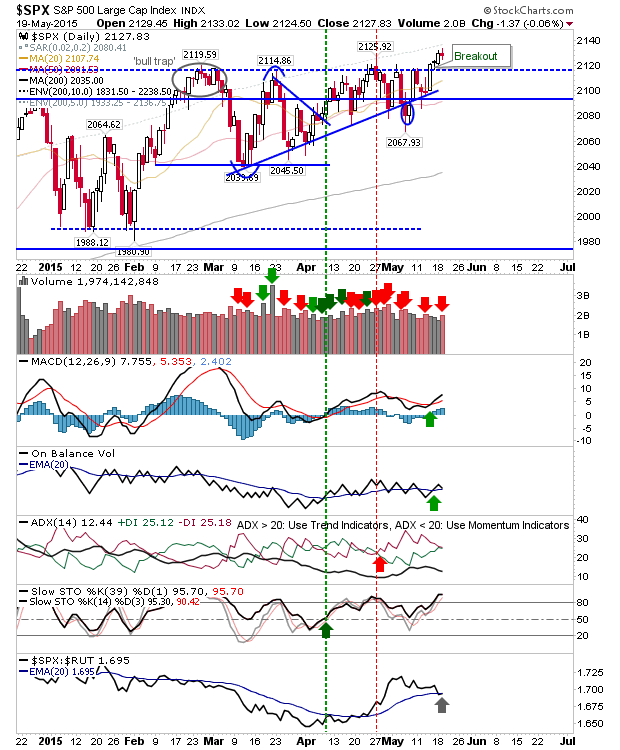

The S&P dropped just over a point yesterday, but finished above 2119 support. Yesterday's action held the gain and remained in bullish mode. Technicals are bullish, although the relative performance against the Russell 2000 has dropped off markedly, which is better for the broader rally, even if bad for the S&P in the near term.

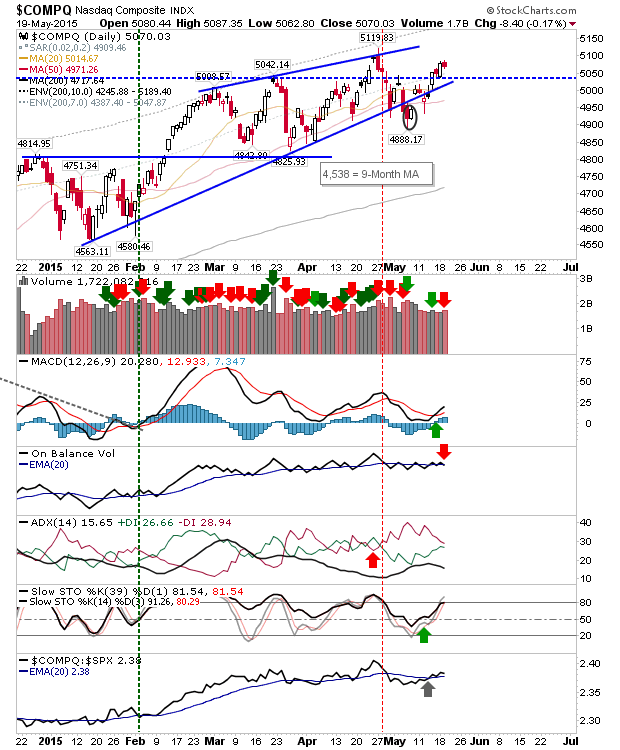

The NASDAQ had a modestly lower close. No real change here.

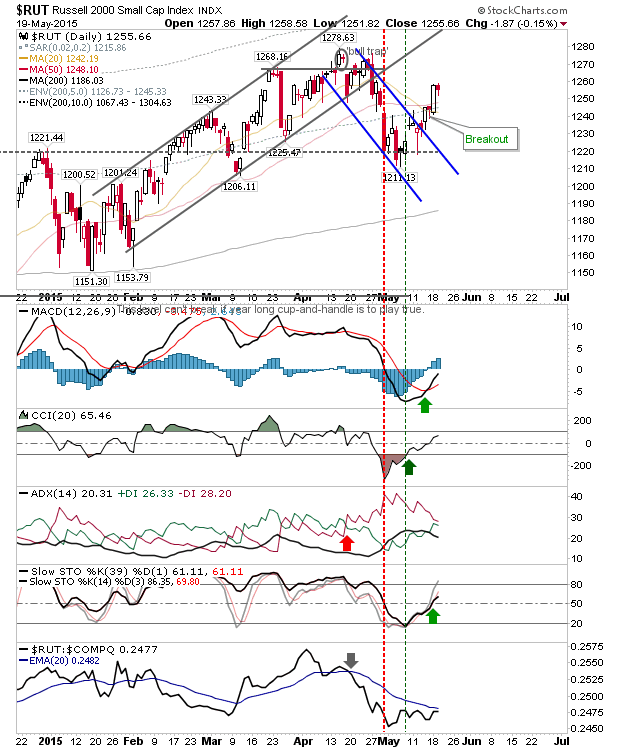

It was a similar experience for the Russell 2000. Small losses for the day remained confined to the upper range of Monday's trading action.

For today, watch for tight pre-market action. This would create a bullish handle (on an hourly time interval), offering a low risk swing trade. Preference is for upside, but don't be caught out if things take a larger turn lower.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI