Wednesday morning the National Association of Realtors released the July data for their Pending Home Sales Index. Lawrence Yun, NAR chief economist, said "Amidst tight inventory conditions that have lingered the entire summer, contract activity last month was able to pick up at least modestly in a majority of areas,” he said.

“More home shoppers having success is good news for the housing market heading into the fall, but buyers still have few choices and little time before deciding to make an offer on a home available for sale. There’s little doubt there’d be more sales activity right now if there were more affordable listings on the market.

The index in the West last month was the highest in over three years largely because of stronger labor market conditions. If homebuilding increases in the region to tame price growth and alleviate the ongoing affordability concerns, the healthy rate of job gains should support more sales" (more here).

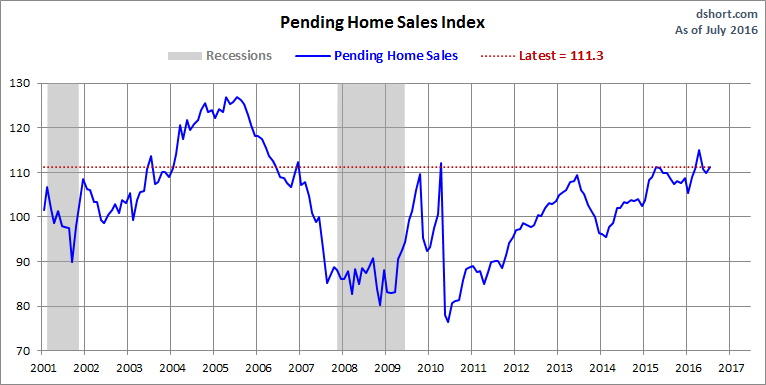

The chart below gives us a snapshot of the index since 2001. The MoM change came in at 1.3%. Investing.com had a forecast of 0.6%.

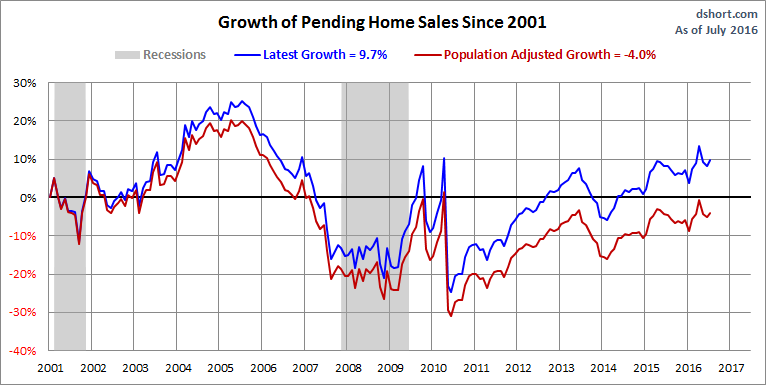

Over this time frame, the US population has grown by 14.2%. For a better look at the underlying trend, here is an overlay with the nominal index and the population-adjusted variant. The focus is pending home sales growth since 2001.

The index for the most recent month is 12% below its all-time high in 2005. The population-adjusted index is 20% off its 2005 high.

Pending versus Existing Home Sales

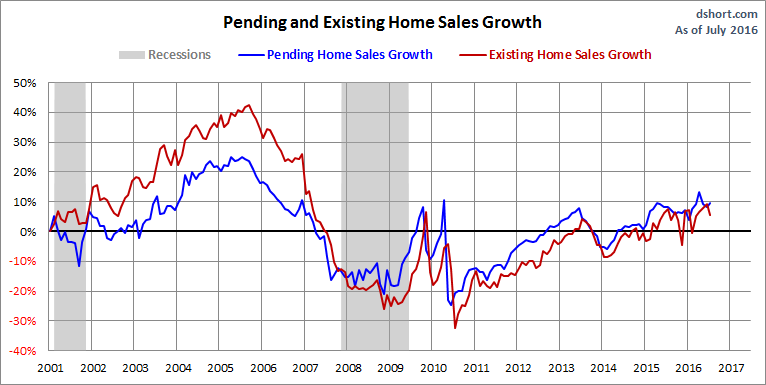

The NAR explains that "because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing Home Sales by a month or two." Here is a growth overlay of the two series.

The general correlation, as expected, is close. And a close look at the numbers supports the NAR's assessment that their pending sales series is a leading index.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI