Dollar in demand, euro slumps after U.S.-EU trade agreement

The traditional focus of speculative activity in the futures market has been the net positioning between the outstanding open long and short positions. While acknowledging that the net position provides useful information, we find the changes in gross positions to be significant. The gross positions are what needs to be adjusted on a short move, not the net position.

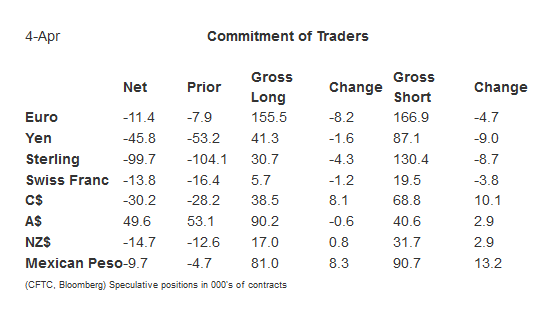

This observation seems particularly relevant when reviewing the speculative positioning in the CFTC reporting week ending April 4. A clear pattern is evident. Speculators reduced gross long and gross short positions in the euro, yen, sterling and Swiss franc.

They mostly added to positions among the dollar-bloc currencies and the Mexican peso. There was one exception. The gross long Australian dollar position was trimmed by 600 contracts to 90.2k. The bears were consistently more aggressive than the bulls.

There were two gross position adjustment that reached the 10k contract threshold. They were both among the dollar-bloc currencies and both were adding to gross shorts. The bears increased their gross short Canadian dollar position by 10.1k contracts to 68.8k. The bears raised their gross short peso position to 90.7k contracts, a 13.2k contract increase.

The position adjusting among the dollar-bloc currencies resulting in an increase in the net short position, or in the Australian dollar's case, a smaller net long position. Among the majors, the net short position was reduced, except in the euro, where the net short position rose to 11.4k contracts from 7.9k.

Speculators continued to unwind the record net short position that peaked at the end of February near 410k contacts. The bears covered nearly 32k contracts to reduce the gross short position to 669.5k contracts. The bulls took some profits and liquidated 18.0k contracts, leaving 613.7k. These adjustments caused the net short position to fall to 55.8k contracts from 69.7k.