Nvidia to resume H20 chip sales in China, announces new processor

Note: Currently US Dollar Index Futures is sort of bullish after FOMC – affects the direction below so I will give both scenarios.

EUR/USD

What ProAct Forex Target Traders See: We are currently sitting at 1.1944 in a range (1 pips from last weeks start). A couple of different scenarios: 1: Bullish: a move to the Day Top at 1.2095 area and 2: Bearish: A break down to the 0.786 Fibo support at 1.1755 and then the bottom at 1.1659. Bearish bias! The average daily true range (ATR) for the pair currently is 87 pips.

————————————————————————--

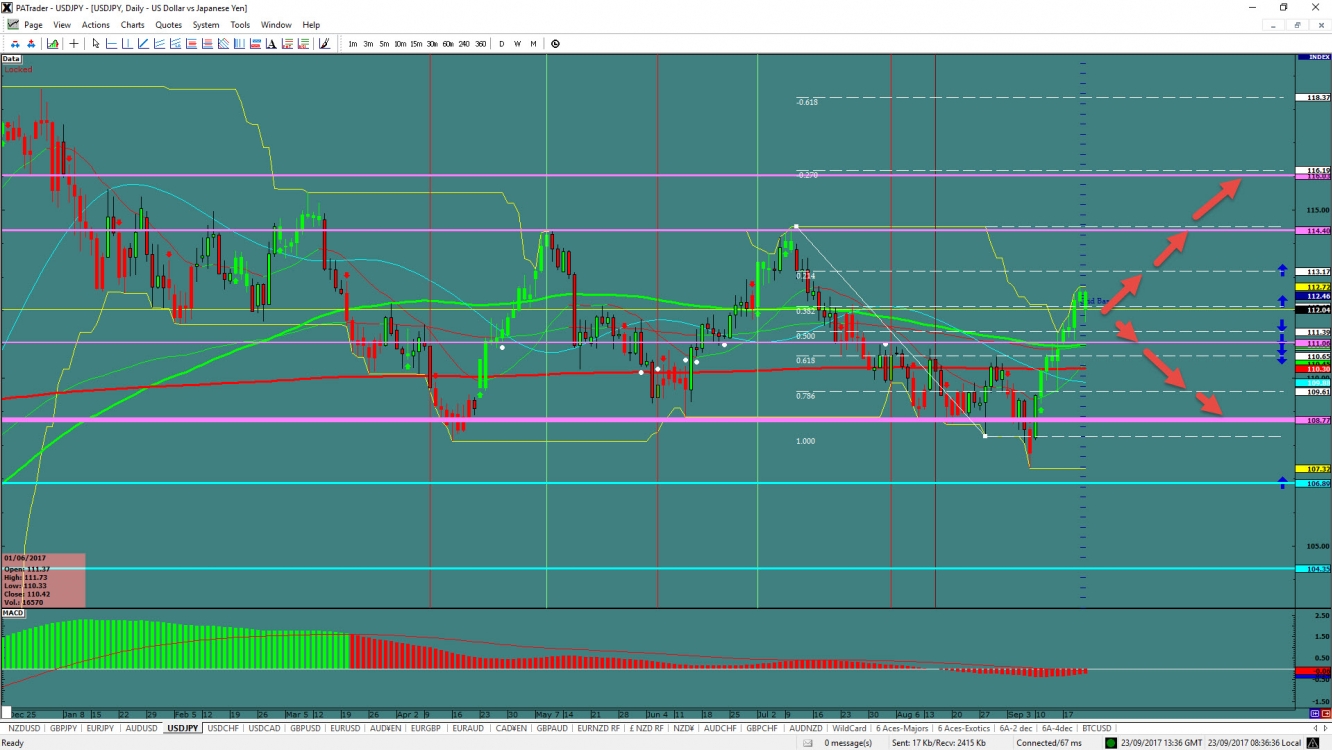

USD/JPY

What ProAct Forex Target Traders See: We are currently sitting at 112.04 in a range. A couple of different scenarios: 1: Bullish: a move to the range top at 114.40 area and 2: Bearish: A break down to the 0.786 Fibo support at 109.61 and then the bottom at 108.77. Bullish bias! The average daily true range (ATR) for the pair currently is 93 pips.

——————————————————————————–

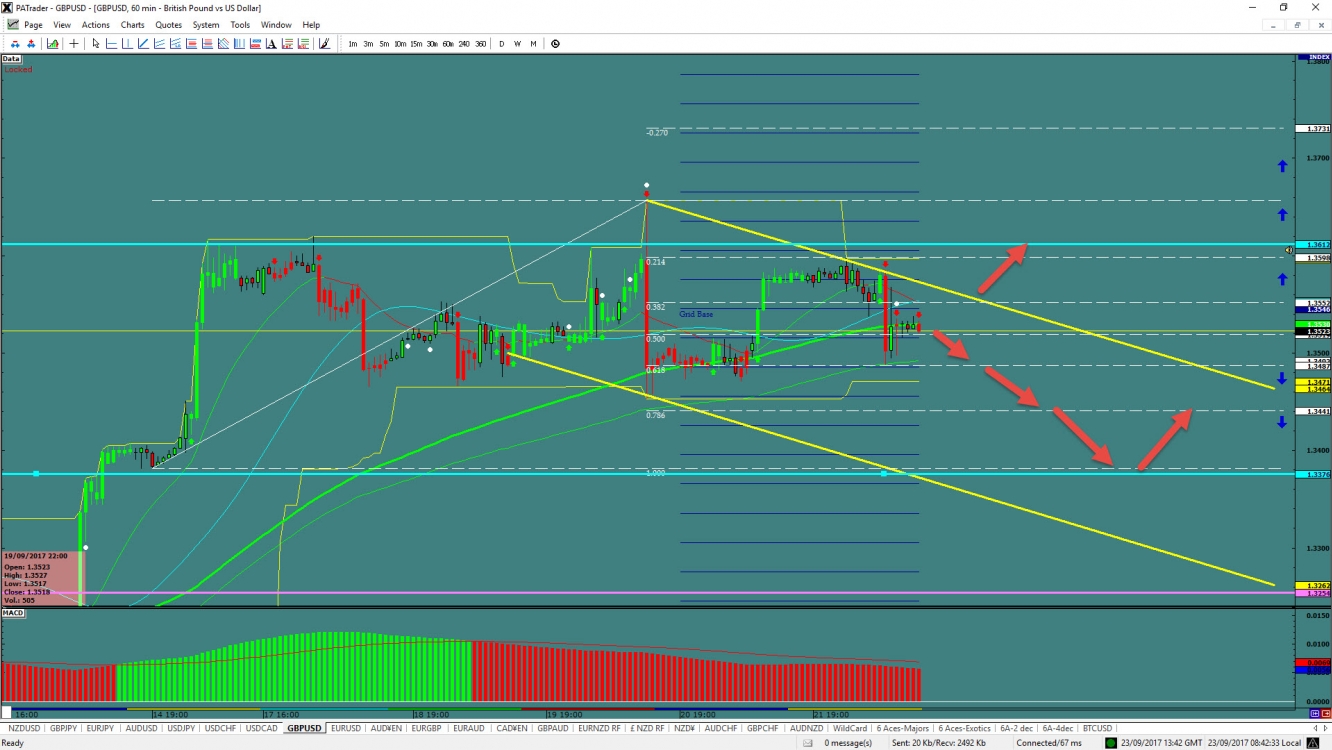

GBP/USD

What ProAct Forex Target Traders See: We are currently sitting at 1.3523 in a range and a channel that continues. ATR has really risen on this pair by 50 pips a day! A couple of different scenarios: 1: Bullish: a move to the Range Top at 1.3612 area and 2: Bearish: A break down to the 0.786 Fibo support at 1.3441 and then the bottom at 1.3376. Clearly bearish bias! The average daily true range (ATR) for the pair currently is 130 pips.

——————————————————————————–

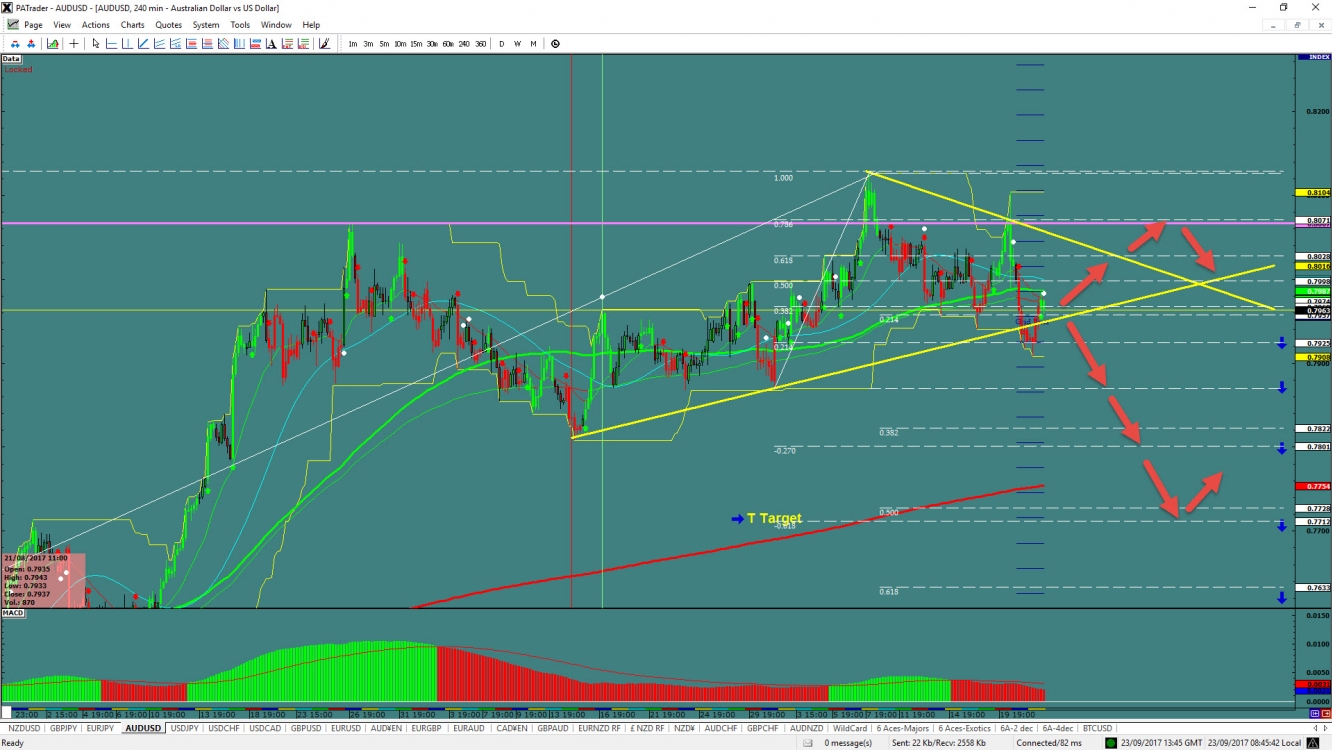

AUD/USD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: We are currently sitting at 0.7963 in a triangle. A couple of different scenarios: 1: Bullish: a move to the Day Top at 1.8071 area and 2: Bearish: A break down to the 1.270 Fibo support at 0.7801 and then the 1.618 Fibo support at 0.7712. Bearish bias! The average daily true range (ATR) for the pair currently is 71 pips.