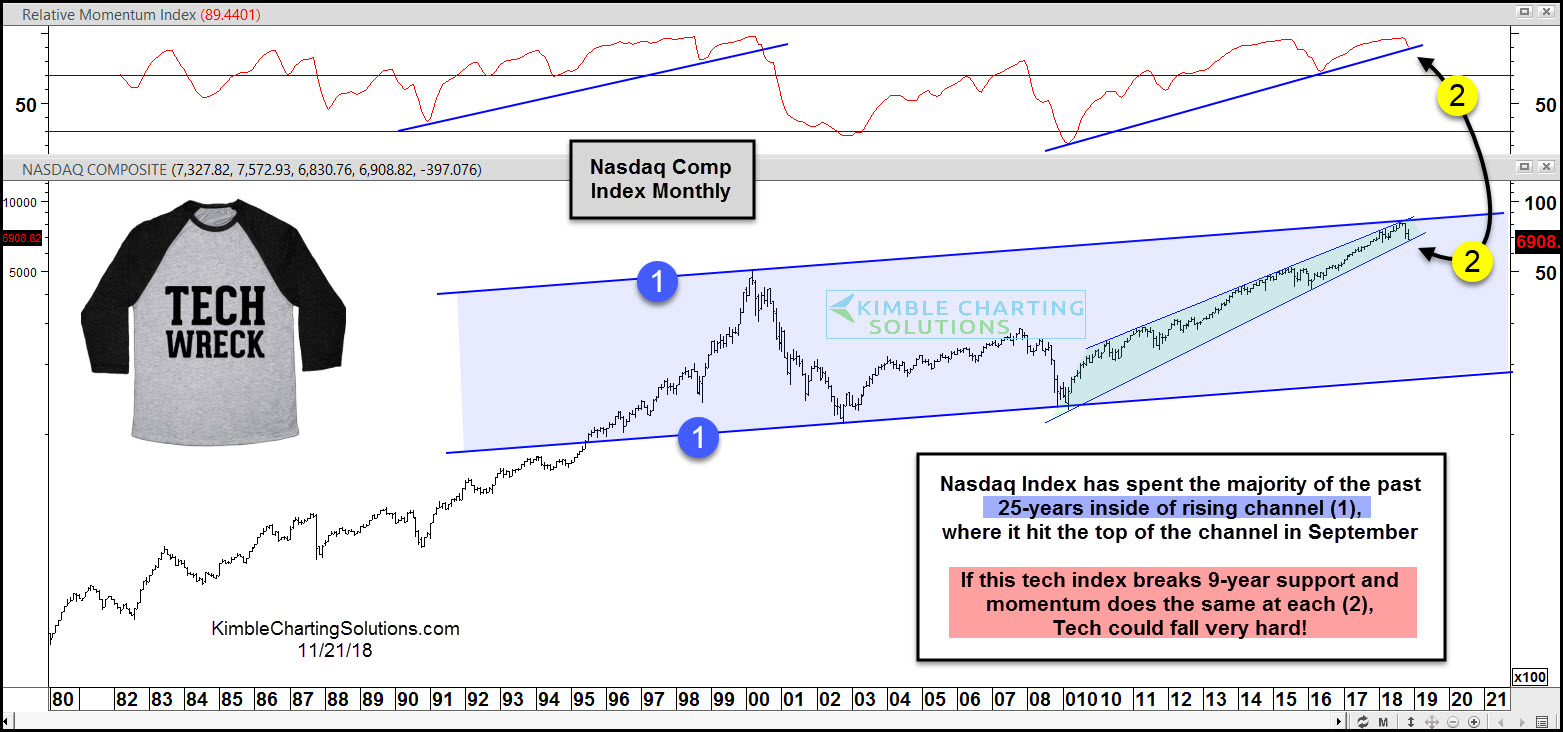

This chart looks at the Nasdaq Composite Index (IXIC) over the past 38 years. It has spent the past 25 years inside of rising channel (1).

The Long-term Trend in this index remains up, despite recent softness.

The rally off the bottom of the channel that started in 2009 hit the top of the channel in September, as monthly momentum reached levels last seen in 2000. The price and momentum decline over the past -weeks has both testing 9-year rising support at (2).

Even though many feel that Tech has been a wreck of late, it has done nothing more than decline to test rising support.

If both support lines break to the downside at (2), the odds greatly increase that Tech sells off by a large percent.

If Tech does wreck, it most likely would get started on a dual break of support at (2).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.