Whilst the FED continues to err on the side of caution FX traders can plan accordingly to select the correct markets.

Despite CPI rising its fastest rate in 2 years, market participants would be wise to remember that since 2012, the FED has identified the Core PCE as its inflation measure which tends to be lower than CPI.

As Real PCE rose 1% in Q1 compared to 3.3% in Q4 ‘13 it paints a slightly less rosy picture than the headline CPI figure. So whilst Yellen remains Dovish (and PCE remains below par) then we can continue to expect USD to struggle and for higher-yields currency pairs such as AUD and NZD to benefit off of Greenback weakness.

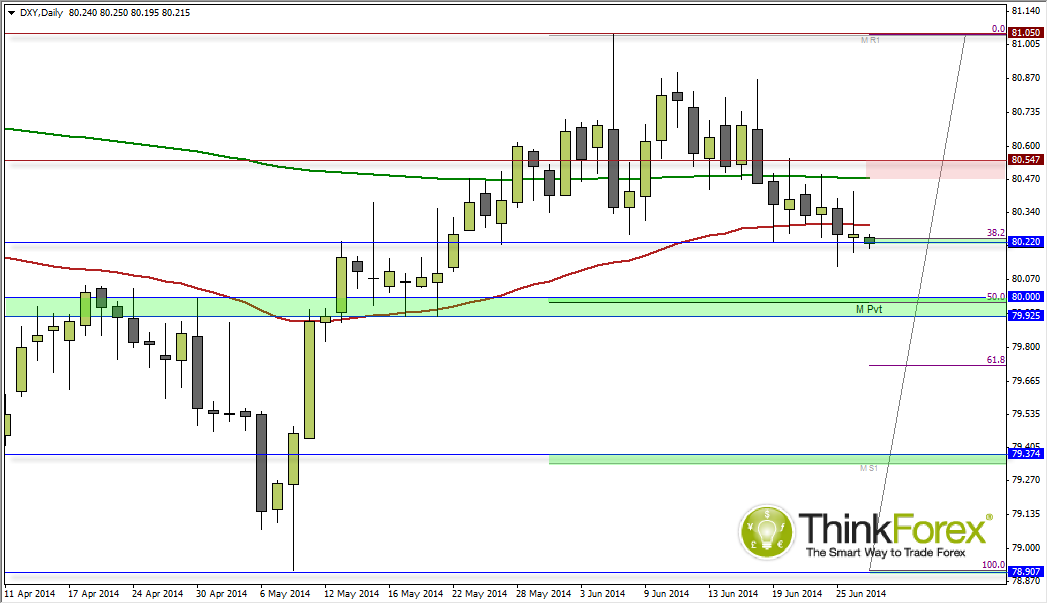

At present USD Index trades below 80.50 resistance with potential to trade down to 80 sometime next week. As long as it remains below 80.50 then I expect it will continue to provide support for AUD, NZD and a slightly more Hawkish BoE to see Cable reach new highs. On that note, due to Australia and New Zealand being in separate phases of their economic cycle and for their monetary policies to diverge further, then NZD is expected to outperform AUD in the foreseeable future. This makes the Kiwi Dollar an excellent proxy for risk-on / risk-off, particularly against JPY and CHF but also the Greenback.

However this is assuming we see no further geo-political tensions such as Iraq and / or Ukraine intensify, in which case the Greenback will quickly regain its title as the ‘real’ safe haven and for AUD, NZD and GBP produce deeper retracements. But at this stage I see no threat to their bullish trends so I’d consider AUD/USD, GBP/USD and NZD/USD to remain ‘buy the dip’ currencies.

Also as you can see on the daily chart, volatility remains low (as it does across most markets) and the Greenback itself is not particularly directional. Whilst volatility remains lows then traders are best to not outstay their welcome on any positions, as traditional trend trading on higher timeframes is difficult.

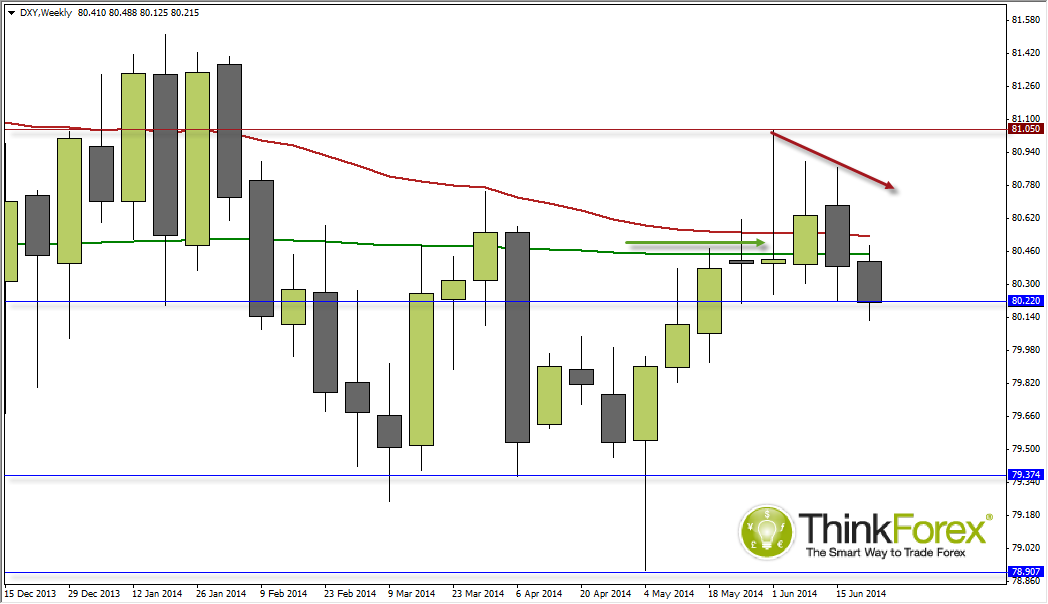

If we zoom out to the weekly chart I suspect we are seeing a topping formation on the Greenback. The 50 and 200 week eMA's are flat (directional) and price now trades below this level. 3 weeks ago we saw a bearish Pinbar, with the following 2 weeks trading inside the range of this Pinbar, with a downside break this week of 80.22 support. A close below this level confirms a topping pattern and for a potential move down to 80, 79.37 and 79.0.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.