Nvidia to resume H20 chip sales in China, announces new processor

After some disappointing after-hour earnings reports on Wednesday we may see this market bounce move towards the next step, the confirmation test of the lows. Will markets confirm the January lows as a swing low, or will markets evolve into some broader measured move lower?

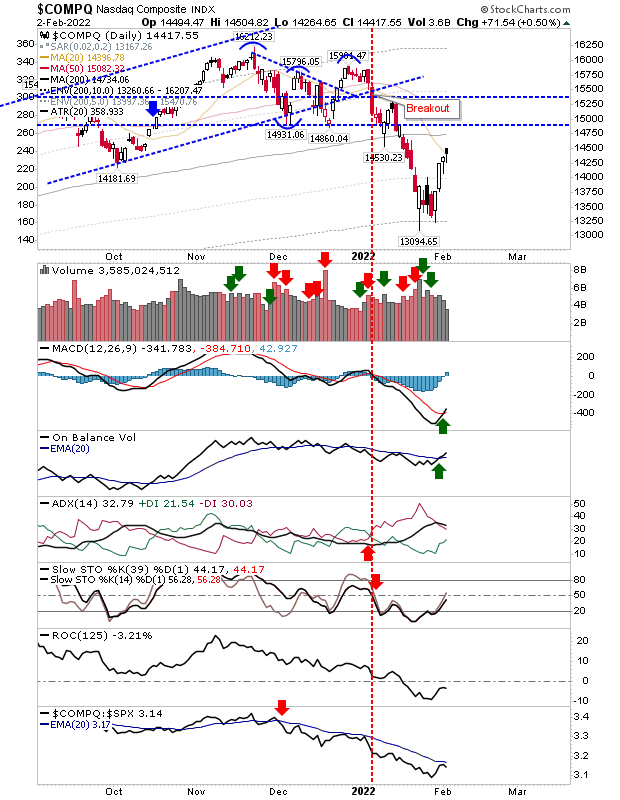

In the case of the NASDAQ we had a narrow 'black' candlestick at the top of the bounce—and at 20-day MA resistance. Bulls can take some comfort with the MACD trigger and On-Balance-Volume 'buy' signals, although the former occurred well below the bullish zero line. A move down would not be surprising—the question is whether it will go all the way back to its 200-day MA.

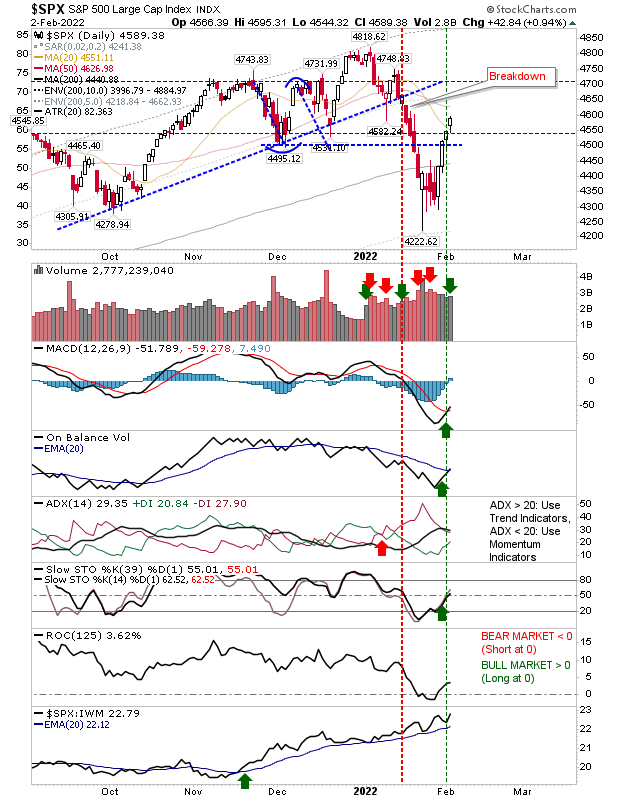

In the case of the S&P 500 we didn't see the bearish black topping candlestick. Instead we saw a modest gain as the index made its way past its 20-day MA and on course to test its 50-day MA. There were positive 'buy' triggers for the MACD, On-Balance-Volume and intermediate stochastics, so there is a good chance that even if markets were to fall here, there is enough demand still to see the rally resume.

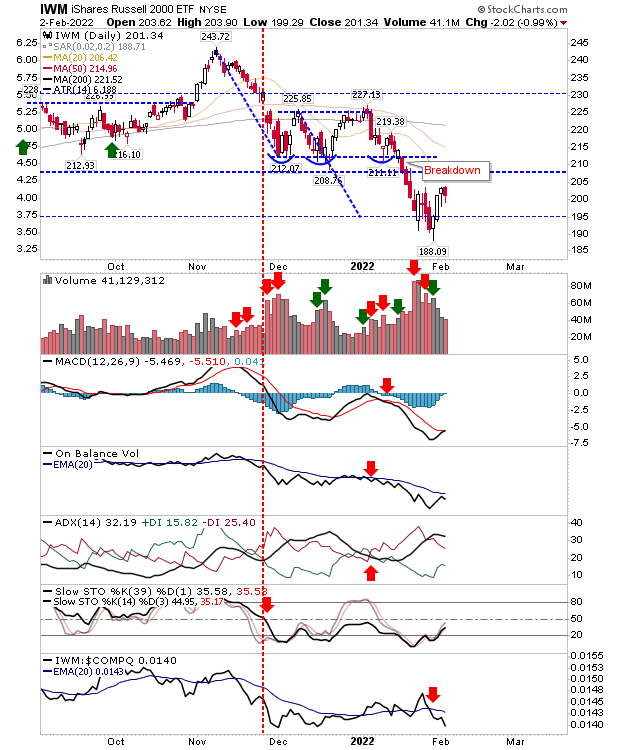

The Russell 2000 (via IWM) was the only index to report a loss on the day yesterday as it remains some distance from retesting its 50-day or 20-day MA. To add to its woes, technicals remain net bearish. It's not good to see growth stocks under such pressure and the likely end result is to see weakness in this index spread to the nascent rallies in the NASDAQ and S&P.

If you were able to take a trade on the swing low, then you have an opportunity to take profits. If your timeframe is longer, then you can hold—but the likelihood of your position spending some time under water is relatively high. However, as a buy-and-hold you have a good chance of having a position in the money in the long run.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI