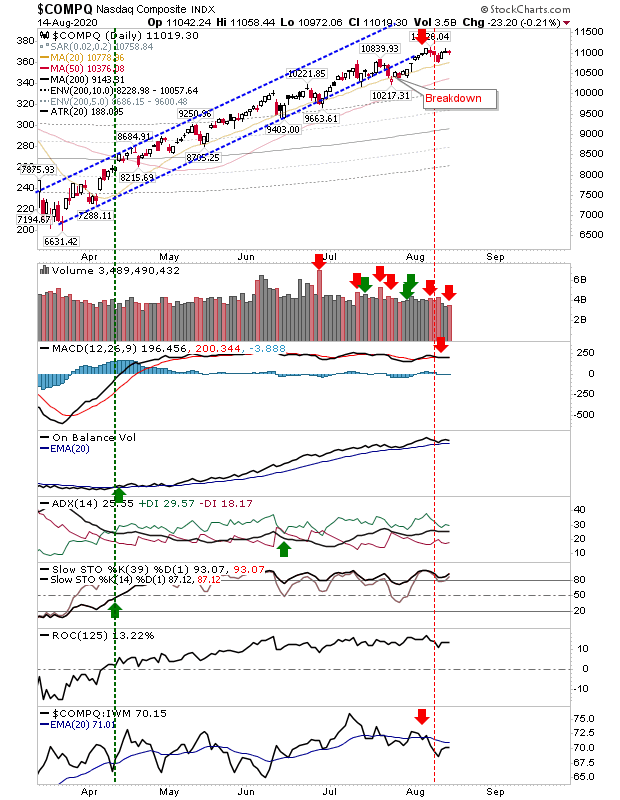

Last week passed with little change in lead indices. The NASDAQ is moving sideways after trading flat out of its five month rising price channel.

The index is underperforming relative to the Russell 2000 with a 'sell' trigger in the MACD, but other technicals are bullish. Friday's narrow range day came with higher volume distribution but it was more of a neutral close to the week. It's anyone's game for the coming week.

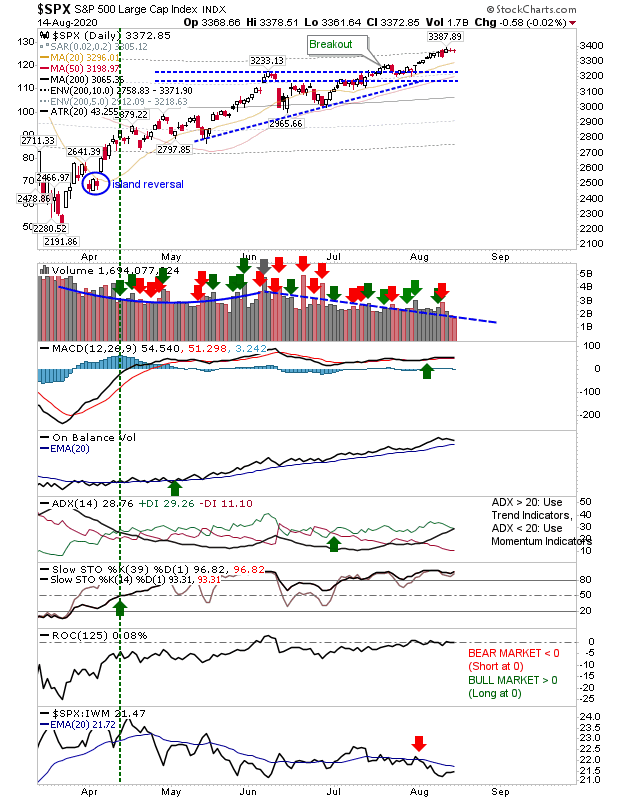

The S&P clocked a third day of flat trading on very light volume. All technicals are bullish, although like the NASDAQ it's underperforming against the Russell 2000.

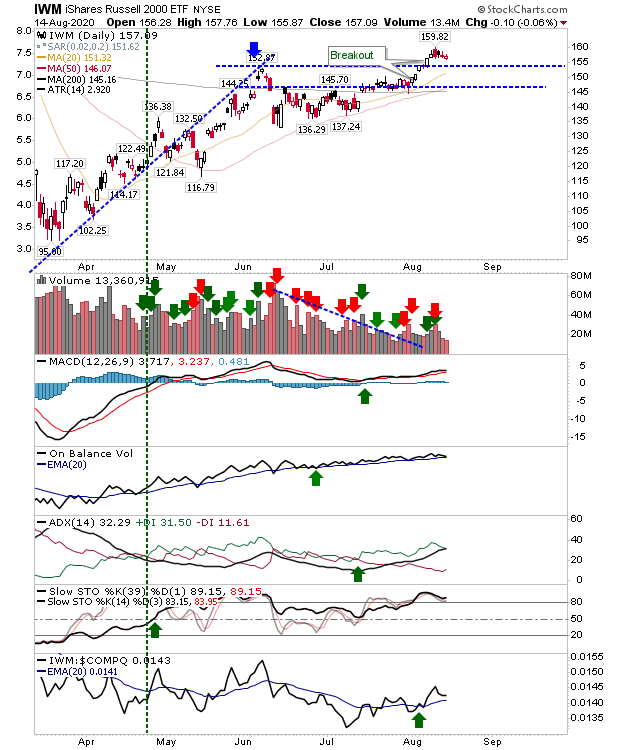

The index to watch for next week is the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)). It's coming off a recent breakout on improving technicals, including a relative improvement to the NASDAQ and S&P. It didn't do a whole lot last week but the small 'bull flag' is a positive.

We can't read too much into what happened last week. Trading days were light and intraday ranges narrow. Vacation season has a few more weeks to go before we can start to consider a pick up in volume and perhaps a directional move for markets.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI