EUR/USD: Exit from the base formation.

Today we can with a higher degree of certainty call for an upward reaction to have started. The break above 1.2963 has made a bear triangle impossible hence enhancing the upside correction case. A couple of possible targets for this correction are 1) 1.3048, the mid body point of the latest falling benchmark candle and 2) 1.3179, 38.2% of wave 3 (4th waves are commonly rather shallow).

AUD/USD: Soon at next support.

The relentless selling just continues and the current wave 3 is now rapidly homing in on its primary target, 0.8965. Following the textbook a wave four bounce should occur (even though in strong trending markets wave 3 sometimes moves 261.8% * wave 1 = 0.8693) from the 0.8965 area.

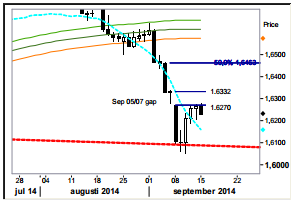

GBP/USD: Trying the low end of the gap.

So far we’ve managed to briefly touch the low end of the gap from last weekend, 1.6270. We are however still penciling in a full gap fill (as continuation gaps almost always get filled) so look for consolidation in primarily a 1.6205 (1.6158 Sep 10 mid body point is an alternative range floor) – 6270 range and thereafter a move up to 1.6332-ish to complete the fill.

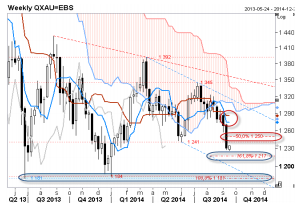

Spot Gold: The sub-1,241 break targets 1,217.

The down move accelerated into a notably bearish candle last week which also violated a 1,241 ref in the process. Conditions may require an early pause/correction early on this week, but investors should, once it fades, start targeting a medium-term 161.8% Fibo projection ref at 1,217 or even a more important zone of support at 1,184-1,181. First-hand resistance comes into play at 1,241-1,250.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.