It has certainly been an interesting time for the 'mighty' dollar in Capital Markets theses days. Outside a bout of Emerging Market anxiety, the dollar has not had that easily predicted ride higher that so many had been expecting on the back of Fed Tapering. With interest rate yields backing up, they were expected to favor the greenback. In fact, the opposite has happened, ever since US Fed tapering has begun at a modest pace, the US 10-yields have actually fallen (+2.69%) to some of its lowest levels in three-months.

Are Fixed Income dealers suggesting that the Fed is getting ahead of itself? Maybe US growth data is not strong enough. Ever since last weeks soft US jobs report, many investors have been slowly exiting their 'long' dollar positions against a basket of currencies. Individuals remain concerned that there may be room for further "iffy" growth expectations. Softer data in general has many investors questioning the ability of the US to achieve its +3% growth this year. Lets hope it's not too hefty a tag that the IMF has bestowed upon the worlds largest economy? Otherwise we are all in trouble.

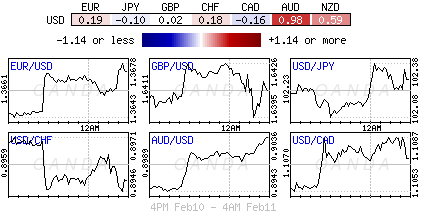

EUR/USD" title="EUR/USD" align="bottom" border="0" height="200" width="300">

EUR/USD" title="EUR/USD" align="bottom" border="0" height="200" width="300">

All market eyes will be on the rookie at the Fed today. New Fed head, Janet Yellen will appear at hearings in the US House of Representatives this morning and the Senate on Thursday. Perhaps more than ever, and especially under the wing of a new fledgling, the markets seek some concrete guidance. It's the first meet in her new role, and a first time for many to hear her. Capital Markets will welcome the opportunity to study her "tone and manner." It gives all interested parties their first opportunity to see if Ms. Yellen is as dovish as they expect her to be, while also promoting a tapering back of the Fed's $65-billion monthly bond-buying program. Despite last Friday's disappointing jobs report raising the stakes for a few (two on the trot with adverse weather to eventually priced out), market consensus expects the Feds modest tapering path to remain in place.

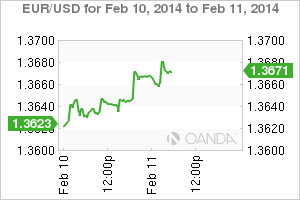

EUR/GBP" title="EUR/GBP" align="bottom" border="0" height="200" width="300">

EUR/GBP" title="EUR/GBP" align="bottom" border="0" height="200" width="300">

There is another US employment report before the Fed meets again to deliver a policy update on March 19. The Fed could very well be dealing with a +6.5% unemployment rate by then. US policy makers would be technically in the same boat as Governor Carney at the BoE – UK employment beating triggered expectations for higher rates. Carney needs to introduce his forward guidance II. This would give him the ability to shift the goalpost without hiking rates too soon that could stymy UK's growth. With unemployment at +6.5%, the Fed is in no position to start thinking about raising interest rates. Policy makers have been preaching, "lower for longer" and "well past" the time +6.5% hits. Today's testimony gives Ms. Yellen the perfect opportunity to back further away from the specific thresholds – maybe she needs to highlight other labor indicators?

The Market will be hoping that Yellen will provide some sense of how the framework of the Fed's forward guidance might evolve. Many expect Yellen to note that low inflation levels give scope for maintaining low rates for an even more extended period. But, it's her tone and manner that everyone seems to be interested with. How she gets to deliver her message across to the markets will be of primary importance today.

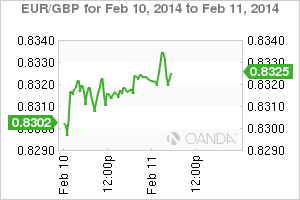

AUD/USD" title="AUD/USD" align="bottom" border="0" height="200" width="300">

AUD/USD" title="AUD/USD" align="bottom" border="0" height="200" width="300">

Taking a quick look around the globe in five: the AUD was the clear outperformer in an otherwise thin Asian session with Japan markets closed for National Foundation Day. Australia's January Business Conditions happened to register a three-year high, coupled with consumer confidence at its own 12-month high, allowed the AUD to regain a foothold above the $0.90c level – first time in a month. Again, these are lofty heights for Governor Stevens and company at the RBA. Aussie policy makers have been very vocal of late, using rhetoric rather than policy to take some of the steam out of a housing supported AUD (Q4 House price index climbed to +9.3% against +8.8%). With volumes and risk appetites being very low has encouraged the AUD to seek out weak stop losses on the topside. What goes up so easy does not intend to stay there.

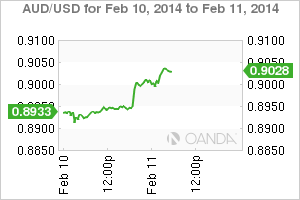

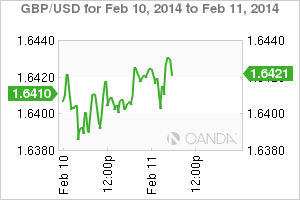

GBP/USD" title="GBP/USD" align="bottom" border="0" height="200" width="300">

GBP/USD" title="GBP/USD" align="bottom" border="0" height="200" width="300">

The underlying markets are relatively weak in Europe as investors and dealers alike wait for Ms. Yellen. Periphery spreads have adopted the usual move wider under the cloud of lower volume, while investors prefer to wait for Fed guidance before committing anything of substance. Ms. Yellen has all the credentials, she just requires the markets respect and today she will go some ways to get it as long as she remains true to the cause from an investor's perspective of course. All the action will begin at 10am EST.