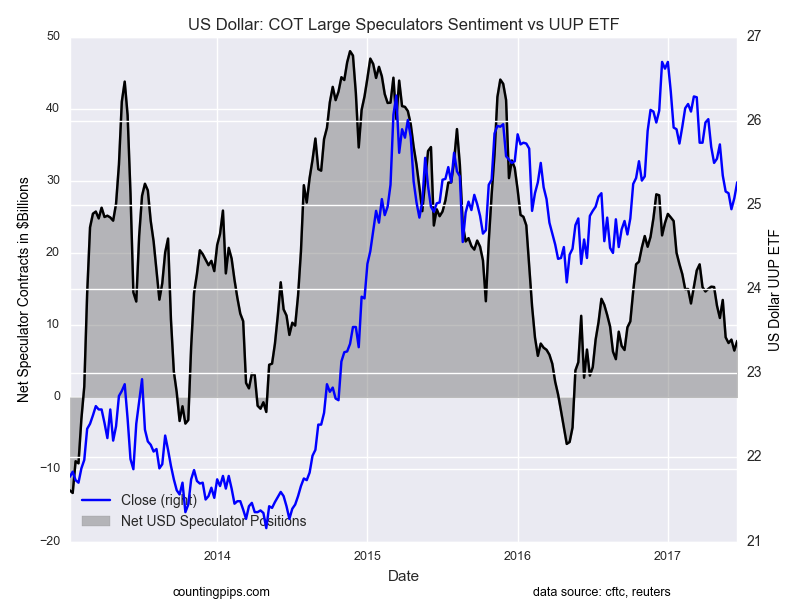

US dollar net speculator positions rose to $7.82 billion last week

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators slightly raised their bullish bets for the USD last week.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $7.82 billion as of Tuesday June 20th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly gain of $1.34 billion from the $6.48 billion total long position that was registered the previous week, according to the Reuters calculation (totals of the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc).

The dollar speculative position has remained under the $10 billion level for the past five weeks after staying above that level for a span of thirty-three straight weeks from October 4th 2016 to May 15th 2017.

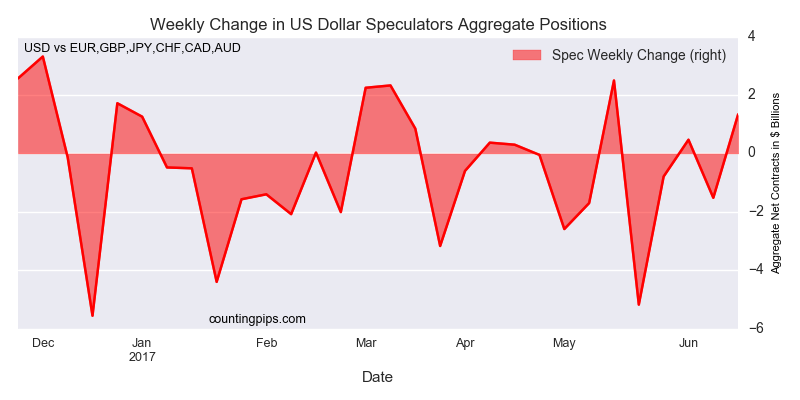

Weekly Speculator Contract Changes:

The individual major currency contracts saw some sharp movements this week with five major currencies seeing weekly changes above the 10,000 contract mark.

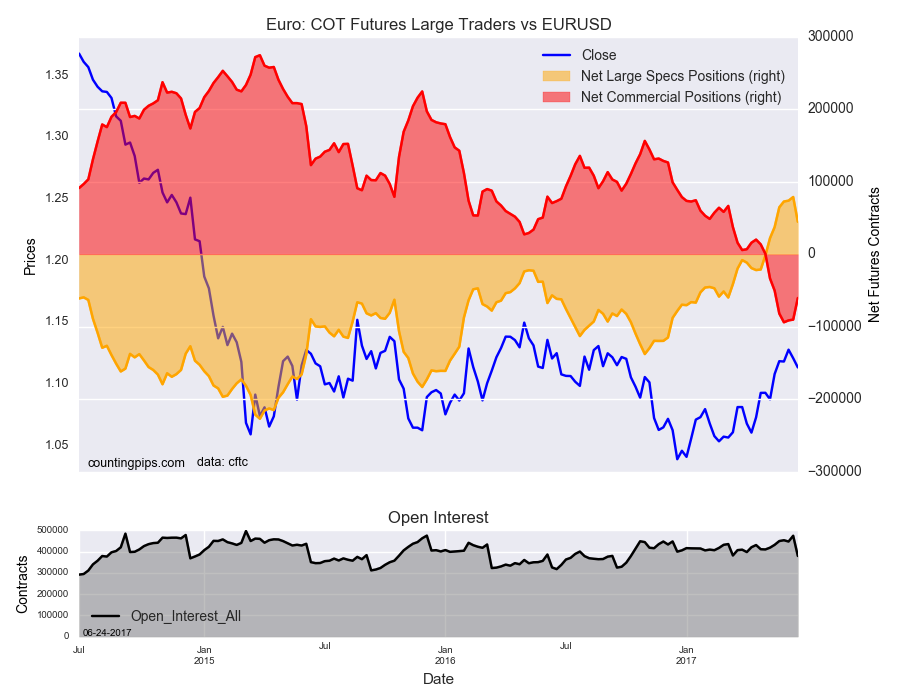

- The euro saw its speculator position fall for the first time in nine weeks and after rising to the best position since 2011.

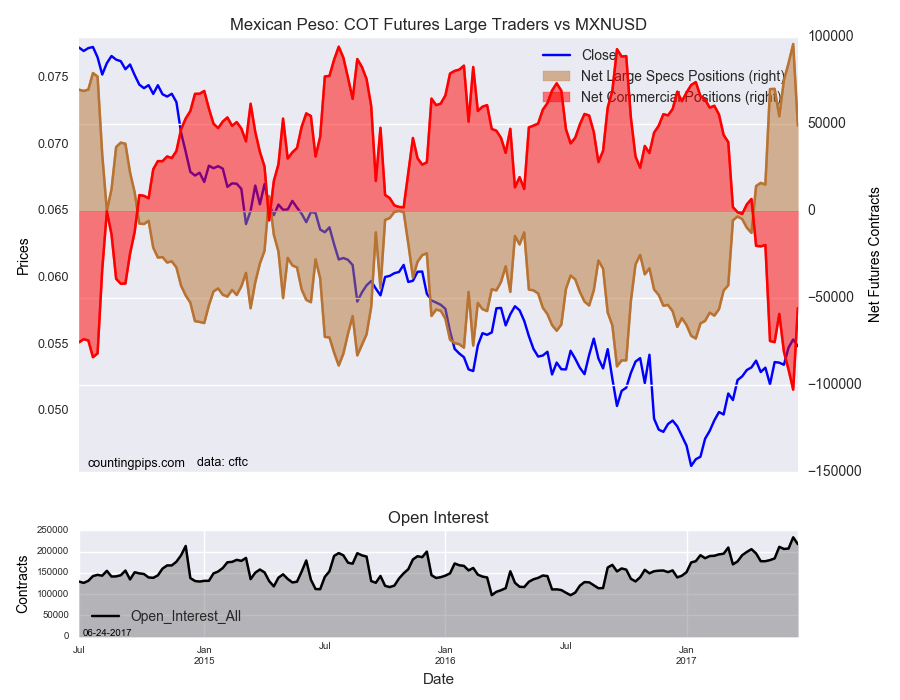

- The Mexican peso positions dropped very sharply after it had reached its highest speculator position level since May of 2013 and had risen for the previous three weeks.

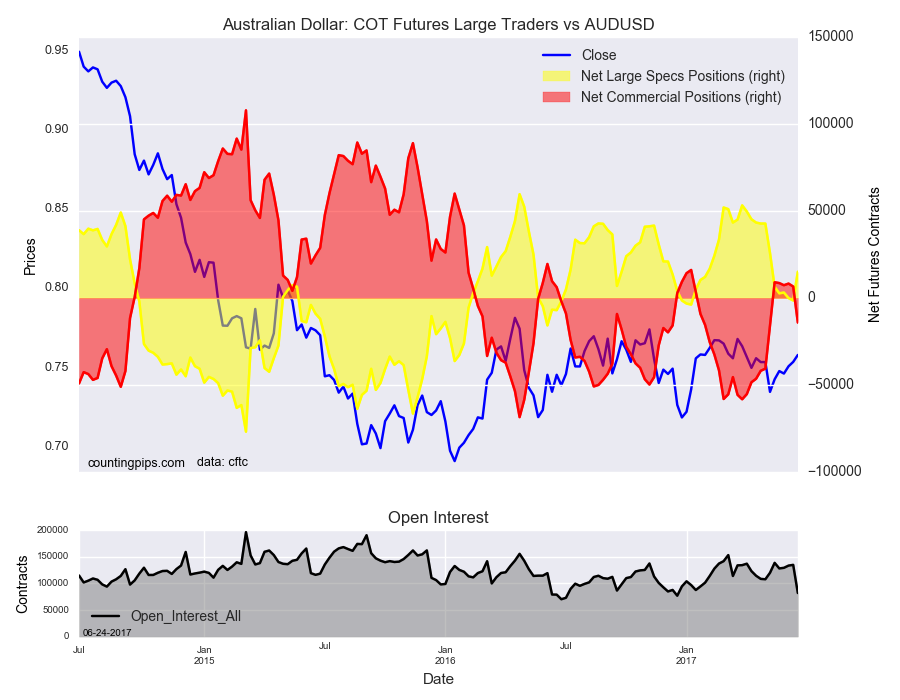

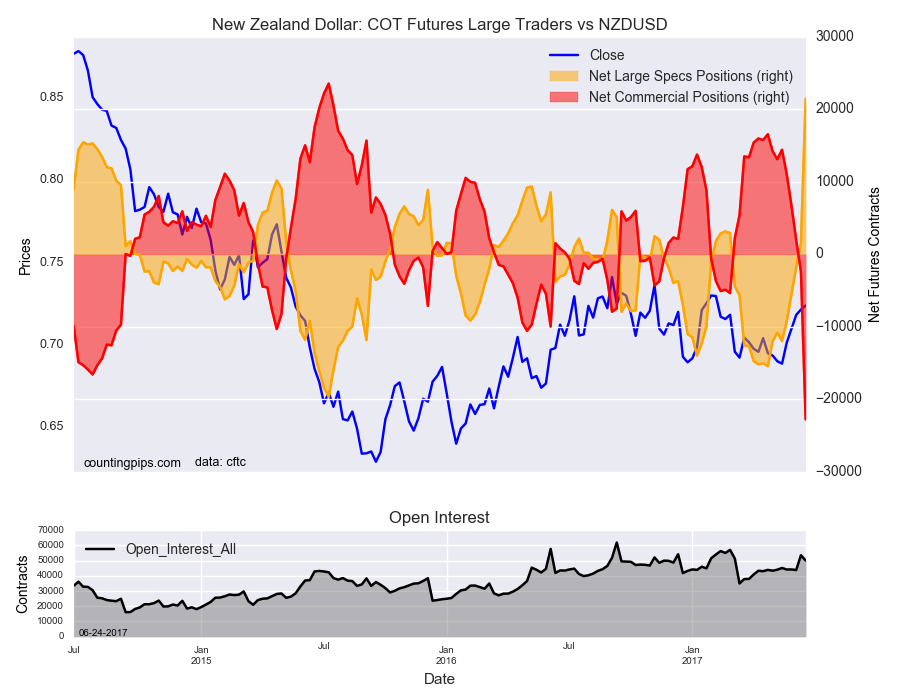

- The Australian dollar rose back into an overall bullish position after a few weeks in bearish territory while the New Zealand dollar rose higher into bullish territory with its fifth straight week gain in spec positions.

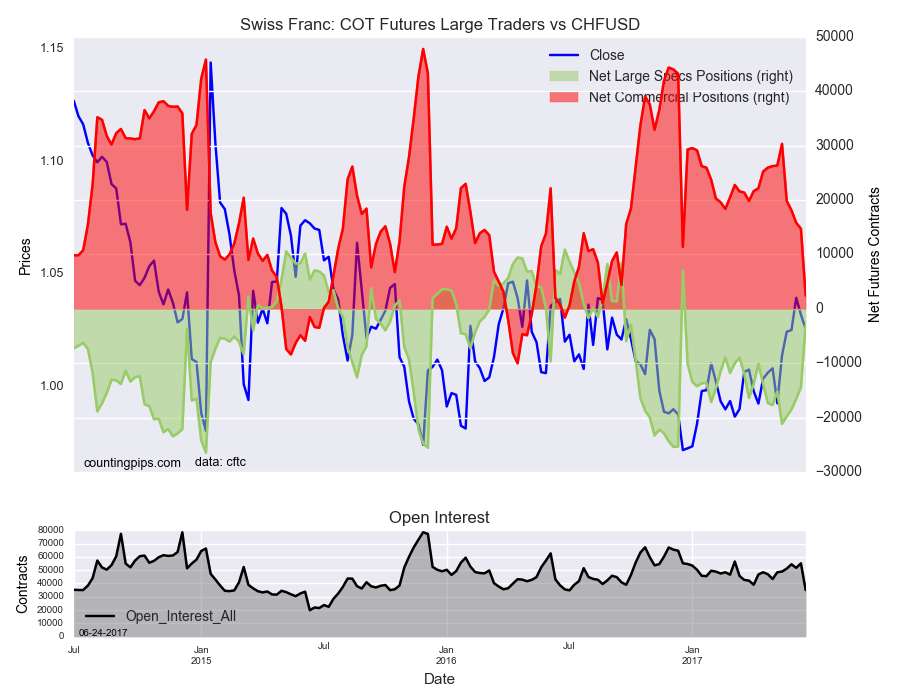

- The Swiss franc speculator positions gained for a fifth week as well and are now at the least bearish level since December 2016.

