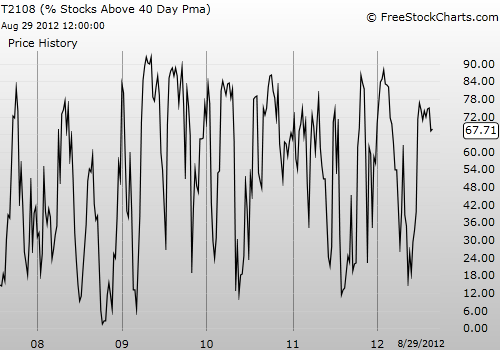

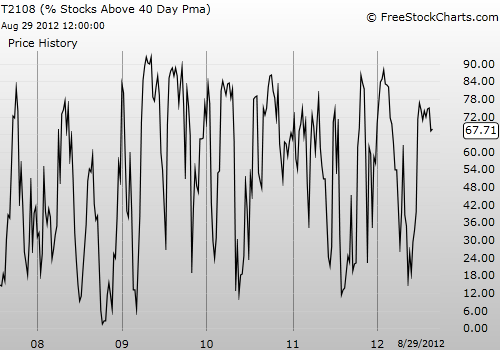

T2108 Status: 67.7%

VIX Status: 17.1

General (Short-term) Trading Call: Hold.

Commentary

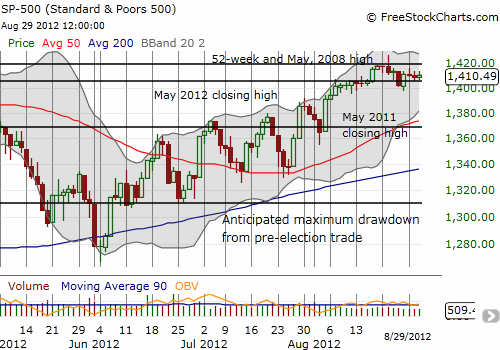

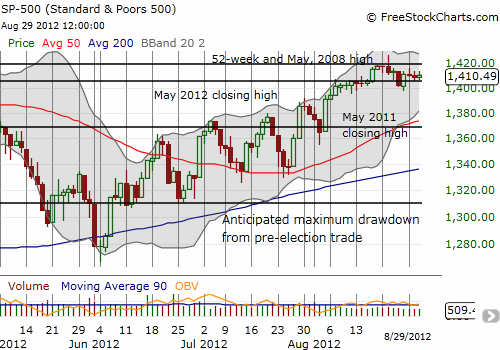

Last week, the Pavlovian market jumped at another mention of old QE3 news. This week, the Pavlovian market anxiously awaits word from Jackson Hole, Bernanke’s word specifically. For three straight days the S&P 500 has swung in a tight range directly above support from the May, 2012 high. Directly above is the tantalizing line of resistance from 52-week highs which remains the bearish scene of a false breakout.

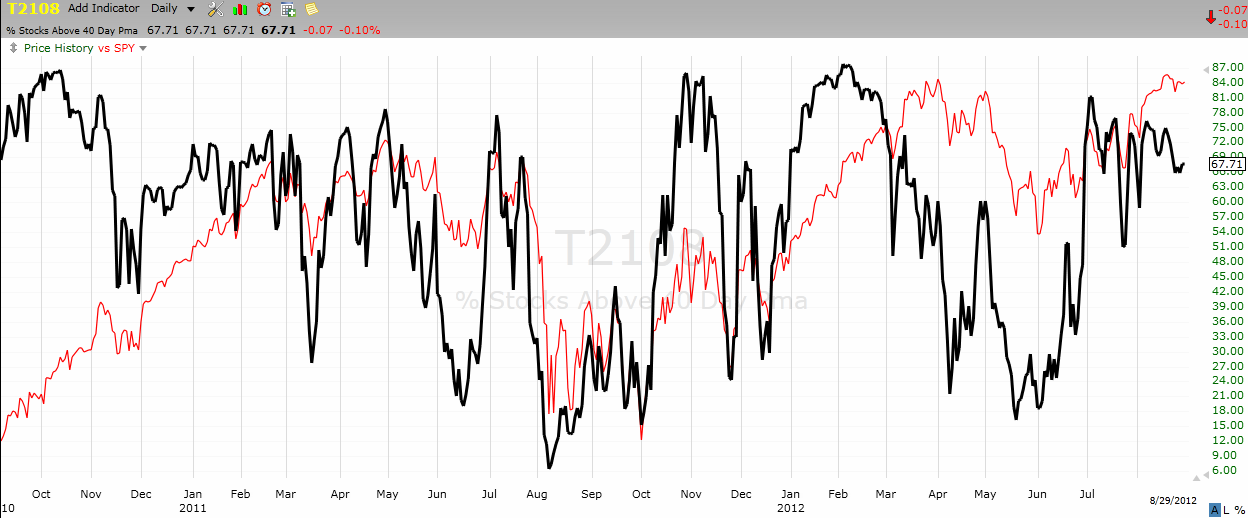

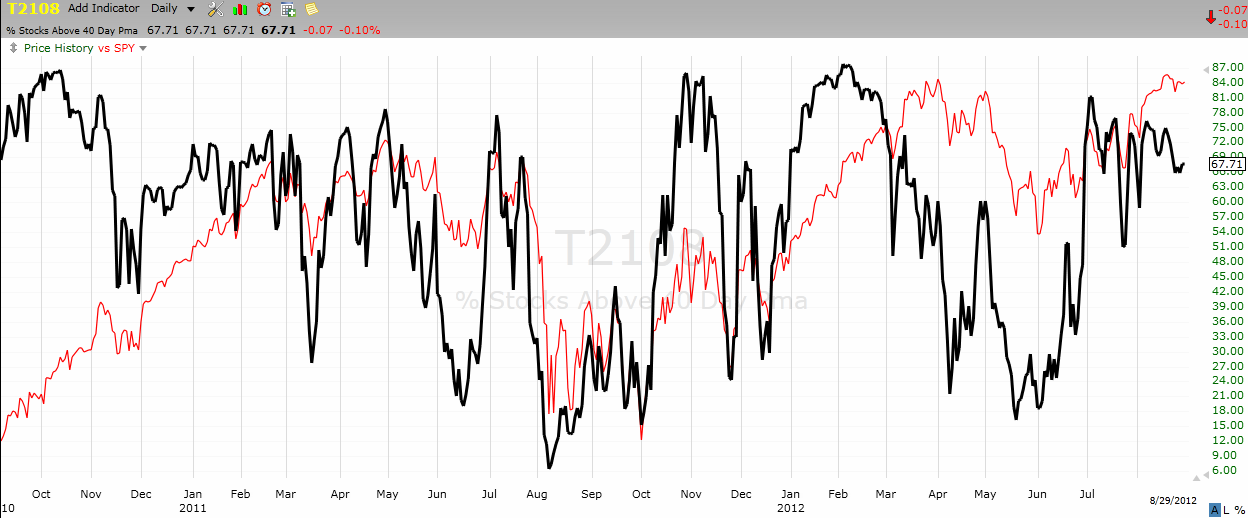

T2108 is also going nowhere, remaining between 65% and 69% since dropping out of overbought conditions a week ago.

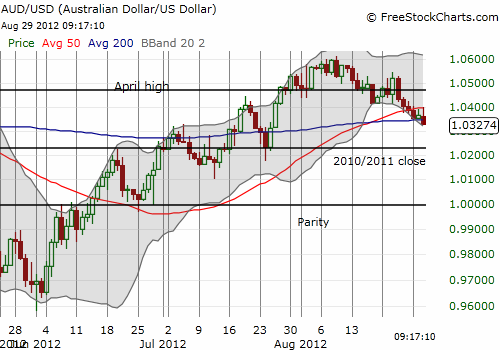

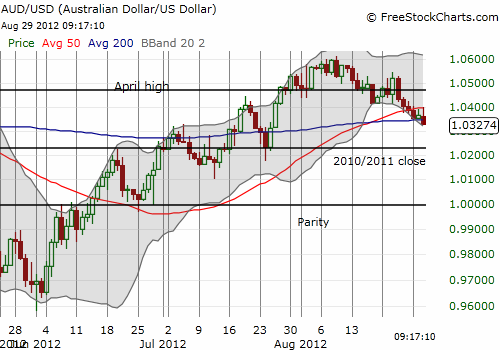

The VIX however is NOT sitting still. At 17 now, the VIX has steadily risen in a straight line from its lows on August 17th at 13.4. I am interpreting this move bearishly given the Australian dollar continues to break down. I have written numerous times demonstrating the convenient relationship between the Australian dollar and the S&P 500.

Yesterday, the bearish divergence lifted its ugly head again as AUD/USD slid below its 200DMA, confirming the breakdown from the 50DMA just on Monday.

Given these technical setups, Jackson Hole could indeed deliver another one of those critical junctures, whether up or down. For the Australian dollar, I am making a small bet that it has one more bounce left before dropping back to parity against the U.S. dollar.

For the S&P 500, it is wait and see until support or resistance next breaks. And of course, since I think the Australian dollar will continue to slide downward, I think the S&P 500 will eventually “have to” follow as well.

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Be careful out there!

Full disclosure: long SSO puts, net long Australian dollar

VIX Status: 17.1

General (Short-term) Trading Call: Hold.

Commentary

Last week, the Pavlovian market jumped at another mention of old QE3 news. This week, the Pavlovian market anxiously awaits word from Jackson Hole, Bernanke’s word specifically. For three straight days the S&P 500 has swung in a tight range directly above support from the May, 2012 high. Directly above is the tantalizing line of resistance from 52-week highs which remains the bearish scene of a false breakout.

T2108 is also going nowhere, remaining between 65% and 69% since dropping out of overbought conditions a week ago.

The VIX however is NOT sitting still. At 17 now, the VIX has steadily risen in a straight line from its lows on August 17th at 13.4. I am interpreting this move bearishly given the Australian dollar continues to break down. I have written numerous times demonstrating the convenient relationship between the Australian dollar and the S&P 500.

Yesterday, the bearish divergence lifted its ugly head again as AUD/USD slid below its 200DMA, confirming the breakdown from the 50DMA just on Monday.

Given these technical setups, Jackson Hole could indeed deliver another one of those critical junctures, whether up or down. For the Australian dollar, I am making a small bet that it has one more bounce left before dropping back to parity against the U.S. dollar.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

For the S&P 500, it is wait and see until support or resistance next breaks. And of course, since I think the Australian dollar will continue to slide downward, I think the S&P 500 will eventually “have to” follow as well.

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Be careful out there!

Full disclosure: long SSO puts, net long Australian dollar

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI