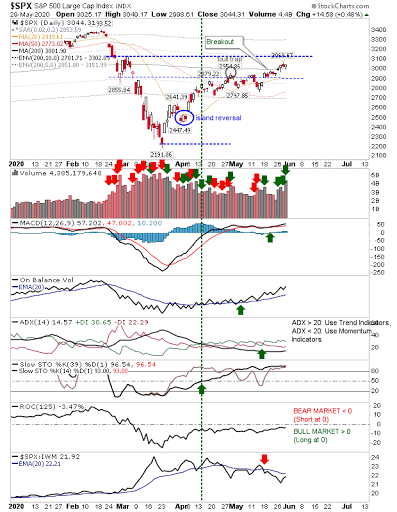

Last week closed strongly with volume rising in confirmed accumulation across indices.

The S&P 50 remained above its 200-day MA on increasing accumulation (rising On-Balance-Volume) as relative performance against the Russell 2000 and NASDAQ remained weak. The index remains on course to challenge the mini-swing high from February—a milestone already achieved by the NASDAQ.

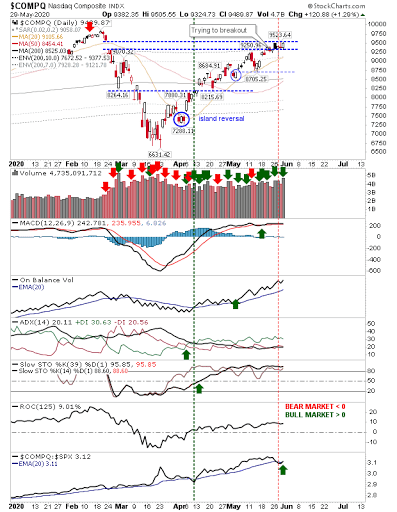

The NASDAQ completed the closure of the February breakdown gap and is just left with February highs to beat before it has a chance to challenge 10,000.

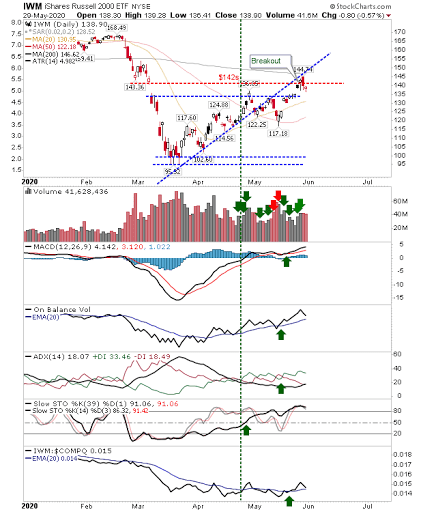

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is still playing catchup, and is struggling to reach the milestones achieved by the S&P and NASDAQ. On Friday it posted a slightly lower close after a big bearish engulfing pattern from Thursday—which itself came off a failed challenge on the 200-day MA. The one thing working in its favor is the relative performance advantage to the NASDAQ and S&P.

The NASDAQ is on course to reverse the entire COVID-19 decline, probably well before the virus disappears in relevance. If this does happen, it will give buyers confidence to do the same for the Russell 2000 or S&P. This coming week could be a big one for the index.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.