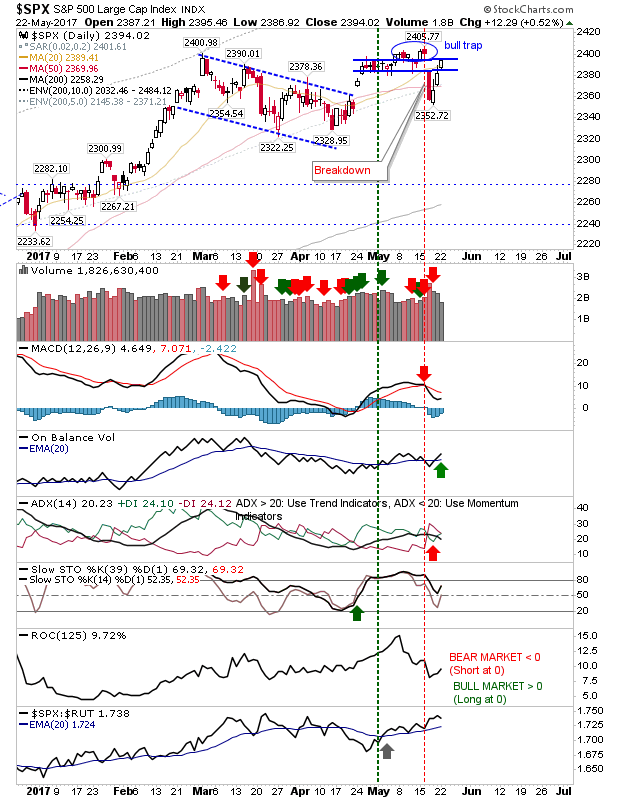

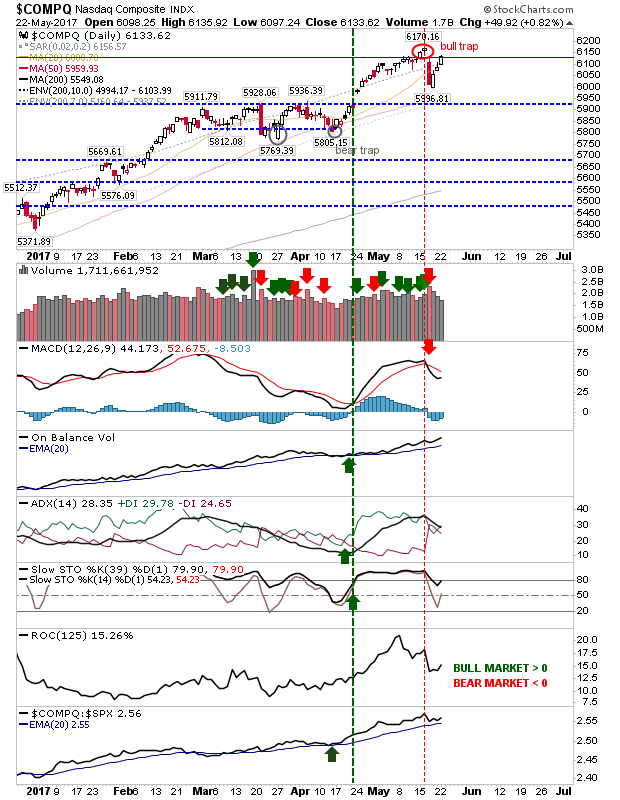

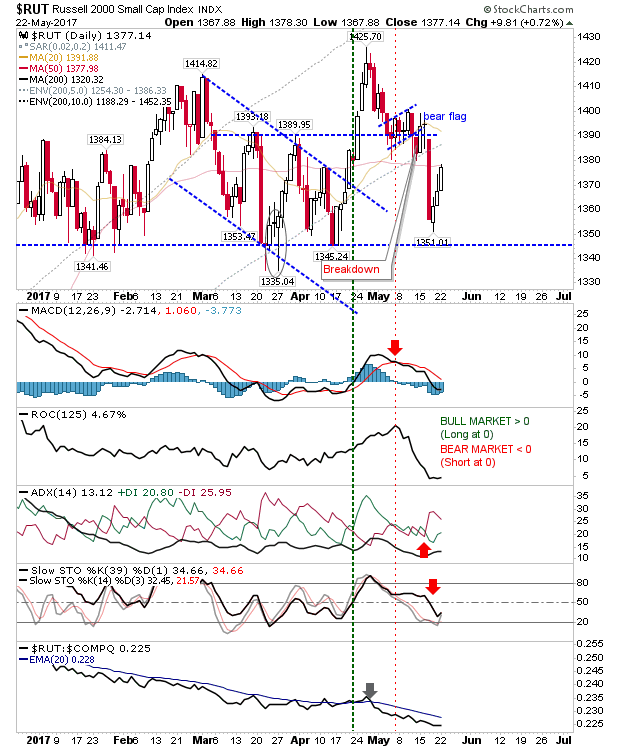

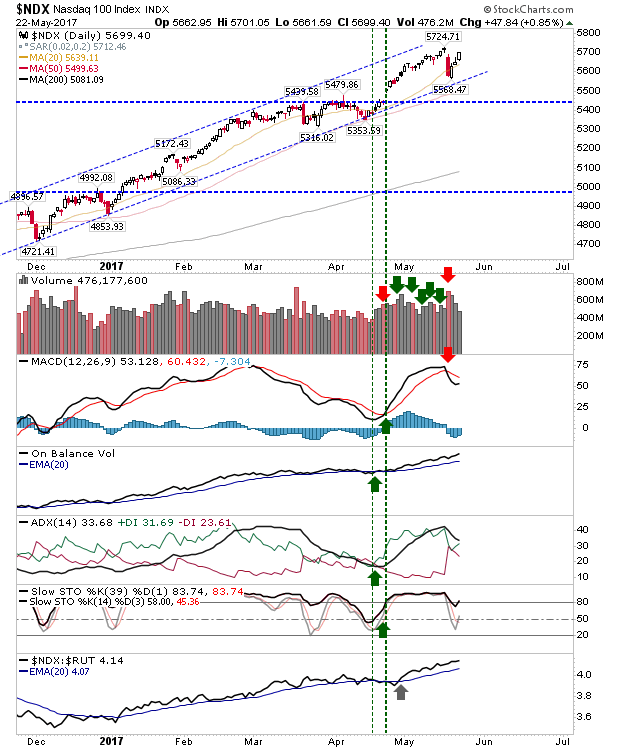

While yesterday's gains were modest they were significant in generating clean pushes inside last week's breakdown gaps. This brings indices back to challenge 'bull traps'

The S&P experienced lighter volume trading as On-Balance-Volume moved to a 'buy' trigger. Yesterday's action opens up for a challenge of 2,405, although shorts may see this as opportunity to go aggressive with a tight stop once markets make all-time highs.

The NASDAQ is also approaching its 'bull trap'. On-Balance-Volume holds to its accumulation trend while the MACD is on a 'sell' trigger. As with the S&P the NASDAQ could see a challenge on the 'bull trap' tomorrow.

The Russell 2000 had the best of the day's action, but it only took the index back to its 50-day MA. Technicals are all in the red, but the risk:reward for the index remains poor particularly with the index stuck inside the 6-month trading range - a push back to 1,390 might make this a better short play.

The NASDAQ 100 looks like it will be challenging the doji with a high of 5,724 today. However, if this breaks above 5,724 then next up will be resistance of the 6-month rising channel (blue hashed line).

Markets might squeeze another day of gains today before profit takers and shorts pay a visit. If there are more gains then a parabolic move higher could emerge if all-time highs are breached.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI