BofA warns Fed risks policy mistake with early rate cuts

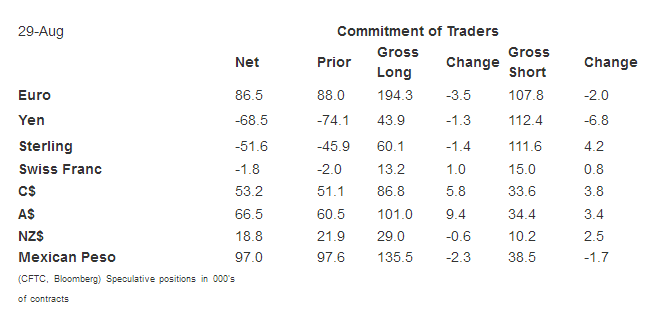

Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29. However, the Australian dollar bulls came close by adding 9.4k contracts to the gross long position. It stood at 101k contracts, which is the highest since April 2016.

The gross Aussie long position has tripled since the middle of June. The gross short position increased by 3.4k contracts to 34.4k. The net long speculative position of 66.5k, the largest in four years.

We track 16 gross positions of large speculators. In the latest reporting period, 13 were adjusted by less than 5k contracts. To the extent there was a pattern, there was a slight bias toward trimming gross long positions and adding to gross short positions. Bulls and bears reduced exposure to the euro, yen and peso futures. Speculators added to gross long and short positions in the Swiss franc, Aussie, and the Canadian dollar.

Separately, although the gross position adjustment was small, we note that the net short sterling position rose for the third consecutive week to stand at nearly four-month highs. The net short speculative yen position has been reduced for six consecutive reporting period.

Bulls continue to press their advantage in the 10-Year Treasury note futures. They added 13.3k contracts to their gross long position to 929.1k contracts. The bears covered 9.1k contracts, leaving them with a gross short position of 645.4k contracts. This resulted in a 22.5k contract increase in the net long position to 283.7k contracts. The record was set this past May near 363k contracts.

The disruption of the energy market in the wake of the devastation of Harvey has boosted volatility. With the front month light sweet crude oil futures contract falling to six-week lows, little wonder that the bulls trimmed their gross long position 13.5k contracts to 663.3k. The bears saw this as an opportunity to press, and they added 66.1k contracts to the gross short position to 297.4k. It was the largest increase in gross short contracts since May and the largest in percentage terms since March. These adjustments generated a little more than a 20% decline in the net long position to 365.9k contracts.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI