Bitcoin price today: gains to $120k, near record high on U.S. regulatory cheer

Talking Points:

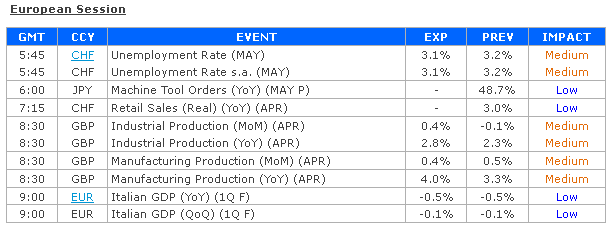

- British Pound at Risk if Industrial Production Data Falls Short of Forecasts

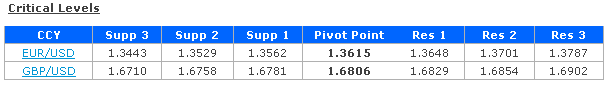

- ECB Commentary in Focus for the Euro as Traders Build Policy Expectations

- Yen Outperformed on Haven Demand as Japan’s Nikkei 225 Fell Overnight

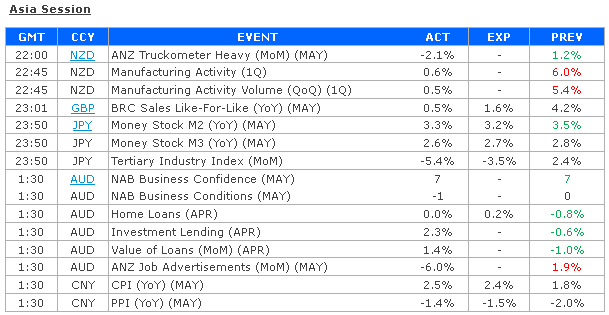

UK Industrial Production figures headline an otherwise quiet economic calendar in European hours. The year-on-year growth rate is expected to have accelerated to 2.8 percent in April, marking a three-month high. UK news-flow has increasingly deteriorated relative to consensus forecasts over recent weeks, hinting analysts are overestimating the health of the economy and opening the door for downside surprises. A disappointing print may weigh against supportive BOE policy expectations, punishing the British pound. We are looking for a GBP/USD selling opportunity.

On the commentary front, a busy round-up of ECB officials is on tap. Governing Council members Erkki Liikanen, Benoit Coeure and Yves Mersch are all set to cross the wires. Traders will be looking for expanded policy guidance after last week’s announcement of expanded stimulus measures failed to produce a Euro breakout. Rhetoric suggesting the central bank is preparing to top-up stimulus further is likely to weigh on the single currency, and vice versa.

TheJapanese yen outperformed in otherwise quiet overnight trade as the island nation’s benchmark Nikkei 225 stock index declined, feeding haven demand for the safety-linked currency. The yen rose as much as 0.2 percent on average against its major counterparts.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI