A very quiet trading day today with thin volumes compounded by the Japanese bank holiday. Of note was general yen strength, and EUR/GBP weakness in the early London session. The latter reportedly due to large agricultural orders and comments from Draghi stating that the ECB may begin another LTRO in order to combat the growth hindering effects of rising rates. SNB’s Jordan reiterated the SNB’s continued support for the EUR/CHF floor. Lockhart and Dudley didn’t really say anything new with Lockhart saying,“the economy still needs the support of a very accommodative monetary policy”, and Dudley saying, “any reduction in QE must be based on the most recent measures of economic health”. Overall, though, price action was very muted.

USD% Index

We have retraced up to a long-standing bearish channel resistance, and slightly pushed through before dropping back under. The RSI is still reading quite oversold which indicates that we may see a further push higher before an attempt to return to bearish trend. My preference remains to begin selling dollars with reasonably short stops once we get to the broken support turned resistance shown at EUR/USD 1.3450 which coincides with a steeper bearish trend line. However, a failure here would open the door for a reasonable rally higher to close the gap from last week’s open, with the Blue channel resistance being the next point of entry for dollar selling. I am short term bullish, medium term bearish USD.

USD% Index Resistance (EUR/USD support): EUR/USD 1.3450, 1.3433, 1.3400

USD% Index Support (EUR/USD support): EUR/USD 1.3524, 1.3600

EUR% Index

The EUR% index dropped slightly from the post-FOMC levels largely due to the drop in EUR/GBP. A decent rejection provided a nice bullish H4 pin bar in EUR/USD which indicates there is still a reasonable demand for euros and this level, although the price action was so slow today, that this was hardly a real test. My preference for a dollar run higher from here may weigh on the euro. But, some encouraging price action in Cable may see that take a greater share of the pressure from any dollar strength along with a potential break to the upside for EUR/GBP keeping EUR/USD relatively supported. I am bullish EUR%

EUR% Index Resistance: EUR/USD 1.3524, 1.3600

EUR% Index Support: EUR/USD 1.3450, 1.3400

EUR/GBP Trade Positioning

Long from the weekly pivot at 0.8423 with stops at 0.8383. Close 50% at the recent high for R:R of 1:1

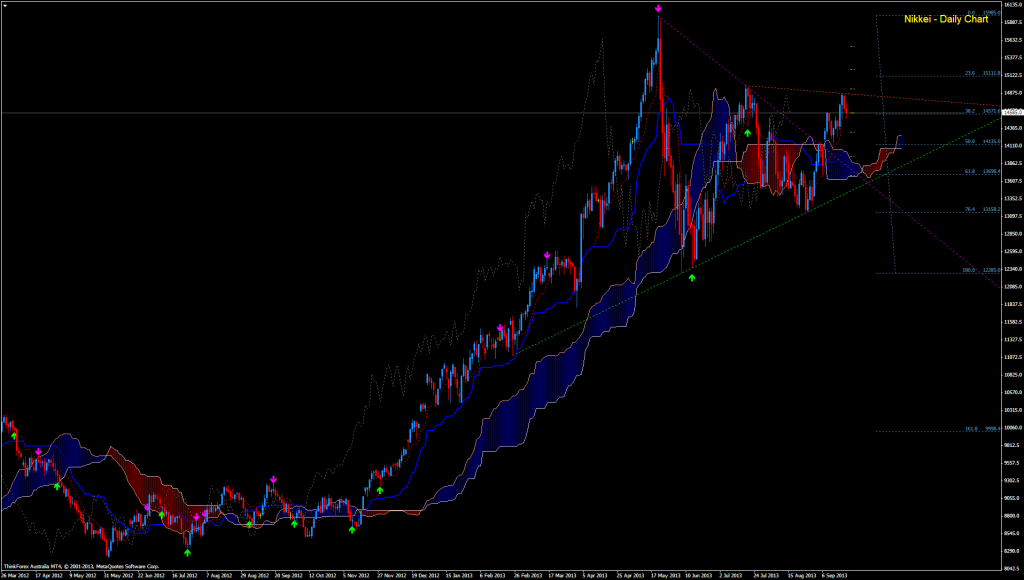

JPY% Index

Trend for the JPY% index continues to be quite erratic with a slight lean towards an overall longer term bearish tone as a result of the major bearish channel, the upper bounds of which were rejected on Wednesday night. The index remains range-bound currently having show some strength today and will continue to do so until the index can push to the upside through the major bearish trend line or make a new low. We are still pushed up against the upper bound of the major bearish channel which may come under further pressure and potentially see a correction higher if today’s rally gathers pace. I am neutral JPY% due to the lack of clarity for the trend, although suspect a retest of higher levels.

JPY% Index Resistance (USD/JPY Support): USD/JPY 98.50, 97.88, 97.88

JPY% Index Support (USD/JPY Resistance): USD/JPY 99.00, 99.73, 100.00

GBP% Index

Currently still very overbought the GBP% index may attempt a push through the recent, steeper aqua coloured trend line that has acted as support over the last few weeks. This may open the door for a challenge of lower support within the current bearish channel with GBP shorts currently looking well priced for further downside provided the dollar continues to buck expectations and rally despite the FOMC decision to delay taper. The index crept higher all day except for one sharp push lower to keep things in check which indicates real money selling interest if the pound from here.

I am bearish GBP

GBP% Index Resistance: GBP/USD 1.6100, 1.6218

GBP% Index Support: GBP/USD 1.6020, 1.5972, 1.5865

AUD% Index

Good Chinese manufacturing data provided a lift for the Aussie today and the AUD% index remains in a bullish channel with further upside possible in the near term before the RBA will likely step in to prevent the rally gaining traction in the medium to longer term. It is surprising to see such a muted reaction to good Chinese data though which could indicate a reluctance to go higher without a retracement first. As such the lower bounds of the bullish channel would be attractive entries for long positions. I am short term bullish AUD

AUD% Index Resistance: AUD/USD 0.9500, 0.9550, 0.9568

AUD% Index Support: AUD/USD 0.9389, 0.9350

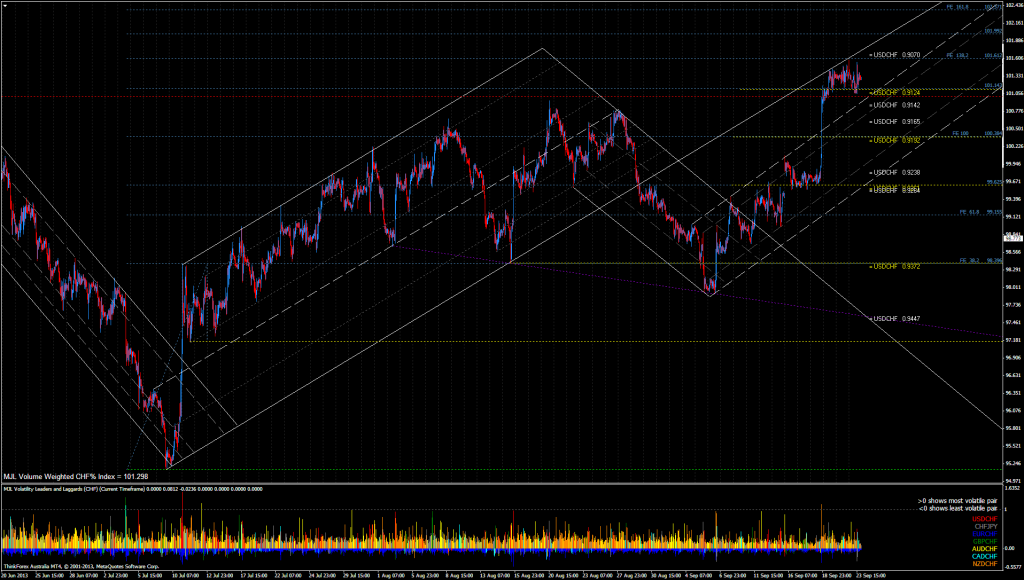

CHF% Index

Much like the EUR% index, the CHF% index maintained the high ground although is now quite overbought having managed to make a fresh high with a test of the 138.2% fib expansion. With quite stiff support just below now, we could see sideways price action until the dollar stops tracking sideways also. The USD/CHF psychological level of 0.9000 is not out of reach for the medium term if the dollar can push lower. However, short positions are now looking quite favourable with USD/CHF longs quite good value following the recent drops.

I am bearish CHF

CHF% Index Resistance (USD/CHF support): USD/CHF 0.9070, 0.9000

CHF% Index Support (USD/CHF resistance): USD/CHF 0.9124, 0.9142, 0.9165

CAD% Index

A strong rejection last week from the top of a bearish channel has shown that the CAD index has the potential to drop lower over the next few weeks, with USD/CAD 1.0573 the first significant support if the downward pressure gathers momentum. The yellow trend line is currently acting like a magnet which makes timing of short entries rather difficult. My preference would be to fade a rally once higher support is met or a significant breakout to the downside occurs.

I am bearish CAD

CAD% Index Resistance (USD/CAD support): USD/CAD 1.0255, 1.0200

CAD% Index Support (USD/CAD resistance): USD/CAD 1.0300

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI