Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

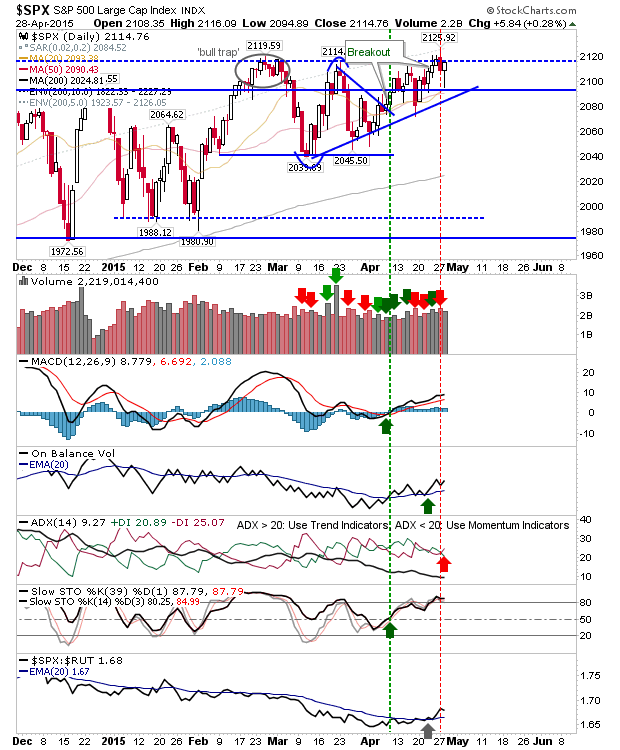

It was looking rough for bulls when cash markets opened yesterday, but a swift recovery helped drive markets back to their daily highs, and in the case of Large Caps close to a new breakout. The S&P finished on lighter volume buying with a 'sell' trigger between +DI and -DI. Today is set up for a breakout.

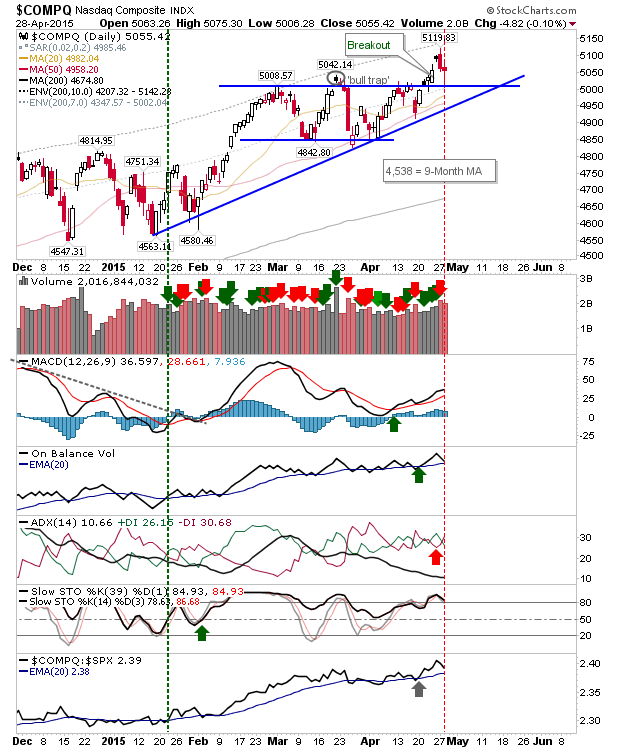

The NASDAQ wasn't quite so lucky, but did find buyers at psychological 5000 support which is also breakout support.

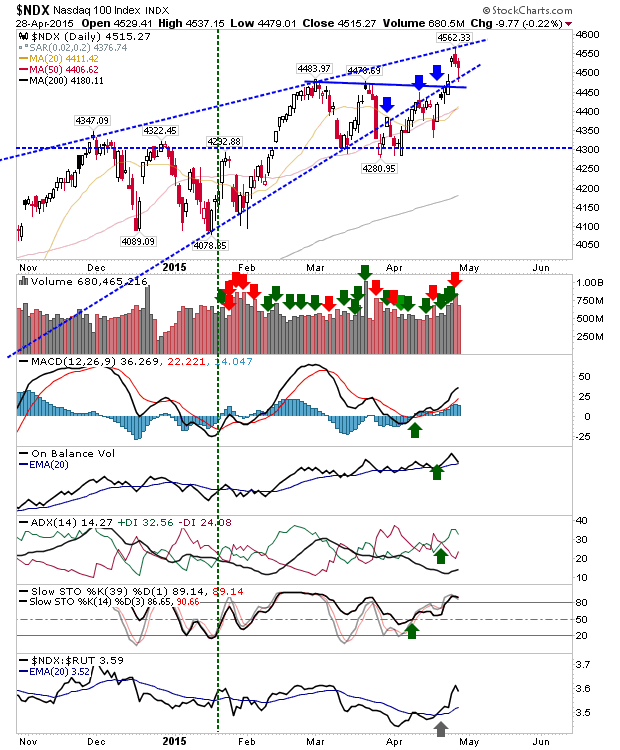

The NASDAQ 100 tagged both wedge support and resistance over the last couple of days, but only one side can prevail. Which way will it go?

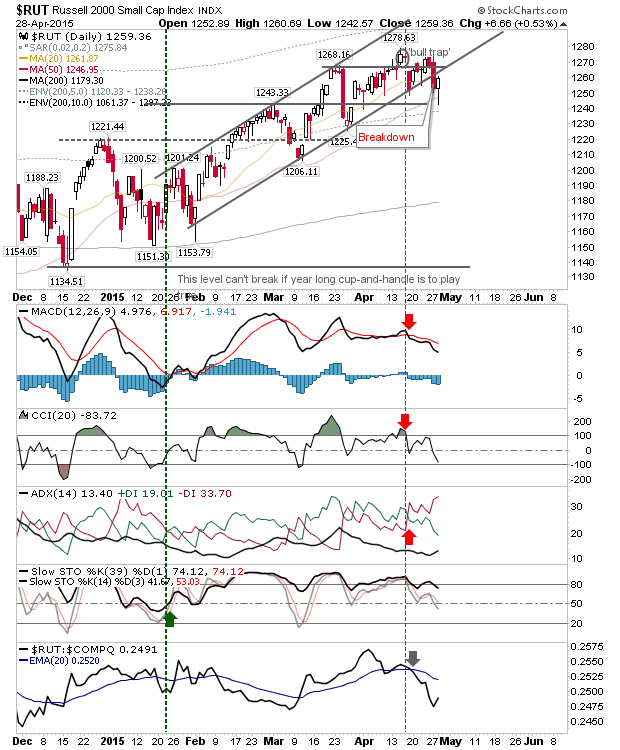

The Russell 2000 performed well, but it didn't recover the breakdown. And relative performance has swung sharply away from Small Caps in favour of Tech indices.

Today is a good opportunity for a bulls to press their advantage. Yesterday's buying was a kick in the teeth for bears looking to squeeze weak hands from positions near market highs. Can they succeed?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI