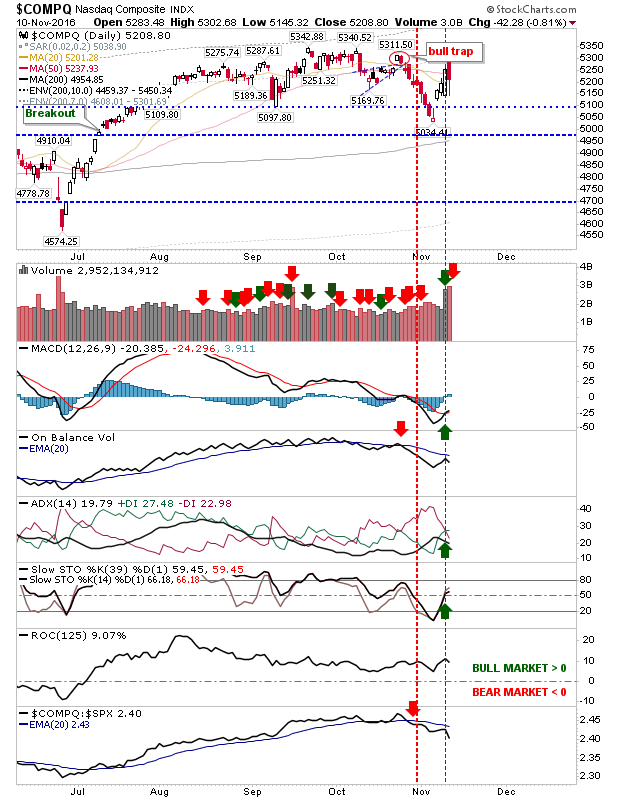

There was a big divergence in markets as the NASDAQ succumbed to fears of a Trump presidency as Blue Chips held fast. Volume climbed to register as distribution for Tech stocks. Unfortunately, this all occurred after my election night short position was stopped out, but new shorts may enjoy better fortune.

The NASDAQ turned a MACD and +DI/-DI 'buy' trigger. Relative performance accelerated lower as other indices enjoyed more positive days.

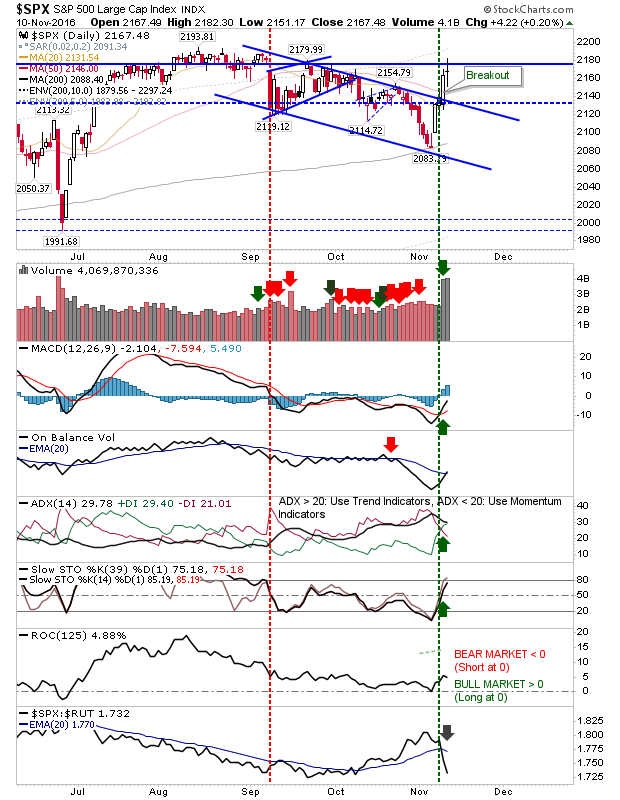

The S&P finished on a doji, but the index was unable to push past 2,180. However, the declining channel from August was decisively broken which should mark the start of an intermediate rally lasting 2-3 months. The chief worry is the sharp drop in relative performance against the Russell 2000.

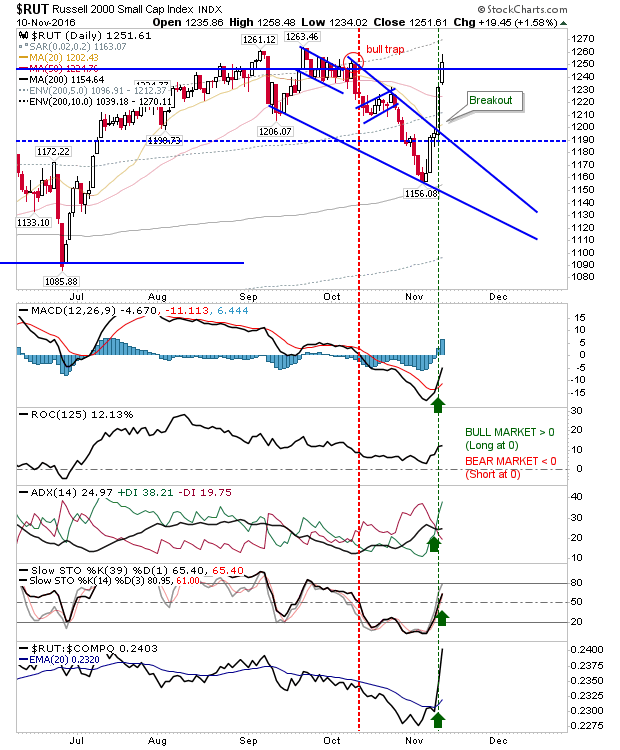

Meanwhile, the Russell 2000 was able to close higher as it works on challenging new all-time highs. Thursday's action was the direct opposite of the NASDAQ (and S&P to a lesser degree) and delivered a massive swing in relative performance. This also marked a net bullish technical picture. Pullbacks in this index are buying opportunities.

With the divergence in activity it will now be down to whether bears can continue in driving Tech weakness, or if bulls can create new multi-years highs with Small Caps.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI