Deutsche Bank lists six ways GPT-5 matters

The big story in the FX market is the sell-off in emerging market currencies and the impact it is having on the majors. In the financial markets, contagion is an ugly word but the BRICs are starting to fall, leading to contagion from emerging market nations to developed economies. While countries like the U.K. have their own problems with Bank of England Governor Carney talking about the headwinds to growth and constrains of a strong currency this morning, the deep sell-of in USD/JPY and AUD/USD have been driven by the outflows from emerging markets. This move is caused by the uncertainty of Fed policy, concerns about China and outright liquidation of risk assets.

EM Nations are Running Out of Money (FX Reserves)

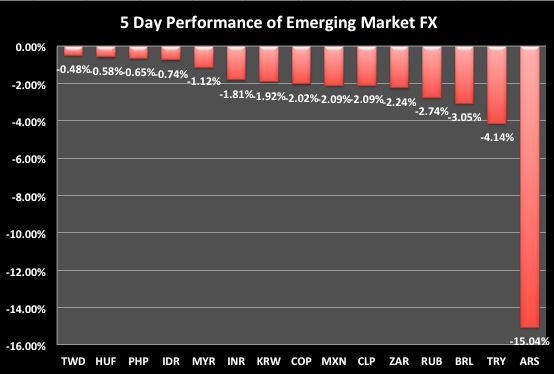

This past week, the Turkish Lira plunged to a record low, the Argentine Peso suffered its largest one-day decline in more than a decade, the South African Rand dropped to its lowest level in 5 years, while the Brazilian Real fell to a 5 moth low. Emerging nations are having a very tough time fighting the outflows, particularly Argentina whose currency has lost more than 18% of its value since the beginning of the year (15% of which occurred this week). In fact, the central bank is scaling back intervention because they are running out of money to intervene – their foreign exchange reserves are dwindling. They can no longer afford to prop up their exchange rate in the same way as before because in 2013, their reserves dropped to their lowest level in 7 years. Turkey is still fighting the uphill battle, spending another $3.5 to $4 billion to shore up the lira yesterday but they have only $33 billion left in their FX reserves. To illustrate the magnitude of the problem the following table shows how the Argentinian peso and Turkish are the worst performing currencies this year.

DM vs EM

In a crisis of confidence, liquidation by investors generally last longer than most expect so there’s a reasonable possibility for another 5% move lower in EM currencies before everything stabilizes. Unfortunately confidence or the lack of it is not the only reason why investors are abandoning emerging market currencies. In our 2014 outlook, we talked about how this will be the year for DM (developed markets) versus EM because slower growth in China will encourage investors to move money out of emerging market assets, particularly money that is parked in countries that are heavily reliant on Chinese growth. Brazil and South Africa supply raw materials to China. Countries with massive current account deficits like Turkey are particularly vulnerable. With Chinese growth expected to slow for the next 5 years, emerging market currencies could underperform for some time to come.

Will there be a Fed Driven Relief Rally?

For the major currencies, the sell-off in global markets could lead to continued risk aversion, which means a deeper sell-off in pairs such as USD/JPY, AUD/USD and GBP/USD ahead of next Wednesday’s FOMC rate decision. If the U.S. central bank decides to provide a bit more support to the U.S. and the global economy by keeping asset purchases unchanged this month, we could see a relief rally in EM and DM currencies.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI