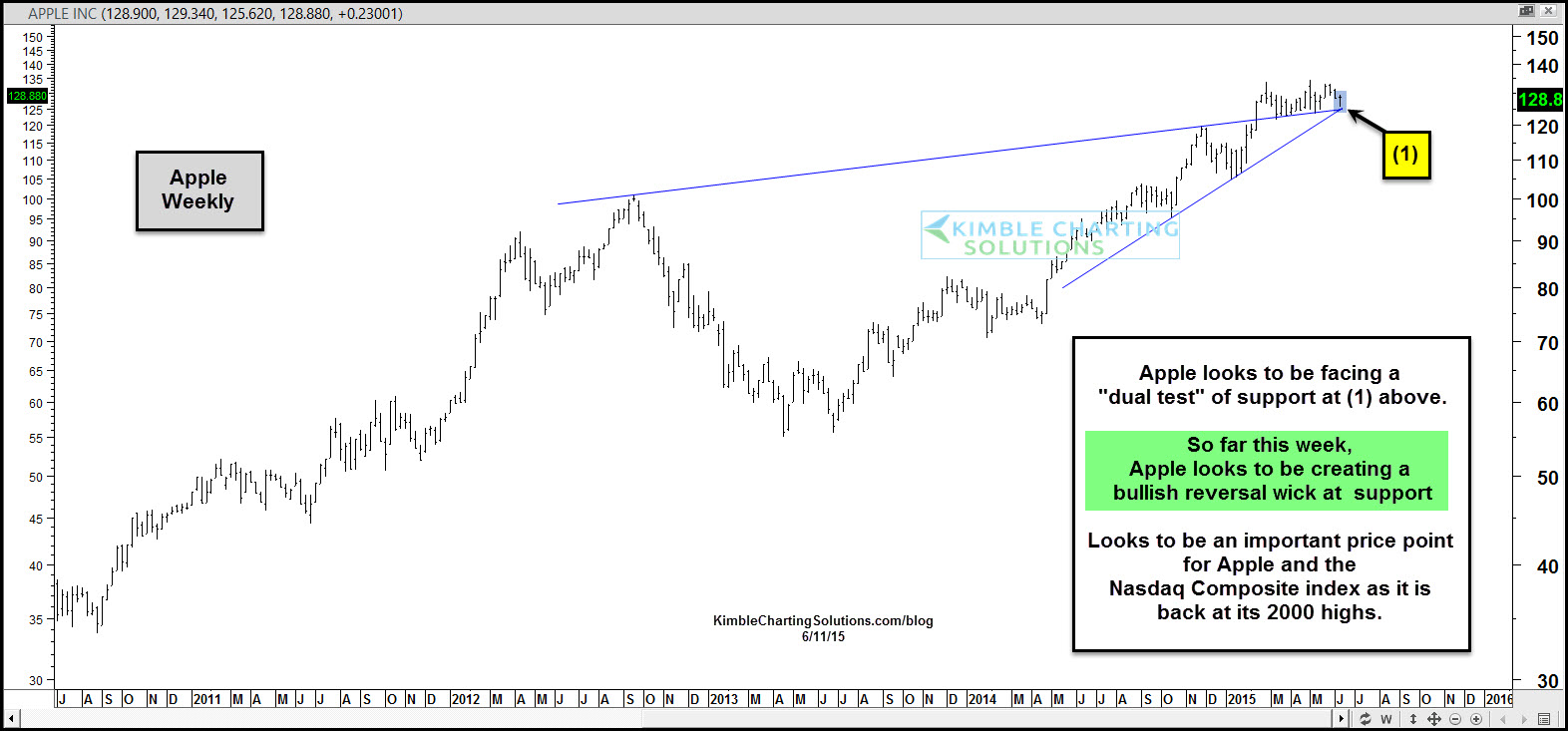

The chart below takes a look at Apple (NASDAQ:AAPL), which could be creating a bullish reversal pattern (wick) at dual support. If this is true and it pushes higher, it could help the Nasdaq Composite index avoid a double-top pattern.

Apple looks to be testing dual support at (1) above. The week is not complete, so far though, Apple looks to be creating a bullish wick (reversal pattern) at dual support.

The Power of the Pattern shared months ago (when it was trading at $108) that Apple could push up to the $150 level, where it would then face dual long-term resistance levels. (see $150 post here)

Could Apple's next move influence the Nasdaq?

This chart shows that the Nasdaq is back at its 2000 highs, at the top of a rising wedge pattern. Is a “Double Top” in the making or a big-time breakout in the cards?

What Apple does at this dual support test could have a big influence over this important price point for tech stocks.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.