Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

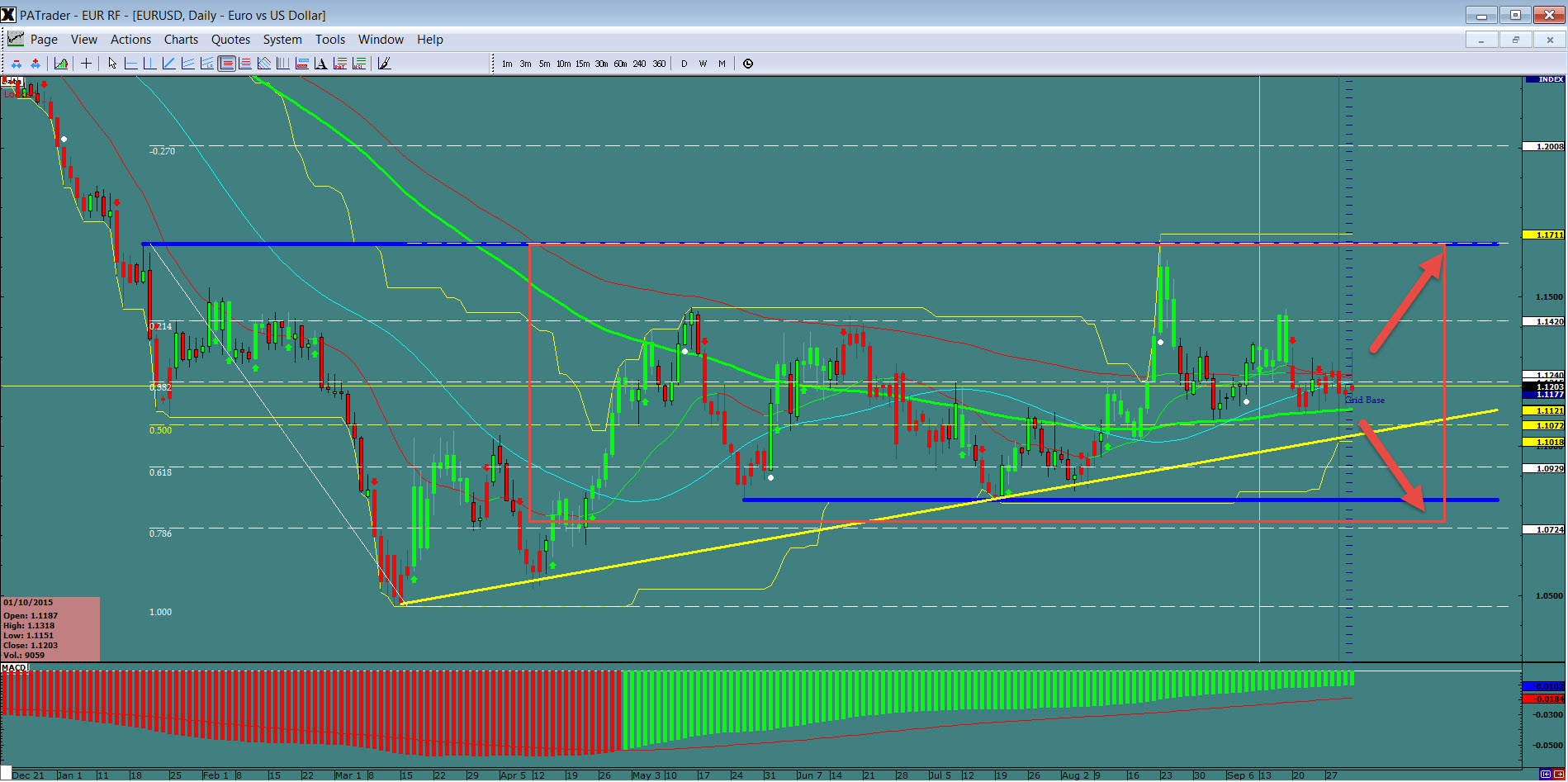

EUR/USD

What ProAct Forex Target Traders See: We are currently sitting at 1.1203. Structure shows we are in a large range with a bullish bias. We are looking for a directionless movement until after FOMC. The average daily true range (ATR) for the pair currently is 107 pips.

————————————————————————--

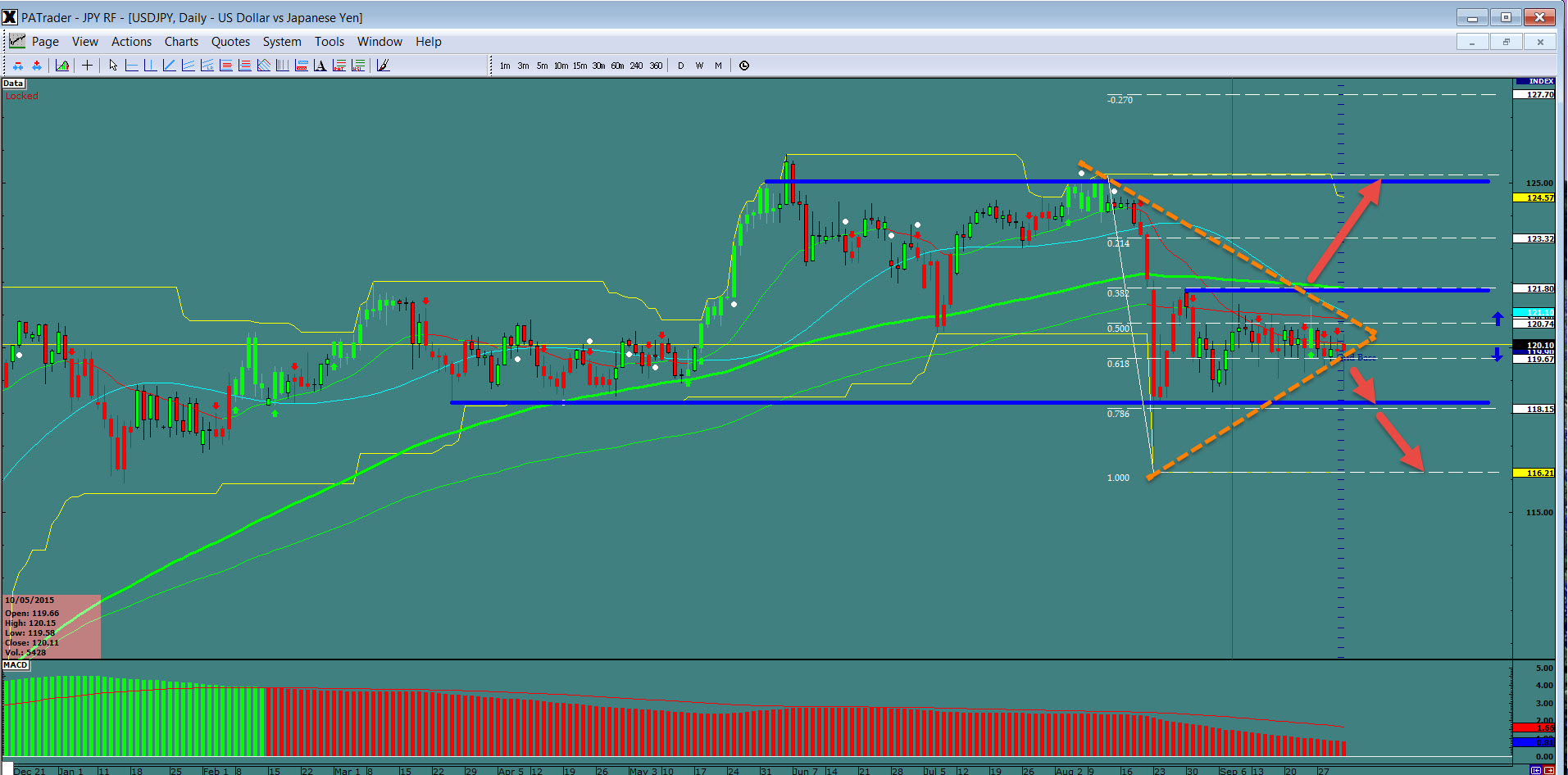

USD/JPY

What ProAct Forex Target Traders See: We are currently at 120.10 and still ranging and also in a wedge. A couple of different scenarios: 1: Bullish: a move to the top of the range and a bounce – look to the 125.00 and 2: Bearish: A break down to the support at 118.15/ 166.21. The average daily true range (ATR) for the pair currently is 93 pips.

——————————————————————————–

GBP/USD

What ProAct Forex Target Traders See: Sterling needs to correct to the 1.5330-82 area before a resumption to the downside. After a correction, look to the 1.5028 area. The average daily true range (ATR) for the pair currently is 101 pips.

——————————————————————————–

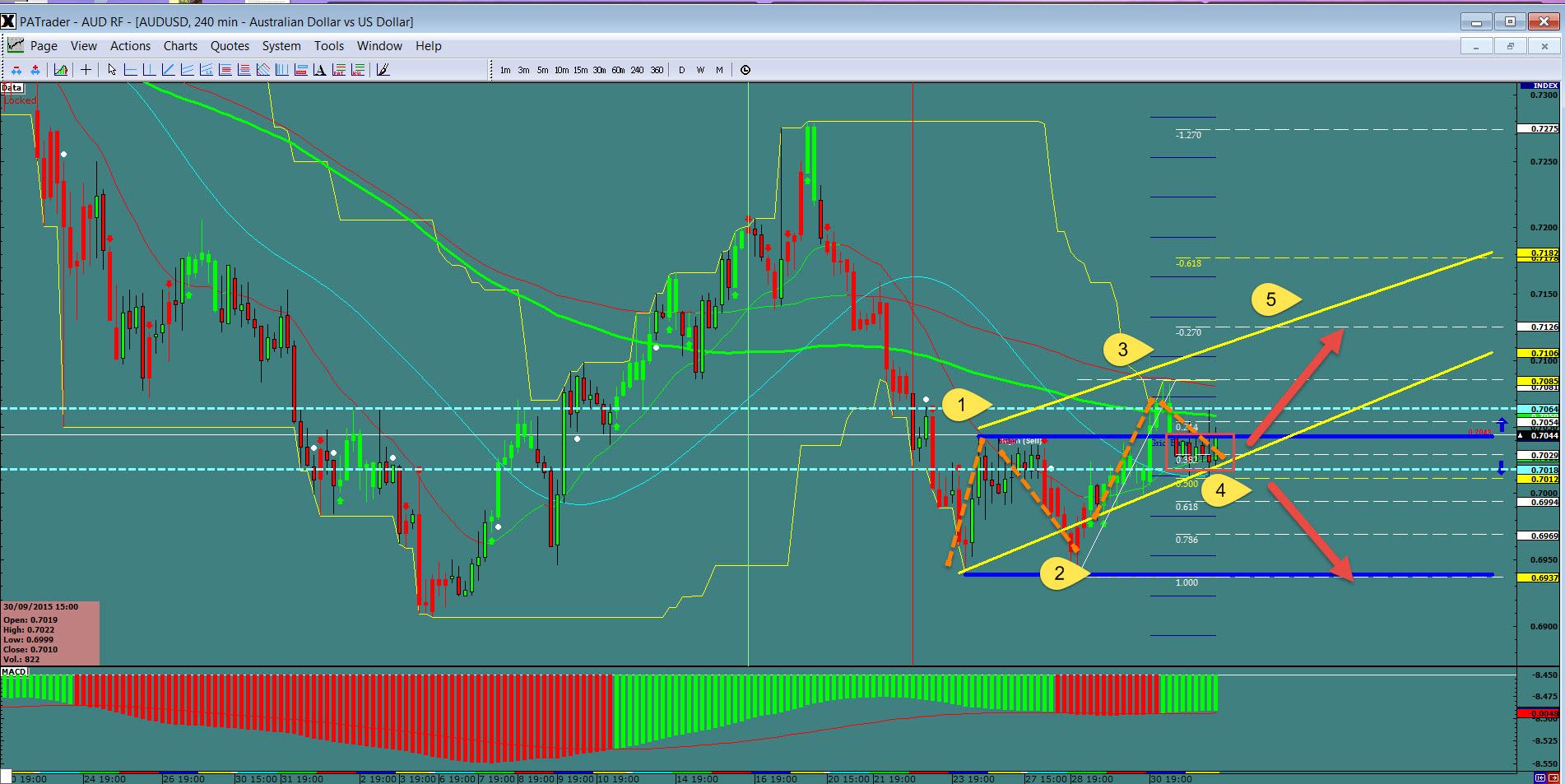

AUD/USD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is at 0.7044 and in a sideways move. Still too early to tell if it will continue the sideways move to the downside and if not, expect that Wave 4 is the bottom of the range. Target now is up to 0.7126. Breakdown look to 0.6937. The average daily true range (ATR) for the pair currently is 76 pips.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.