Asia stocks mixed; Australia gains on soft CPI, Japan steady before BOJ

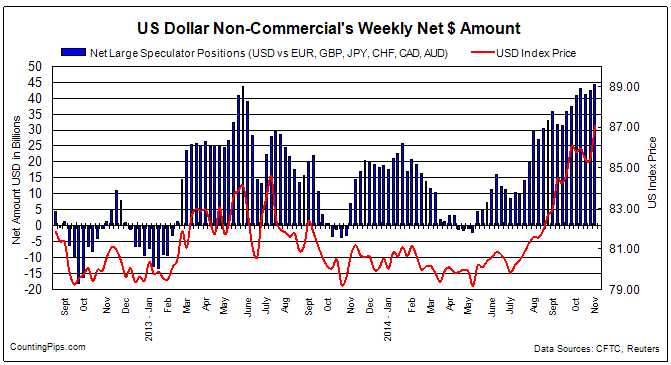

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators added to their overall US dollar bullish bets last week for a second straight week and to the highest level of its current bullish cycle.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $44.38 billion as of Tuesday November 4th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of +$1.99 billion from the $42.39 billion total long position that was registered on October 28th, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

The US dollar’s aggregate bullish position remains in a very strong state and above the +$40 billion level for a fifth straight week while each of the individual tracked currencies have now had a net bearish position versus the dollar for a fifth week.

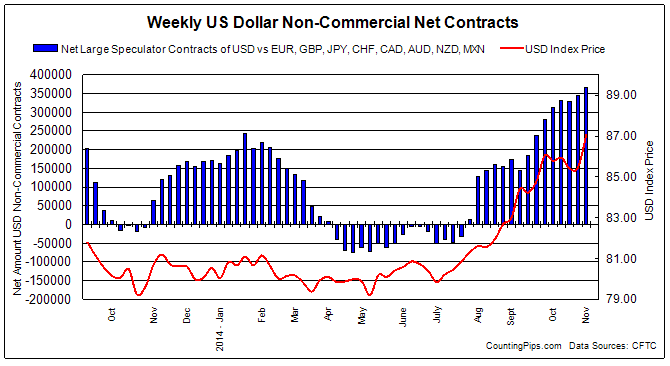

Overall Speculative Net US Dollar Contracts

In terms of total speculative contracts, overall US dollar contracts advanced higher last week to +366,737 contracts as of Tuesday November 4th. This was a change by +21,104 contracts from the total of +345,633 contracts as of Tuesday October 28th. This total US dollar contracts calculation takes into account more currencies than the Reuters dollar amount total and is derived by adding the sum of each individual currencies net position versus the dollar. Currency contracts used in the calculation are the euro, British pound, Japanese yen, Swiss franc, Canadian dollar, Australian dollar, New Zealand dollar and the Mexican peso.

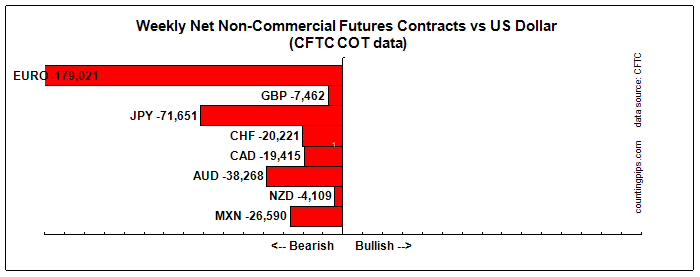

Major Currency Weekly Levels & Changes: One Sided – All currencies have net bearish position versus the USD for 5th week

Overall changes on the week for the major currencies showed that large speculators increased their bets last week in favor of the Swiss franc, Canadian dollar and the Mexican Peso while decreasing weekly bets for the euro, British pound sterling, Japanese yen, Australian dollar and the New Zealand dollar.

Notable changes on the week for the Major Currencies:

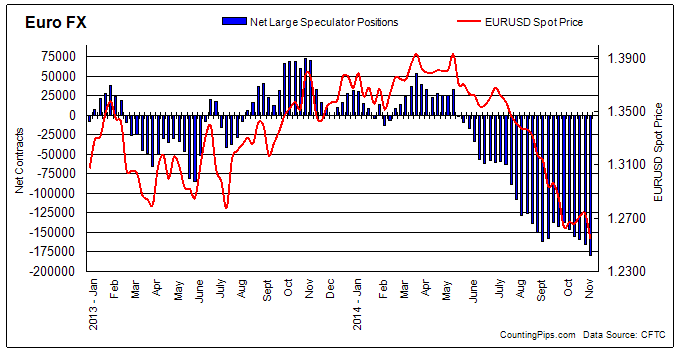

- Euro positions fell further for a 5th straight week and to a new lowest level in the downturn at -179,021 contracts. The EUR/USD exchange rate declined for a 3rd straight weekly close to fall under the 1.2500 level

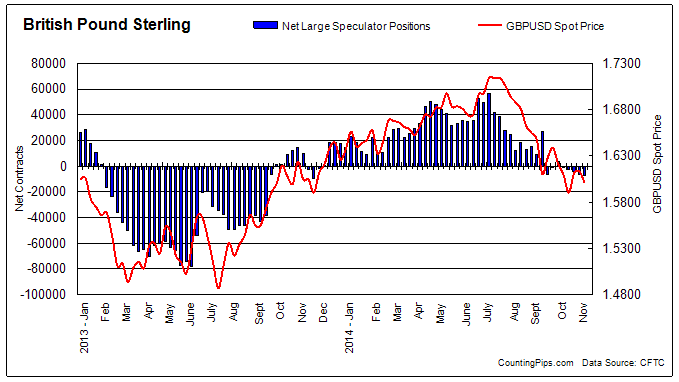

- British pound sterling positions also dropped last week for a 5th week and overall positions remain slightly bearish (-7,462) although getting slightly more bearish each week. The GBP/USD spot exchange rate ended the week on the decline with a lower weekly close for a 3rd week and situated below the 1.5900 level

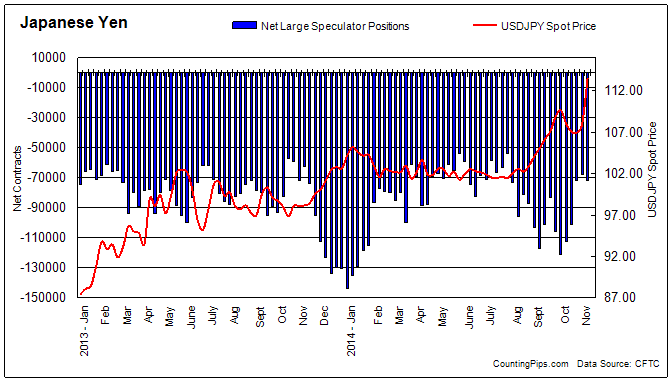

- Japanese yen bets fell last week after rising the previous four weeks. The yen, however, got crushed to end the week as the Bank of Japan expanding QE program weighs heavily on the currency. The USD/JPY exchange rate ended the week over the 114 level for the first time since 2007

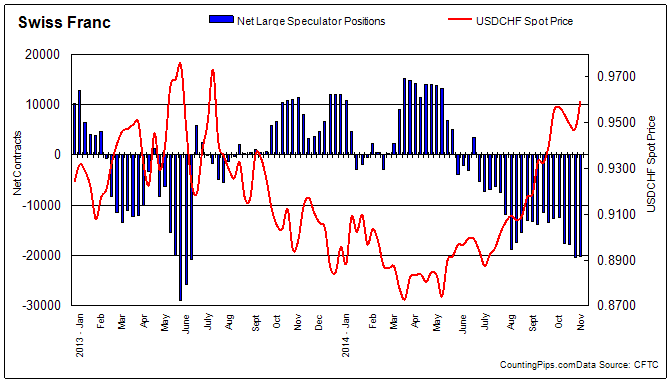

- Swiss franc bets were virtually unchanged last week with a +62 contract gain. The Franc positions (-20,221) are right near their lowest level since June 2013. The USD/CHF pair closed the weekly slightly higher by +0.29% and up for a 3rd week

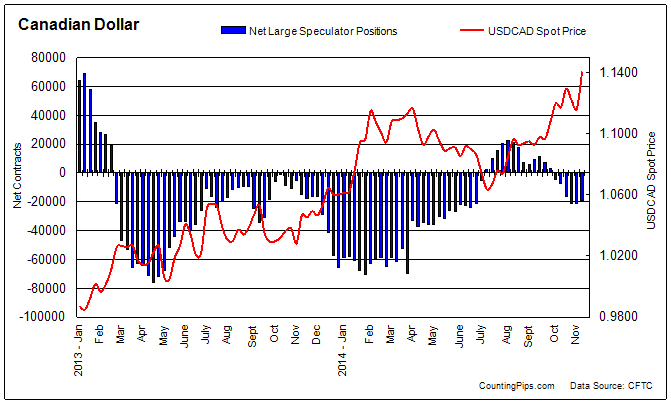

- Canadian dollar positions edged higher last week for a second week although remain bearish. The USD/CAD exchange rate ended the week higher (+0.54%) with the rate just above the 1.1300 major level

- Australian dollar net positions dropped for a ninth week last week to a new most bearish Aussie position since March 11th. The AUD/USD finished the week sharply lower (-1.85%) with the exchange rate now below the 0.8700 level

- New Zealand dollar net positions fell very slightly last week (-211 contracts) and positions remain bearish overall for a 5th week. The NZD/USD exchange rate declined for a third week by approximately -0.44% to end the week near the 0.7750 level

