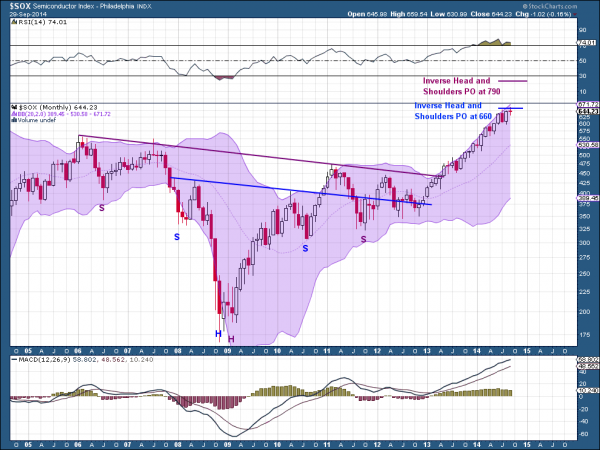

The Philadelphia Semiconductor Index or SOX had a long run higher from November 2012 until it stalled earlier this summer. So what happened? Well the SOX has stalled right at the Price Objective of one of two nested Inverse Head and Shoulders patterns:

The chart above shows both Inverse Head and Shoulders patterns. The smaller one in blue carries a price objective to at least 660, right where it is having trouble. This could lead to more consolidation and maybe even a short term pullback.

Despite the Bollinger® bands continuing to run higher, you can see the momentum indicator RSI is a wee bit overbought. But don’t forget the bigger Inverse Head and Shoulders pattern marked in purple. This one carries a Price Objective of at least 790, well above the current level.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.