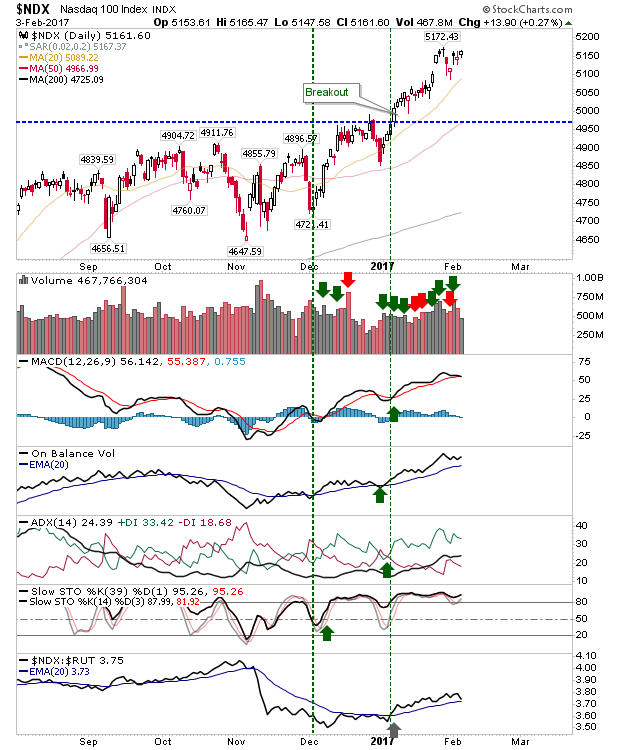

Aside from the light volume on Friday it was a solid finish to the week for indices. Tech Indices are very close to new all-time highs as the post-Trump rally continued its unabated ascent; the rally in the NASDAQ 100 even managed to stay ahead of its 20-day MA.

The only concern for the NASDAQ 100 is the loss in relative strength against the Russell 2000, although this hasn't flipped negative. Despite this, a push above 5,172 is likely to trigger short covering and another buying surge.

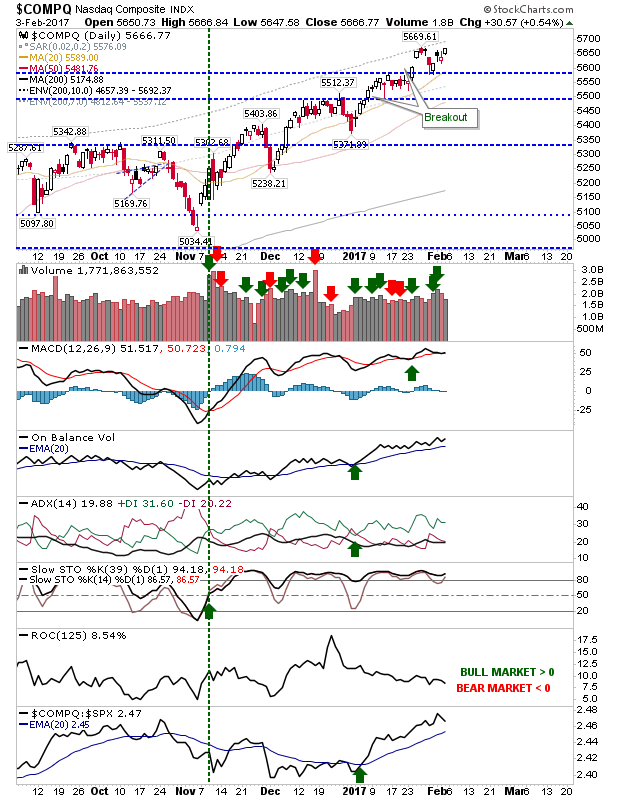

Gains in the NASDAQ have been a little slower as it has tagged its 20-day MA a couple of times since November's election result. As with the NASDAQ 100, a push above 5,669 is likely to attract short covering.

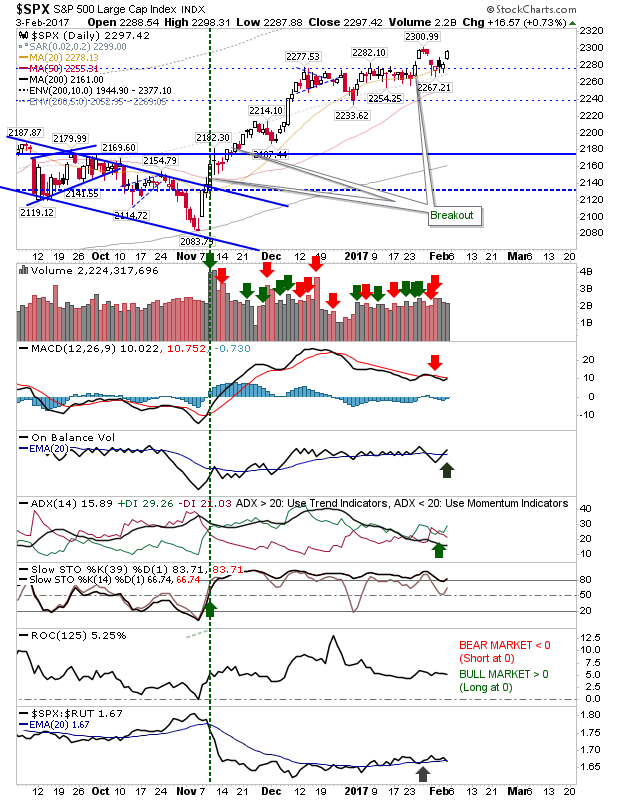

The S&P successfully defended former resistance, now new support, at 2,280. The MACD is holding on to a 'sell' trigger, but it's very close to a fresh trigger 'buy'. Given the prior consolidation, this index is perhaps best placed to enjoy more sustained gains.

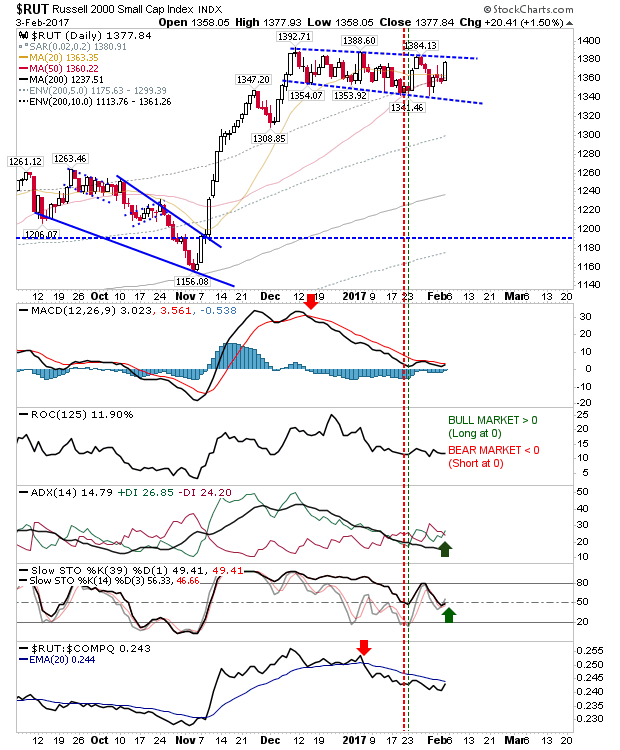

The Russell 2000 had the best of Friday's action with a 1.50% gain. The gain was enough to finish the tit-for-tat bull/bear trap and redirected the index to a broad consolidation. Buyers have defended the 50-day MA; watch for fresh buyers on the pending MACD trigger 'buy'.

For Monday, the S&P is the index to watch as it works to build a new rally. However, the Russell 2000 could surprise if it can break above 1,380 and out of the 2-month consolidation. Day Traders can look to the Tech Indices to take advantage of short covering.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.