Equities traded south yesterday and today in Asia, which combined with rising bond yields suggests that market participants are increasing their bets regarding faster tightening by several major central banks.

The yen was the leading gainer among the major currencies, but the Swiss franc, which is also considered a safe haven, was the main loser, perhaps due to the increase in the SNB’s sight deposits.

As for today, Fed Chair Powell testifies before the Senate Banking Committee, and it will be interesting to hear his view with regards to the Fed’s future course of action.

Rising Yields Hurt Equities as Investors Await Powell’s Remarks

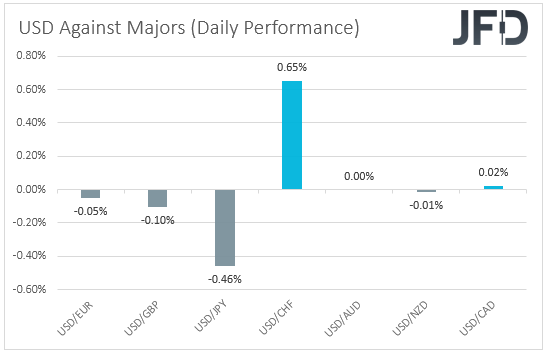

The US dollar traded nearly unchanged against most of the other major currencies on Monday and during the Asian session Tuesday. It gained only against CHF, while it underperformed versus JPY, and slightly against GBP.

Now, given that both the Japanese yen and the Swiss franc are considered safe-haven currencies, the fact that they moved in opposite directions paints a confusing picture regarding the broader market sentiment. A strengthening yen could signify risk-off trading activity, while a weaker franc points otherwise.

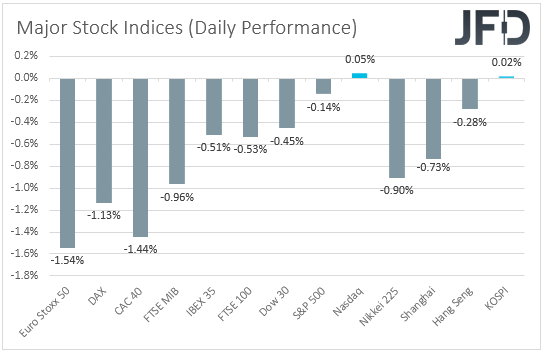

Shifting attention to the equity world, we see that major EU indices were a sea of red, with the negative appetite rolling into the opening of the US session. Despite Wall Street staging a strong comeback later in the day, only NASDAQ managed to poke its nose in positive territory, while today, in Asia, appetite deteriorated again.

With European and US bond yields rising, we can only assume that the driver behind those market movements may have been expectations over faster tightening. Yes, some participants may have already increased their tightening bets regarding the Fed, but now, it seems that they are looking at the ECB as well.

Although the bank has clearly pointed that they are unlikely to touch the hike button this year, last week’s unexpected acceleration in Eurozone inflation may have prompted some investors to add such kinds of bets.

Now, as far as the Swiss franc is concerned, the fact that the SNB’s sight deposits increased notably last week suggests that the central bank has resumed its foreign currency purchases to prevent its own from rising further.

With that in mind, and also taking into account the rising expectations over a faster tightening process by the Fed, we would expect the USD/CHF pair to continue drifting north. After all, it seems that the SNB is one of the few banks market participants are anticipating to stay dovish for a long time, and its actions point in that direction.

Ok, some risk-off episodes could result in some franc inflows, but we don’t expect them to be game-changers. We believe that FX traders looking for a haven shelter may prefer the yen for now.

As for today, Fed Chair Jerome Powell is due to testify before the Senate Banking Committee at a hearing to confirm his nomination to a second term. Fed Governor Lael Brainard is also scheduled to appear before the same committee on Thursday for confirmation of her nomination as Vice-Chair.

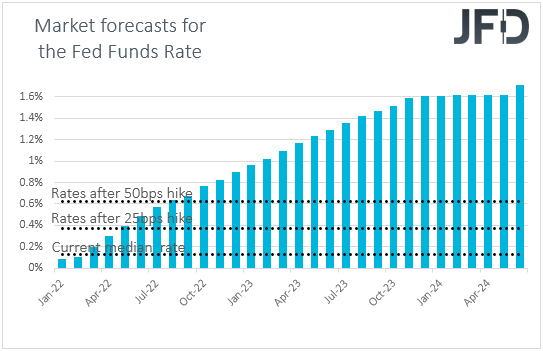

On Friday, the US employment report revealed that nonfarm payrolls slowed to 199k in December from 249k in November, missing estimates of acceleration to 400k. This resulted in a retreat in the US dollar, but it did not change expectations around the Fed’s future course of action.

After all, the unemployment rate tumbled to a 22-month low of 3.9%, while wages accelerated unexpectedly in monthly terms.

According to the Fed funds futures, market participants are still fully pricing in the first quarter-point rate increase to be delivered in May, with a decent chance of this happening one or even a couple of months earlier. Many believe that this will happen in March.

Therefore, it will be interesting to hear what those two officials have to say, especially with the minutes of the latest gathering revealing that officials said that the “very tight” labor market might warrant sooner rate increases.

Brainard, who had been considered a dove before her nomination, appeared more hawkish than expected when she was appointed, showing commitment to getting inflation down. In our view, the risks are for both officials to support a faster than previously assumed rate path.

After all, Wednesday’s CPI data are expected to reveal that inflation has continued to accelerate in December, with the headline rate hitting 7.0% for the first time since 1982, and the core one rising to 5.4%. Anything suggesting a more cautious approach could come as a surprise and perhaps bring the US dollar under strong selling interest.

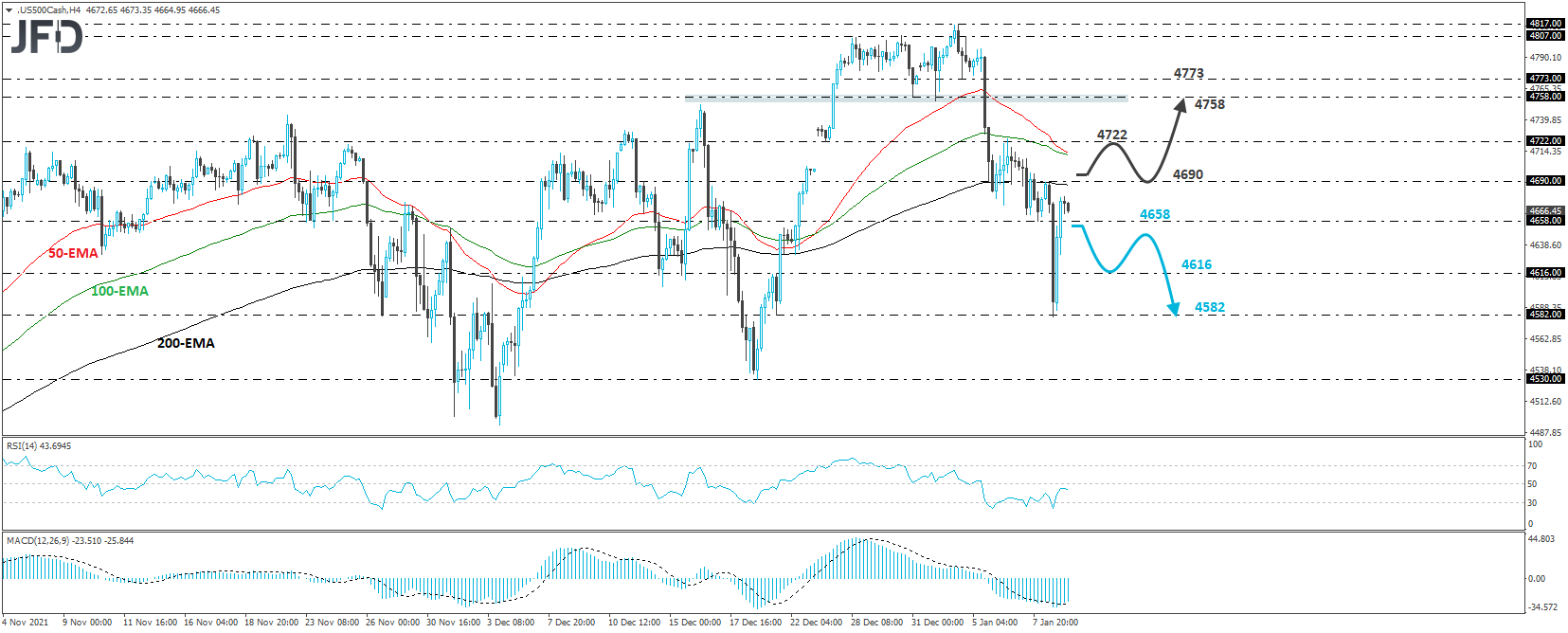

S&P 500 – Technical Outlook

The S&P 500 cash index fell sharply yesterday but hit support near the 4582 barrier, marked by an intraday low formed on Dec. 21, and then it rebounded strongly. However, the price structure on the 4-hour chart remains of lower higher and lower lows, and thus, we would still see a somewhat negative short-term picture.

A dip back below Friday’s low of 4658 may confirm that the bears are back in control and could initially pave the way towards the 4616 zone, marked as support by an intraday swing high formed on Dec. 21. If they are not willing to stop there, then a break lower could see scope for more declines and perhaps another test near the 4582 zone.

On the upside, a break above 4690 could signal the continuation of yesterday’s late recovery. The first stop after that could be the peak of Thursday, at 4722, the break of which could extend the recovery towards the key zone of 4758, which provided support on Dec. 31 and Jan. 3.

USD/CHF – Technical Outlook

USD/CHF traded sharply higher yesterday to hit resistance at 0.9275. Then, it pulled somewhat back. Overall though, the pair remains above the last downside resistance line taken from the high of Nov. 24 and above the upside support line drawn from the low of Dec. 31. Therefore, even if the rate corrects a bit lower, we would stay optimistic about the short-term picture.

The bulls may decide to stop the current setback near the aforementioned short-term upside line and perhaps shoot for another test at the 0.9275 barrier, the break of which would confirm a forthcoming higher high and possibly target the peak of Dec. 15 at around 0.9295. Another break above 0.9295 could carry extensions towards the inside swing low of Nov. 25, at 0.9325.

On the downside, a dip below 0.9219 could signal the break below the short-term upside line and may first target the 0.9200 area, which provided decent resistance between Dec. 27 and Jan. 6. If the bears are not willing to stop there, we could see them aiming for the low of Jan. 7, at 0.9182, the break of which could carry extensions towards the low of Jan. 4, at 0.9135.

Elsewhere

Besides Fed Chair Powell, we will also get to hear from ECB President Christine Lagarde and ECB Governing Council member Jens Weidmann. It will be interesting to see what they have to say after last week’s inflation data and how the market may respond to their remarks.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI