The 3 required skills for covered call writing and selling cash-secured puts are stock selection, option selection and position management. This article will use real-life examples highlighting the first 2 of these skill sets in a bull market environment.

Article assumptions and guidelines

- Portfolio is set up in a bull market environment

- Target goals for initial time value returns are 2% – 4%

- $50k cash available

- Select 5 different stocks in 5 different industries

- Adequate cash allocation

- 2% – 4% of total cash available reserved for exit strategy execution, if needed

- Premium Report dated 12/15/2017 for 1/19/2018 expirations is used for stock selection

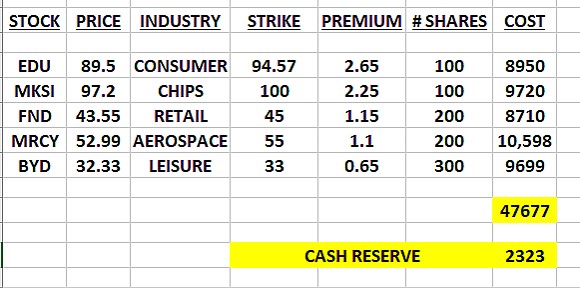

Stocks selected

Selection guidelines achieved

- 5 different stocks

- 5 different industries

- Cash allocation near $10,000.00 per position (no single position dominates from a cash investment perspective)

- Adequate cash reserve ($2323.00) for potential exit strategy opportunities

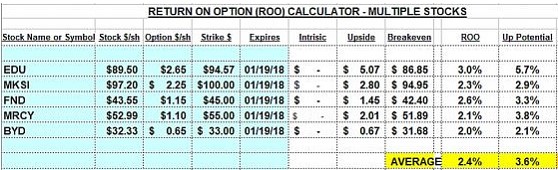

Calculating Initial time value portfolio returns

Calculation guidelines achieved

Returns fall into our target 2% – 4% range (2.4%)

Establishing a significant upside potential bull market opportunity (3.6%)

Discussion

When targeting initial time value return goals (ROO) for our covered call writing portfolios of 2% – 4%, we are using these stats to set up the portfolios. Final results can be lower or higher. In bull markets we favor out-of-the-money strikes which offer the opportunities for share appreciation up to the strike price in addition to the option premiums…two income streams per position. In the real-life portfolio highlighted in this article, the average initial return (ROO) was 2.4% and the potential share appreciation averaged 3.6%. This created a portfolio with a possible 6%, 1-month return. Stock and option selection were discussed in this article but I would be remiss if I didn’t mention the importance of position management in our final returns. Also, two final points:

- The odd $94.95 strike for MKSI was a result of a contract adjustment after a corporate event

- Bid prices were used for the calculations. Leveraging the Show or Fill Rule may have elevated the returns displayed

Market tone

This week’s economic news of importance:

- NAHB home builders’ index June 68 (70 last)

- Housing starts May 1.301 Million (1.300 million expected)

- Building permits May 1.301 million (1.364 million last)

- Existing home sales May 5.43 million (5.52 million expected)

- Weekly jobless claims 6/16 218,000 (220,000 expected)

- Philly Fed June 19.9 (29.0 expected)

- Leading indicators May 0.2% (0.4% last)

- Markit manufacturing PMI June 54.6 (56.4 last)

- Markit services PMI June 56.5 (56.8 last)

THE WEEK AHEAD

Mon June 25th

Tue June 26th

- Case-Shiller home price index April

- Consumer confidence index June

Wed June 27th

Thu June 28th

- Weekly jobless claims through 6/23

- GDP revision Q1

Fri June 29th

- Personal income May

- Consumer spending May

- Chicago PMI June

- Consumer sentiment (final) June

For the week, the S&P 500 moved down by 0.89% for a year-to-date return of 3.04%

Summary

IBD: Confirmed uptrend

GMI: 5/6- Buy signal since market close of April 18, 2018

BCI: Favoring 3 out-of-the-money calls for every 2 in-the-money calls.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral tone. In the past six months, the S&P 500 was up 3% while the VIX (13.77) moved up by 40%.

Wishing you much success,

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.