Trump says firing Fed Chair Powell "highly unlikely" unless fraud found

US dollar speculator positions see small pullback on February 10th

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators cut back on their net bullish positions for the US dollar last week.

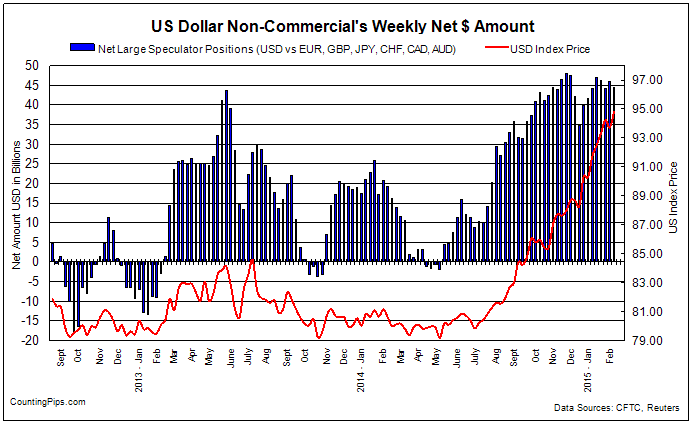

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $44.51 billion as of Tuesday February 10th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of -$1.31 billion from the $45.82 billion total long position that was registered on February 3rd, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

The latest US dollar speculative level, despite the decrease last week, remains strongly in bullish territory and above the +$40 billion mark for a seventh straight week. The US dollar also continues to maintain an overall net bullish position against all the other major currencies.

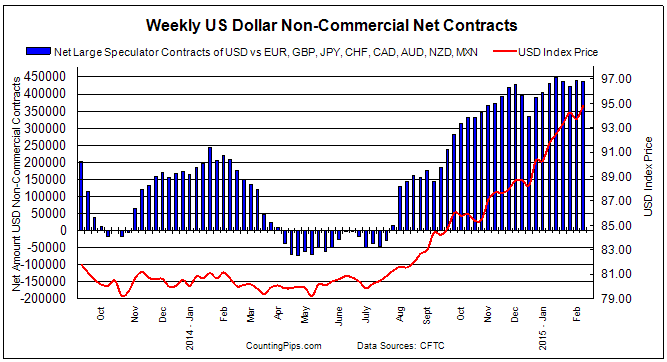

Overall Speculative Net US Dollar Contracts

In terms of total net speculative contracts, overall US dollar contracts fell for the third time in four weeks last week to a total of +435,804 contracts as of Tuesday February 10th. This was a change by -4,038 contracts from the total of +439,842 contracts as of Tuesday February 3rd. This total US dollar contracts calculation takes into account more currencies than the Reuters dollar amount total and is derived by adding the sum of each individual currencies net position versus the dollar. Currency contracts used in the calculation are the euro, British pound, Japanese yen, Swiss franc, Canadian dollar, Australian dollar, New Zealand dollar and the Mexican peso.

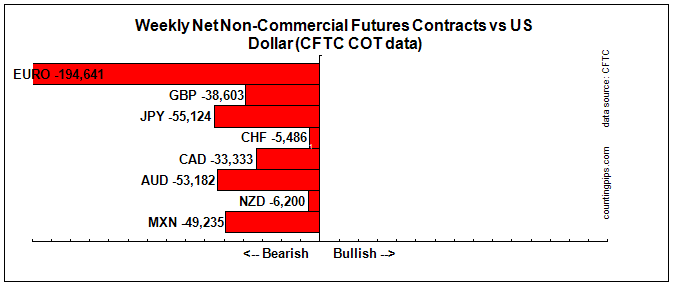

Major Currency Weekly Levels & Changes: One Sided – All currencies continue to remain net bearish versus the USD

Weekly changes for the major currencies showed that large speculators increased their bets in favor of the euro, British pound sterling, Japanese yen and the Australian dollar while decreasing weekly bets for the Swiss franc, Canadian dollar, New Zealand dollar and the Mexican peso. Overall however, all currencies continue to remain in bearish territory against the US dollar.

