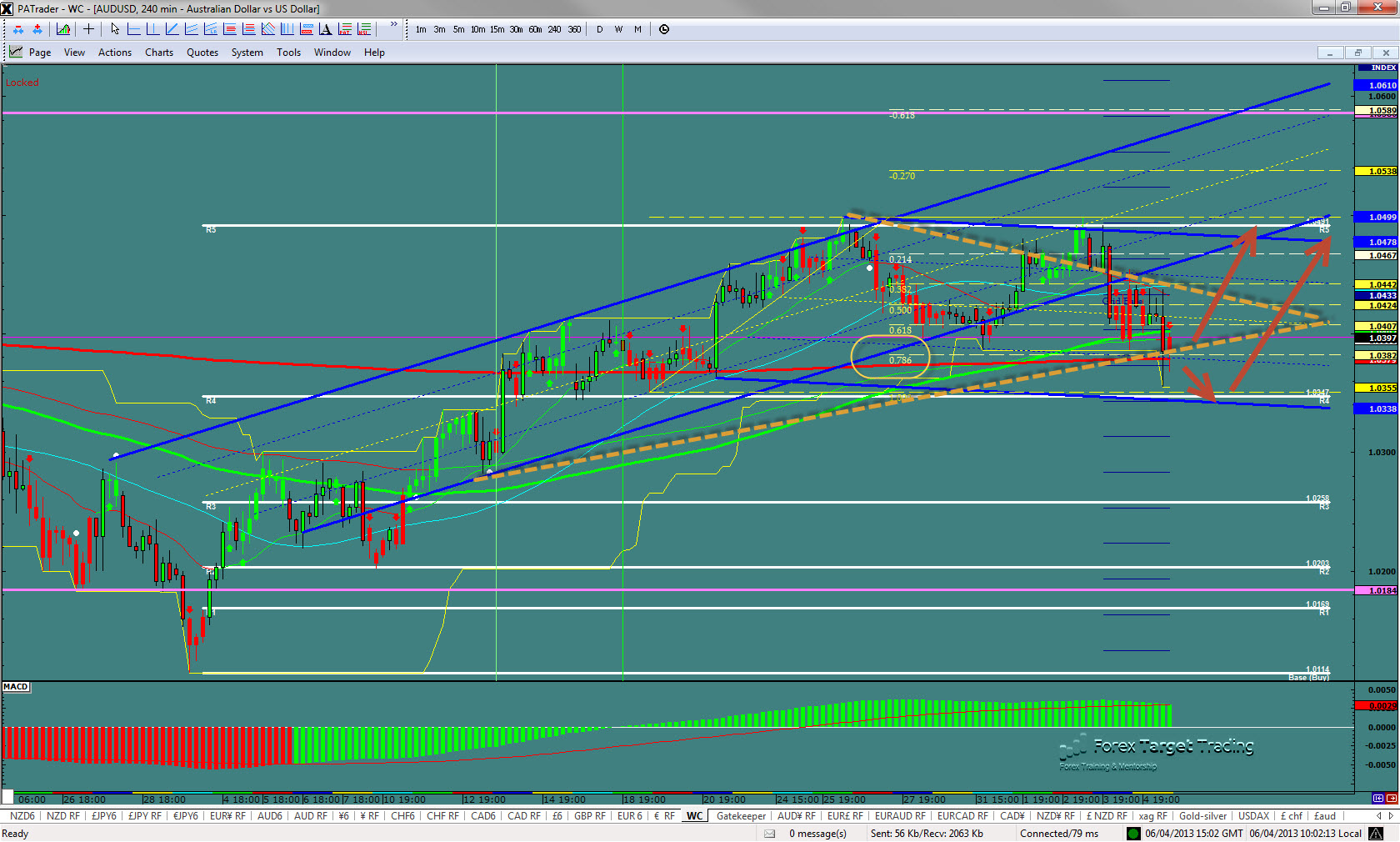

AUD/USD – A great smooth currency for Newbie’s!

What Forex Target Traders See: Aussie is currently at 1.0355 –in a wedge pattern. We are sitting on the .786 fibo which is a bounce point. Although we could go lower to the support at 1.0350 the immediate target is currently the R5 at 1.0490 area. The average (14 day) daily true range (ATR) for the pair currently is 56 pips.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.