- Mexican peso positions edged higher last week (+253 contracts). The peso spec positions have been on the bearish side now for six straight weeks while the USD/MXN exchange rate ended the week above 13.5000 on continued USD strength

This latest COT data is through Tuesday November 4th and shows a quick view of how large speculators and for-profit traders (non-commercials) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

EuroFX:

Last Six Weeks data for EuroFX futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 409986 | 67030 | 204555 | -137525 | 4440 |

| 10/07/2014 | 425656 | 61467 | 207679 | -146212 | -8687 |

| 10/14/2014 | 434873 | 60158 | 215500 | -155342 | -9130 |

| 10/21/2014 | 439863 | 60188 | 219559 | -159371 | -4029 |

| 10/28/2014 | 441369 | 59054 | 224761 | -165707 | -6336 |

| 11/04/2014 | 465332 | 59566 | 238587 | -179021 | -13314 |

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 132369 | 54243 | 50654 | 3589 | 4639 |

| 10/07/2014 | 129666 | 46503 | 47578 | -1075 | -4664 |

| 10/14/2014 | 138471 | 43116 | 45953 | -2837 | -1762 |

| 10/21/2014 | 135766 | 36567 | 41052 | -4485 | -1648 |

| 10/28/2014 | 138661 | 40718 | 46965 | -6247 | -1762 |

| 11/04/2014 | 144215 | 43289 | 50751 | -7462 | -1215 |

Japanese Yen:

Last Six Weeks data for Yen Futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 239477 | 29910 | 150788 | -120878 | -15456 |

| 10/07/2014 | 223255 | 24837 | 137388 | -112551 | 8327 |

| 10/14/2014 | 212420 | 22839 | 123986 | -101147 | 11404 |

| 10/21/2014 | 185412 | 26634 | 98372 | -71738 | 29409 |

| 10/28/2014 | 184120 | 23883 | 91282 | -67399 | 4339 |

| 11/04/2014 | 207974 | 37917 | 109568 | -71651 | -4252 |

Swiss Franc:

Last Six Weeks data for Franc futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 57223 | 11998 | 24555 | -12557 | 818 |

| 10/07/2014 | 60516 | 15509 | 27928 | -12419 | 138 |

| 10/14/2014 | 60968 | 11113 | 28666 | -17553 | -5134 |

| 10/21/2014 | 55550 | 7643 | 25505 | -17862 | -309 |

| 10/28/2014 | 57006 | 6887 | 27170 | -20283 | -2421 |

| 11/04/2014 | 59699 | 7844 | 28065 | -20221 | 62 |

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 89376 | 33014 | 37580 | -4566 | -7630 |

| 10/07/2014 | 100900 | 39174 | 46626 | -7452 | -2886 |

| 10/14/2014 | 104060 | 35688 | 51855 | -16167 | -8715 |

| 10/21/2014 | 102170 | 28837 | 50371 | -21534 | -5367 |

| 10/28/2014 | 99309 | 26093 | 47498 | -21405 | 129 |

| 11/04/2014 | 104720 | 29627 | 49042 | -19415 | 1990 |

Australian Dollar:

Last Six Weeks data for Australian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 118488 | 43193 | 45210 | -2017 | -10364 |

| 10/07/2014 | 129561 | 31601 | 58087 | -26486 | -24469 |

| 10/14/2014 | 115941 | 14367 | 44638 | -30271 | -3785 |

| 10/21/2014 | 115985 | 13951 | 45460 | -31509 | -1238 |

| 10/28/2014 | 120071 | 17446 | 51297 | -33851 | -2342 |

| 11/04/2014 | 123342 | 14595 | 52863 | -38268 | -4417 |

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 18209 | 10092 | 10028 | 64 | -1777 |

| 10/07/2014 | 19214 | 10052 | 10152 | -100 | -164 |

| 10/14/2014 | 21317 | 9171 | 11555 | -2384 | -2284 |

| 10/21/2014 | 21311 | 8526 | 10858 | -2332 | 52 |

| 10/28/2014 | 22023 | 8506 | 12404 | -3898 | -1566 |

| 11/04/2014 | 23716 | 9737 | 13846 | -4109 | -211 |

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 09/30/2014 | 148678 | 48864 | 56178 | -7314 | -17818 |

| 10/07/2014 | 147139 | 43781 | 51364 | -7583 | -269 |

| 10/14/2014 | 139036 | 39798 | 45561 | -5763 | 1820 |

| 10/21/2014 | 138193 | 30087 | 51211 | -21124 | -15361 |

| 10/28/2014 | 144016 | 26832 | 53675 | -26843 | -5719 |

| 11/04/2014 | 159857 | 30218 | 56808 | -26590 | 253 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.