This latest COT data is through Tuesday February 10th and shows a quick view of how large speculators and for-profit traders (non-commercials) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

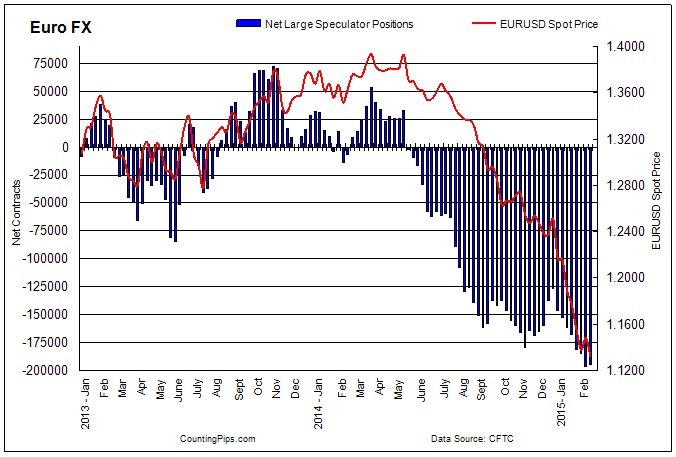

EuroFX:

Last Six Weeks data for EuroFX futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/15 | 406624 | 46016 | 207056 | -161040 | -8821 |

| 01/13/2015 | 422426 | 50858 | 218709 | -167851 | -6811 |

| 01/20/2015 | 450262 | 52047 | 232777 | -180730 | -12879 |

| 01/27/2015 | 449726 | 50489 | 235234 | -184745 | -4015 |

| 02/03/2015 | 457209 | 47719 | 244028 | -196309 | -11564 |

| 02/10/2015 | 444139 | 47217 | 241858 | -194641 | 1668 |

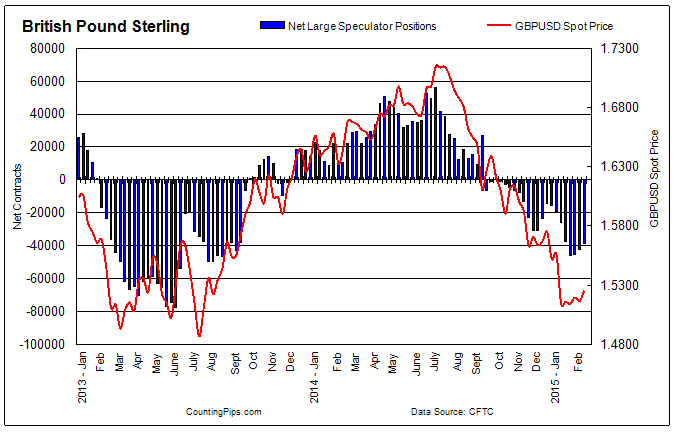

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 161876 | 39156 | 64726 | -25570 | -6268 |

| 01/13/2015 | 178563 | 41920 | 79060 | -37140 | -11570 |

| 01/20/2015 | 182860 | 35319 | 81027 | -45708 | -8568 |

| 01/27/2015 | 185350 | 38649 | 83989 | -45340 | 368 |

| 02/03/2015 | 182903 | 36220 | 78618 | -42398 | 2942 |

| 02/10/2015 | 175966 | 36798 | 75401 | -38603 | 3795 |

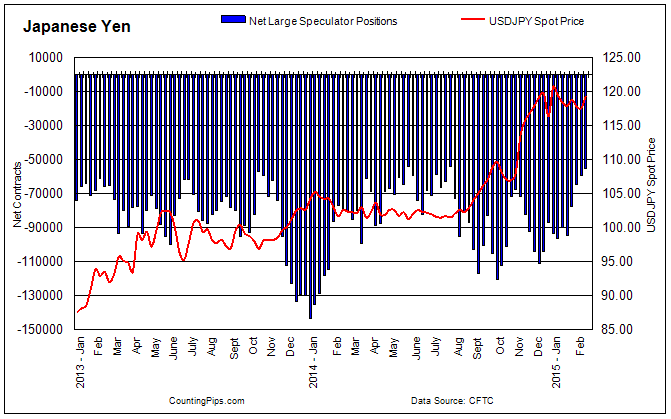

Japanese Yen:

Last Six Weeks data for Yen Futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 228954 | 33160 | 123243 | -90083 | 6236 |

| 01/13/2015 | 231223 | 25872 | 120497 | -94625 | -4542 |

| 01/20/2015 | 215413 | 26525 | 104411 | -77886 | 16739 |

| 01/27/2015 | 202571 | 26526 | 91184 | -64658 | 13228 |

| 02/03/2015 | 203963 | 25586 | 85157 | -59571 | 5087 |

| 02/10/2015 | 204193 | 25884 | 81008 | -55124 | 4447 |

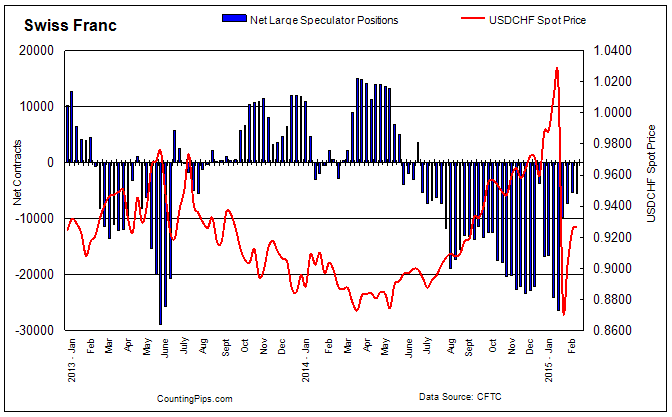

Swiss Franc:

Last Six Weeks data for Franc futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 64427 | 5547 | 29718 | -24171 | -7626 |

| 01/13/2015 | 66272 | 4922 | 31366 | -26444 | -2273 |

| 01/20/2015 | 47236 | 8226 | 18035 | -9809 | 16635 |

| 01/27/2015 | 42956 | 8841 | 16214 | -7373 | 2436 |

| 02/03/2015 | 38421 | 8383 | 13733 | -5350 | 2023 |

| 02/10/2015 | 34459 | 5771 | 11257 | -5486 | -136 |

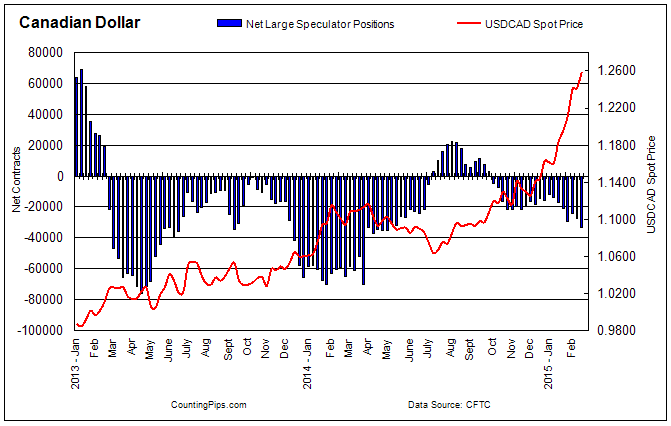

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 103775 | 31275 | 48362 | -17087 | -3054 |

| 01/13/2015 | 105003 | 27599 | 48778 | -21179 | -4092 |

| 01/20/2015 | 111631 | 24238 | 53318 | -29080 | -7901 |

| 01/27/2015 | 112718 | 28914 | 52877 | -23963 | 5117 |

| 02/03/2015 | 113662 | 24553 | 51874 | -27321 | -3358 |

| 02/10/2015 | 115744 | 21176 | 54509 | -33333 | -6012 |

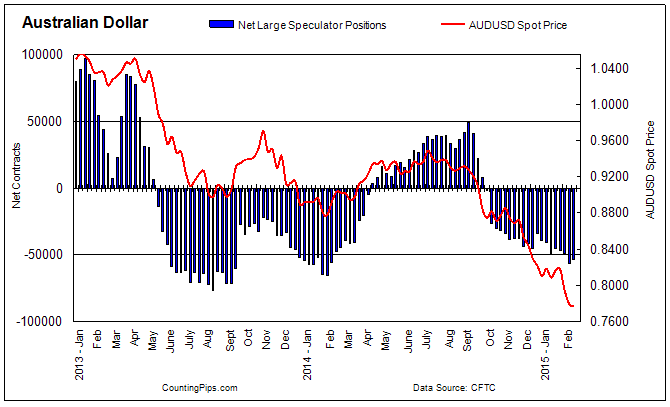

Australian Dollar:

Last Six Weeks data for Australian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 122205 | 16981 | 65633 | -48652 | -7955 |

| 01/13/2015 | 119819 | 14778 | 60143 | -45365 | 3287 |

| 01/20/2015 | 110904 | 9828 | 56408 | -46580 | -1215 |

| 01/27/2015 | 125620 | 16079 | 65022 | -48943 | -2363 |

| 02/03/2015 | 133075 | 15969 | 72128 | -56159 | -7216 |

| 02/10/2015 | 125359 | 12517 | 65699 | -53182 | 2977 |

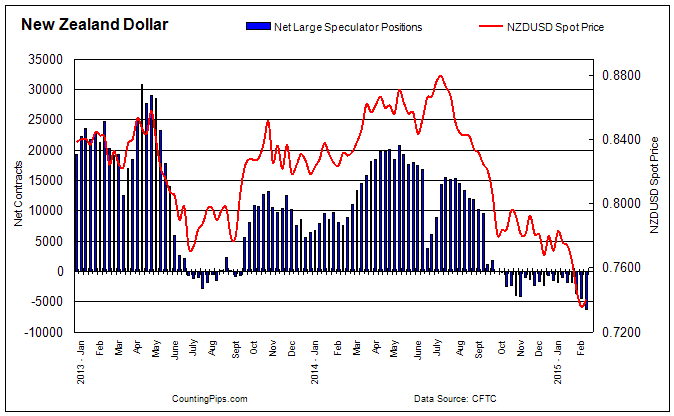

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 19437 | 9865 | 10772 | -907 | 939 |

| 01/13/2015 | 21064 | 8396 | 10172 | -1776 | -869 |

| 01/20/2015 | 22818 | 10941 | 12758 | -1817 | -41 |

| 01/27/2015 | 25594 | 11908 | 15567 | -3659 | -1842 |

| 02/03/2015 | 25687 | 10537 | 15034 | -4497 | -838 |

| 02/10/2015 | 26593 | 9272 | 15472 | -6200 | -1703 |

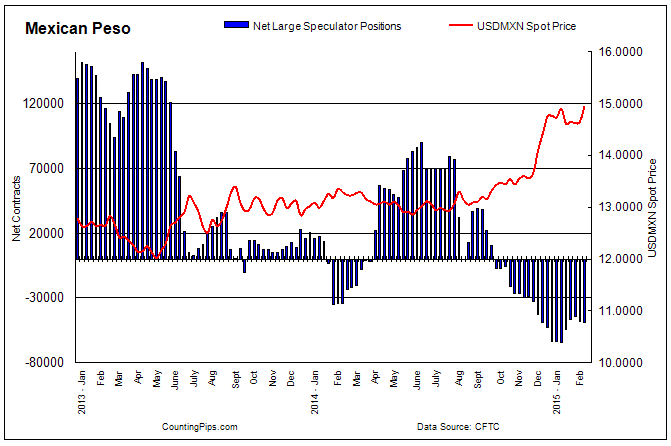

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 01/06/2015 | 131121 | 18667 | 83118 | -64451 | -646 |

| 01/13/2015 | 131155 | 17305 | 71600 | -54295 | 10156 |

| 01/20/2015 | 148671 | 19017 | 65280 | -46263 | 8032 |

| 01/27/2015 | 153115 | 26739 | 71312 | -44573 | 1690 |

| 02/03/2015 | 161412 | 23599 | 71836 | -48237 | -3664 |

| 02/10/2015 | 174861 | 25691 | 74926 | -49235 | -998 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.