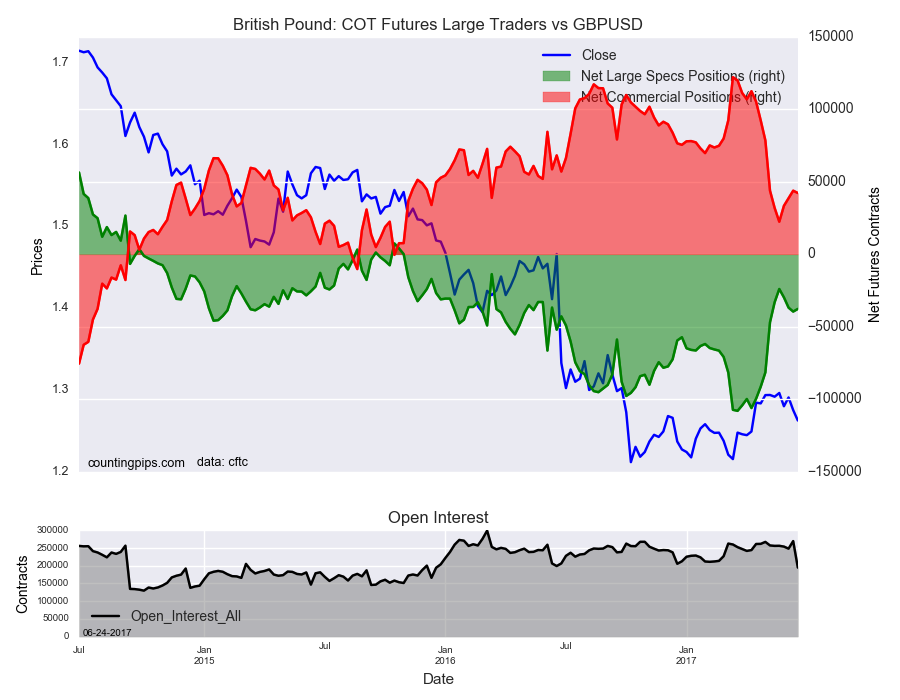

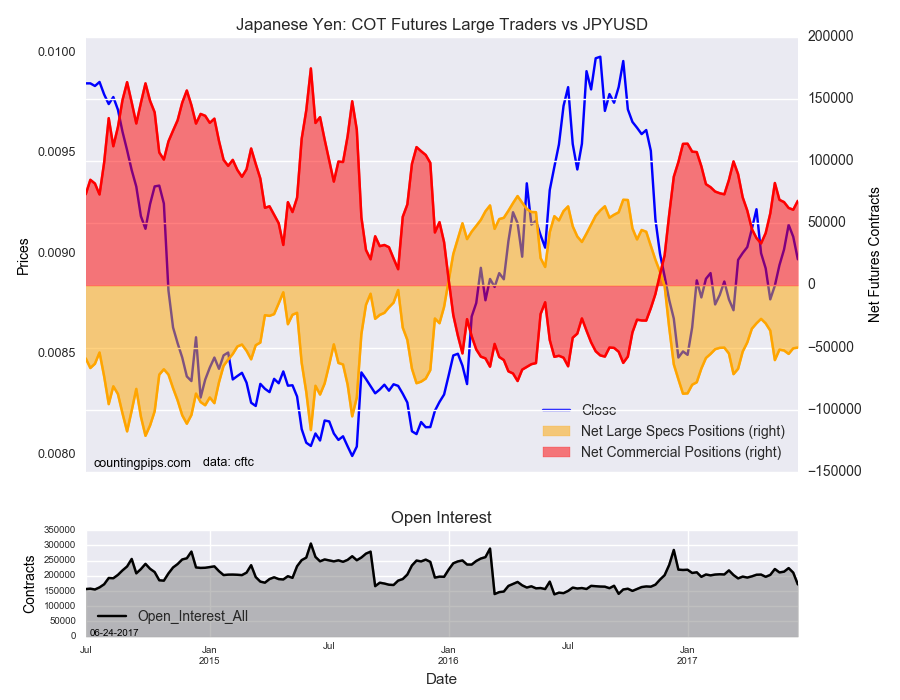

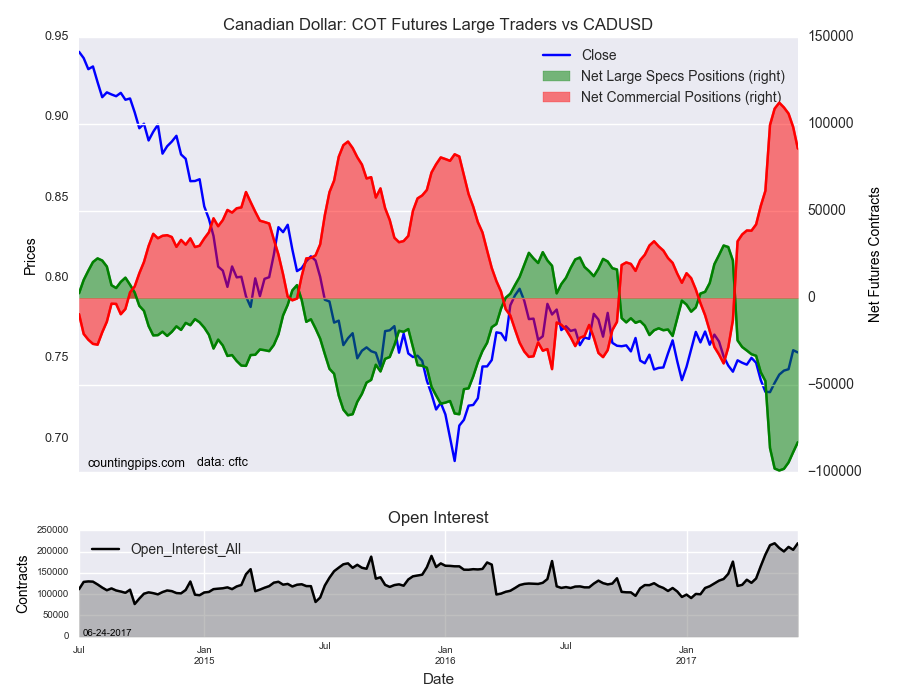

The list of all the major currencies that improved against the US dollar last week includes the British pound sterling (1,837 weekly change in contracts), Japanese yen (594 contracts), Swiss franc (11,478 contracts), Canadian dollar (5,714 contracts), Australian dollar (16,544 contracts) and the New Zealand dollar (19,860 contracts).

The currencies whose speculative bets declined last week versus the dollar were the euro (-34,201 weekly change in contracts) and the Mexican peso (-46,829 contracts).

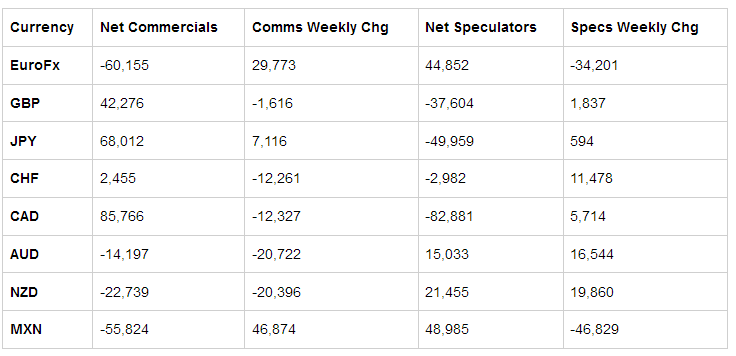

Table of Weekly Commercial Traders and Speculators Levels & Changes:

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

British pound sterling:

Japanese yen:

Swiss franc:

Canadian dollar:

Australian dollar:

New Zealand dollar:

Mexican peso:

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI