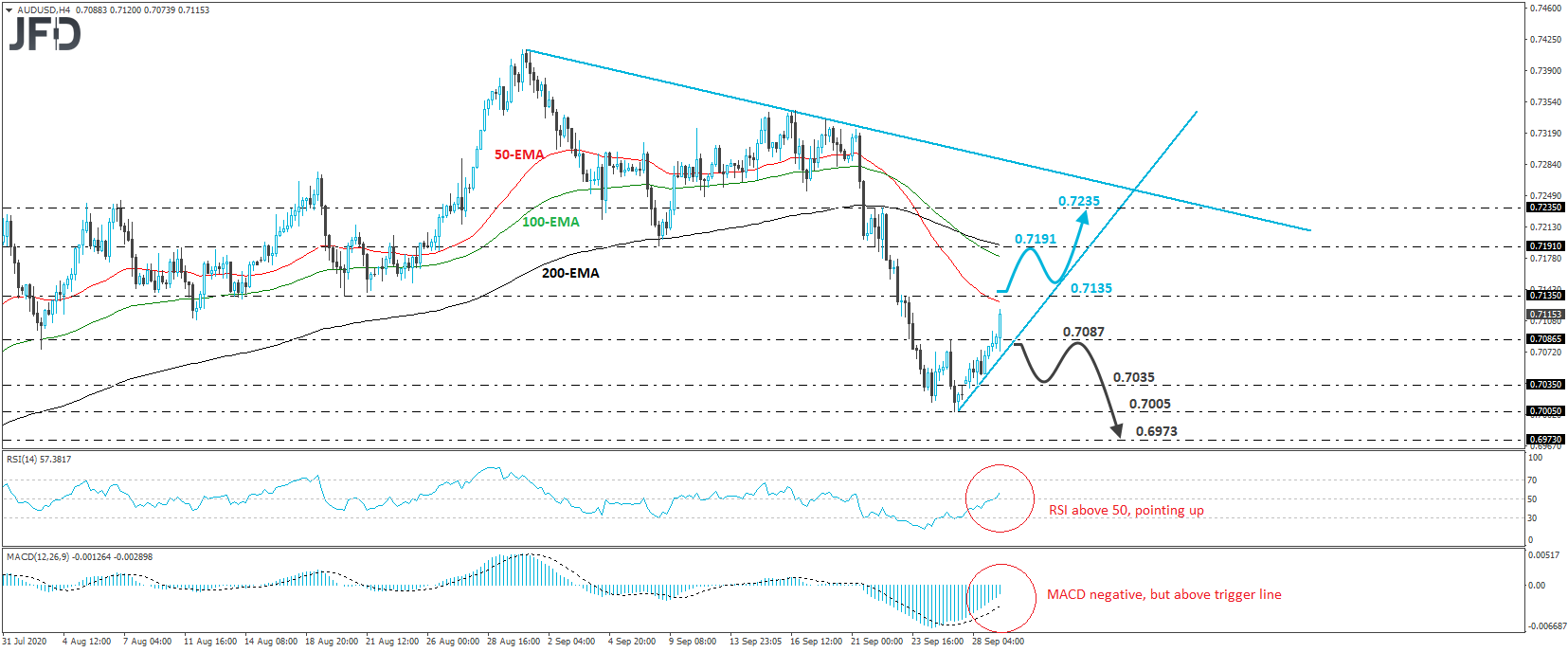

AUD/USD edged north on Tuesday, breaking above the resistance (now turned into support) barrier of 0.7087, marked by Friday’s high, thereby completing a non-failure swing bottom formation.

The pair has been in a recovery mode this week, while trading above a very short-term upside support line drawn from the low of Friday. Although the rate is still trading below the downside line taken from the high of Sept. 1, there is ample room for the recovery to continue before it hits that line.

If the bulls are willing to stay in the driver’s seat, we may see them challenging the 0.7135 hurdle soon, defined as a resistance by the inside swing low of Aug. 20. If they manage to overcome it, the next stop may be near the 0.7191 level, marked by the inside swing low of Sept. 8. Another break, above 0.7191, could set the stage for advances towards the peak of Sept. 22, at 0.7235.

Shifting attention to our short-term oscillators, we see that the RSI crossed above the 50 line and is now pointing up, while the MACD, although negative, stands above its trigger line and points north as well. Both indicators suggest that the rate may have started gaining upside speed, which supports the notion for some further recovery, at least in the short run.

On the downside, we would like to see a slide below 0.7087 before we start examining whether the bears have gained the upper hand again. Such a move would also take the rate below the pre-mentioned short-term upside support line, and may initially pave the way towards yesterday’s low, at around 0.7035, the break of which may target Friday’s low of 0.7005. If the slide does not end there, the next support to consider may be the 0.6973 obstacle, defined as a support by the low July 20.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.