Yesterday we saw a good response from bulls, with higher volume accumulation marking action of buyers and not just short covering.

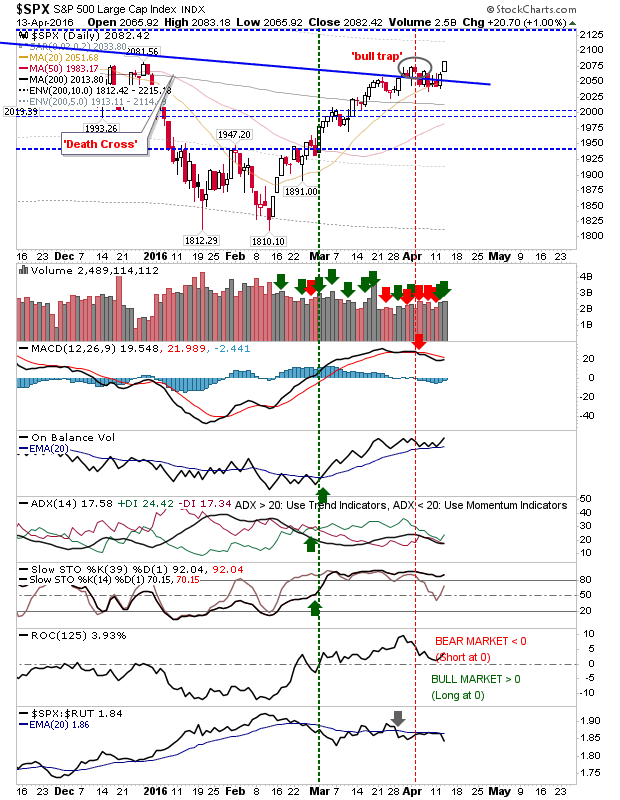

Gains in the S&P were paired with further losses in relative performance (against the Russell 2000). However, other technicals are improving and the only other 'sell' trigger in the MACD could turn into a strong 'buy' by the end of this week.

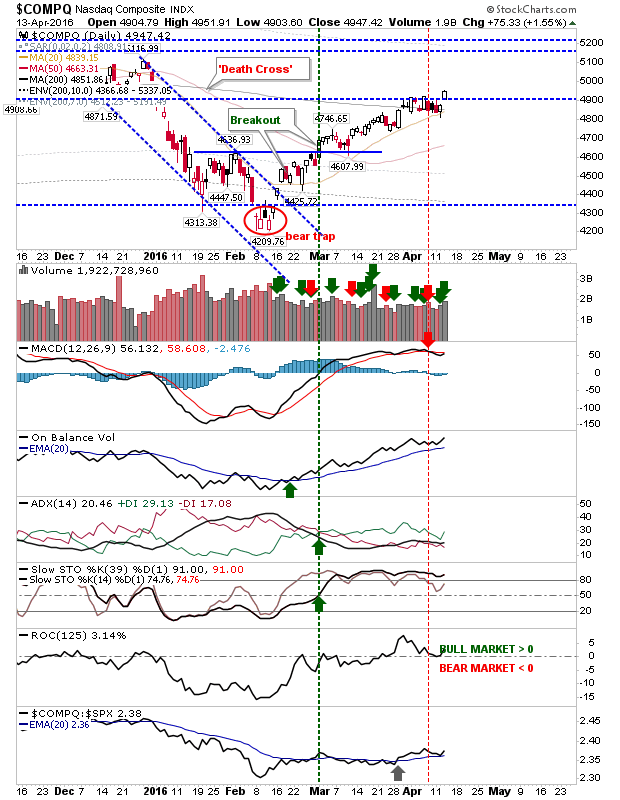

The NASDAQ finally pushed into the 4900+ zone yesterday, (taking my short position with it) as volume climbed in solid accumulation. Rate of Change bounced off the zero line in another tick for the bull column. As an added bonus, it also made relative strength gains against the S&P.

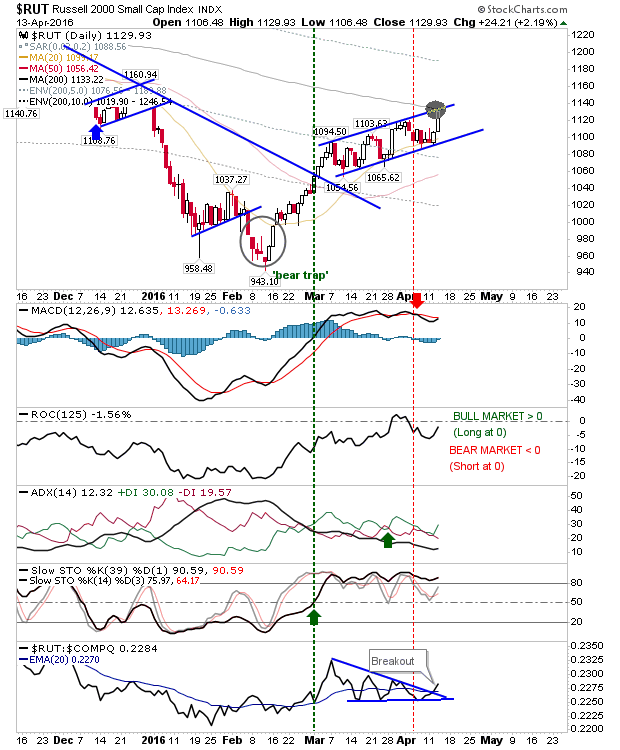

The Russel 2000 made a picture-perfect tag of the 200-day MA, but will it play as resistance? More importantly, the relative performance went from a possible breakdown to a bullish breakout.

Yesterday may have put to bed the indecision which has plagued the market for the past couple of weeks. This opens up possibility for moves to new 52-week/all-time highs.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.