Morgan Stanley identifies next wave of AI-linked "alpha"

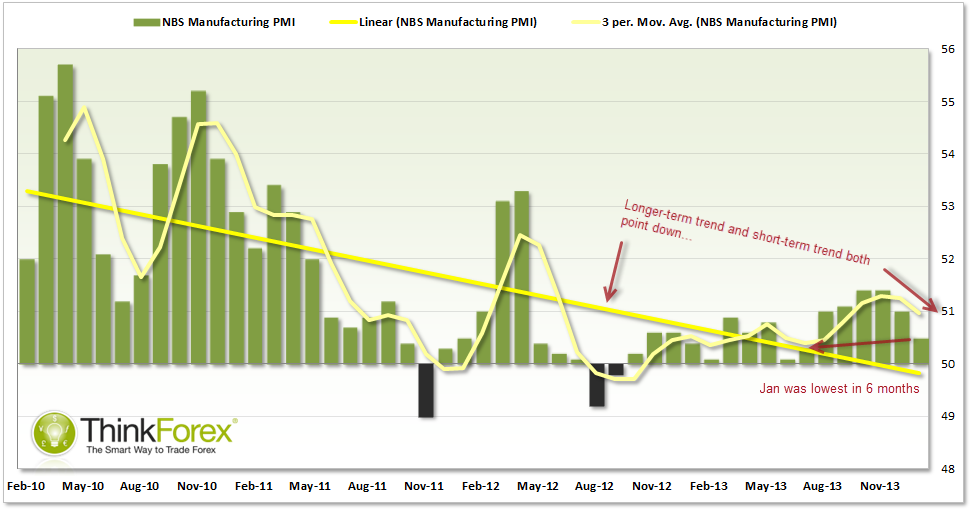

Following on from HSBC Flash PMI last week we now have the 'official' Manufacturing PMI for China tomorrow. Taking into account the 2 tend to track very closely in terms of trend and the disappointing release from Flash PMI last week, the market consensus is for a 3rd consecutive decline in tomorrow's Official PMI whilst the markets are closed for the weekend. This is what weekend gaps are made for!

We have only seen 3 numbers below 50 since November 2011 which came in at 49. The last time it was below 50 was back in September 2012 with a reading of 49.8. However we can clearly see the broader trend is down to highlight the manufacturing slowdown of the world's 2nd largest economy.

Last month was the 2nd consecutive decline and below its own 3-month moving average. If tomorrow's release comes in below 50.2 then it will be the first time we have seen 3 consecutive declines since May 2011.

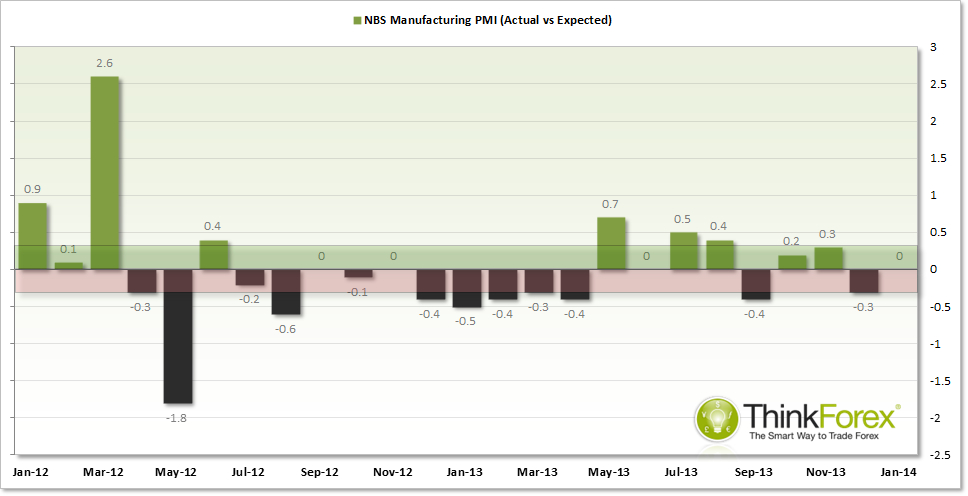

ACTUAL vs CONSENSUS DIFFERENTIAL: Tends to be between +/- 0.3

The differential chart simply shows us the difference between market consensus and the actual release. A positive reading denotes the release was better than expected, whereas a negative reading denotes the release was worse than expected. The differential makes it a little easier to see why the market may have been caught by surprise.

Whilst many expect a lower level of 50.1 (to come in 0.1 less than expected) we can see the more meaningful numbers tend to be when there is a differential over 0.3. Also interesting to note how we have more negative differentials than positive, to suggest the consensus is actually more positive before the actual release. So if we do see a number between 50-50.1 then it is likely to cause as few spikes/gaps over the weekend, but not necessarily a trend changer.

However if we see numbers below 50 then we can expect to see more meaningful moves from Monday onwards.

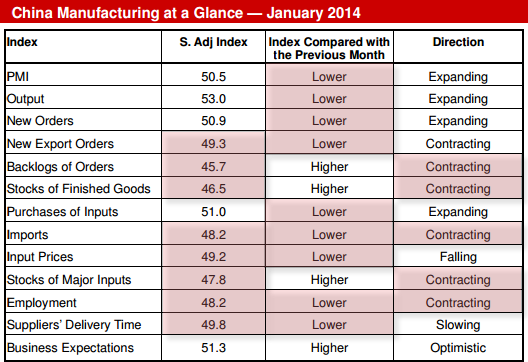

CHINA MANUFACTURING AT A GLANCE: Individual numbers favour continued contraction

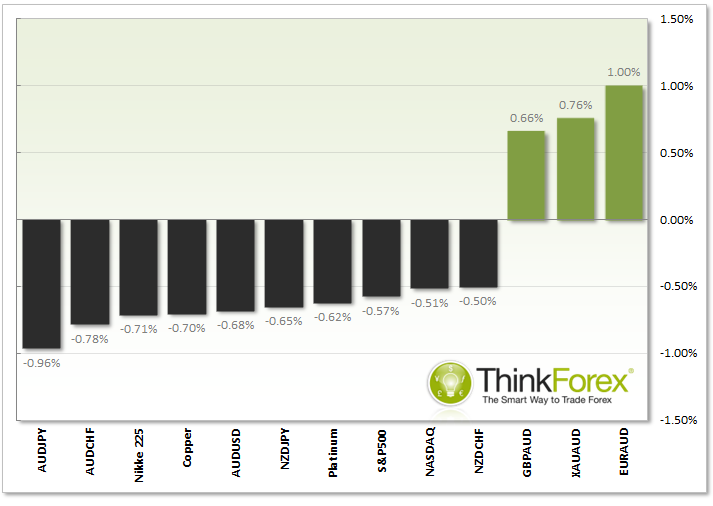

HSBC FLASH PMI: The Aftermath

Above is the candle range of the biggest overs within 30 minutes of the release. As expected the AUD and NZD were sold off against safe havens such as CHF, JPY, EUR and Gold. Indices also declined to further highlight the risk-off sentiment across the markets.

In the event we see further disappointment from China I would expect similar patterns to occur. However to see more sustainable trend we would require a significant deviation from the 50.2 expected, such as a release below 49.8.

The AUD/USD which is struggling to hold above 0.90 would target 0.888 and 0.882 next week, with next target becoming 0.8866 and beyond if the bearish trend accelerates.

SUMMARY:

- Deviations +/- 0.3 would be of greater significance for the markets

- A reading below 50 would cause some major ripples going into next week

- This would be negative for AUD, NZD and Indices and positive for safe havens (Gold, JPY, CHF)

- A reading below 49.8 should cause the more sustainable bearish moves for AUD

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.