Daily FX Market Roundup 03_11_20

By Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

In the last few weeks, the Federal Reserve, Bank of Canada, Bank of England and the Reserve Bank of Australia have lowered interest rates. Now, it's time for the European Central Bank to act. Up until today, the ECB has been relatively quiet about the impact of coronavirus and the volatility in the markets. However on the eve of its next central-bank meeting, ECB President Lagarde warned that Europe could face a 2008 style economic shock if European governments do not provide a coordinated response. This worry is a sign that a big announcement will be made on Thursday. In order to ease the selling in the markets and provide genuine support to the economy, the ECB needs to do more than lower interest rates.

Investors should expect a package of measures aimed at increasing liquidity and providing cheap funding.

Here Are Some Of The Central Bank’s Options:

- Lower interest rates by 10bp-20bp

- More QE – Increase asset purchases from EUR 20B to EUR 40B per month

- New LTRO for small and medium-size enterprises (SME)

- Cut TLTRO rate, lengthen maturity

- Increase tiering multiplier to ease the impact of negative rates on banks

The low-lying fruit would be an interest-rate cut combined with more asset purchases and changes to the TLTRO program. The only question for the ECB tomorrow will be the magnitude of these changes. A 10bp rate cut is completely discounted by the markets, which means the impact of a move that small will be limited. A rate cut needs to be larger or combined with a series of easing measures.

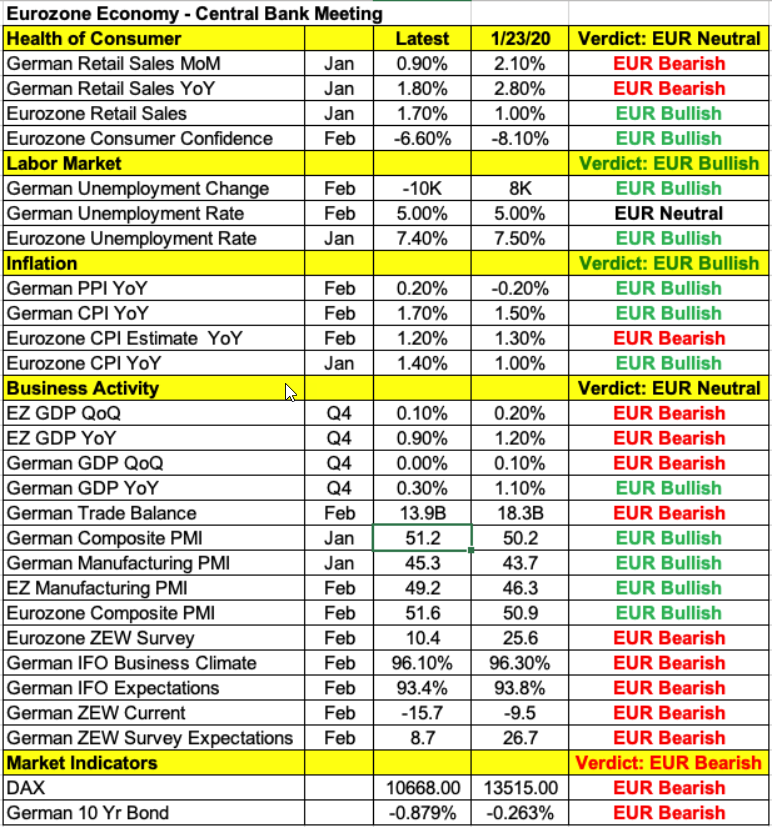

Data itself hasn’t been terrible. On Monday we learned that German industrial production rose more than expected and according to the table below, there has been more improvements than deterioration in the Eurozone economy since ECB's last meeting. Of course none of this data reflects the true impact of coronavirus. February and March data will be much worse with the Eurozone economy likely to contract in the first quarter. As ECB President Lagarde warned, coronavirus poses a 2008-style risk to the region’s economy and should not be taken lightly. Euro rose more than 10 cents ahead of the rate decision and while it pulled back in the last 48 hours, EUR/USD could sink to 1.1150 and lower if the ECB delivers powerful easing on Thursday.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.