Trump announces trade deal with EU following months of negotiations

There wasn't a whole lot to yesterday's action. Small gains in the NASDAQ and S&P on Wednesday were unable to return a challenge on the prior swing high, while Tuesday's new high in the Russell 2000 saw a minor loss.

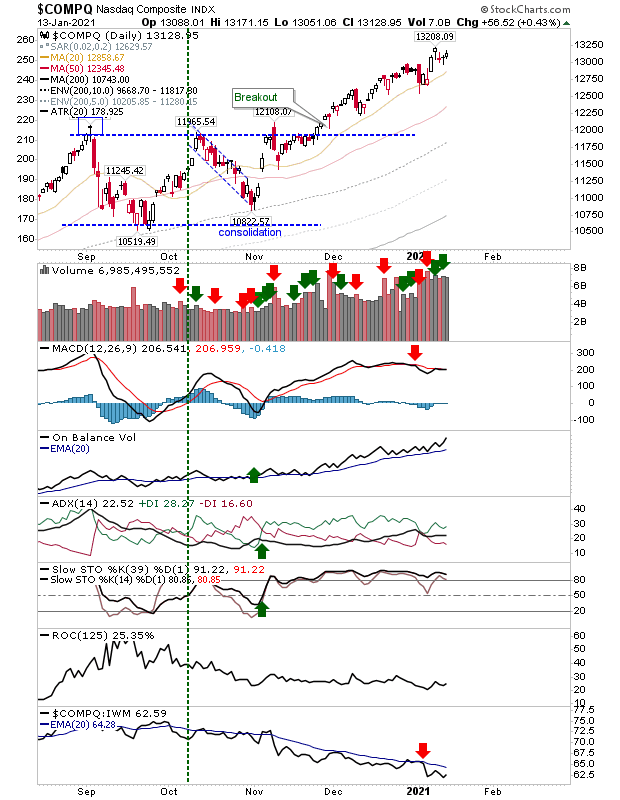

Buying volume for the NASDAQ was lighter than normal and there was already a 'sell' trigger in the MACD. In addition, relative performance remained poor.

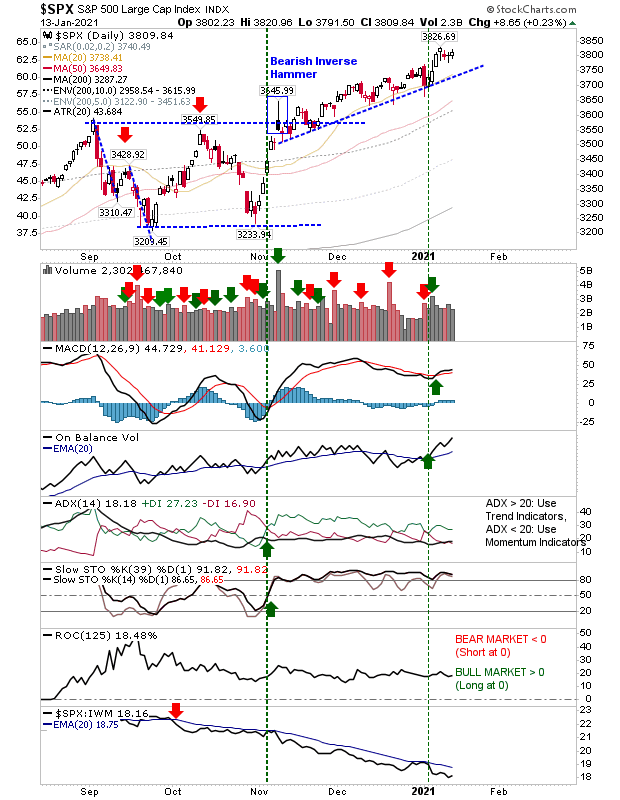

The S&P is net bullish with yesterday's buying representing a nice consolidation handle.

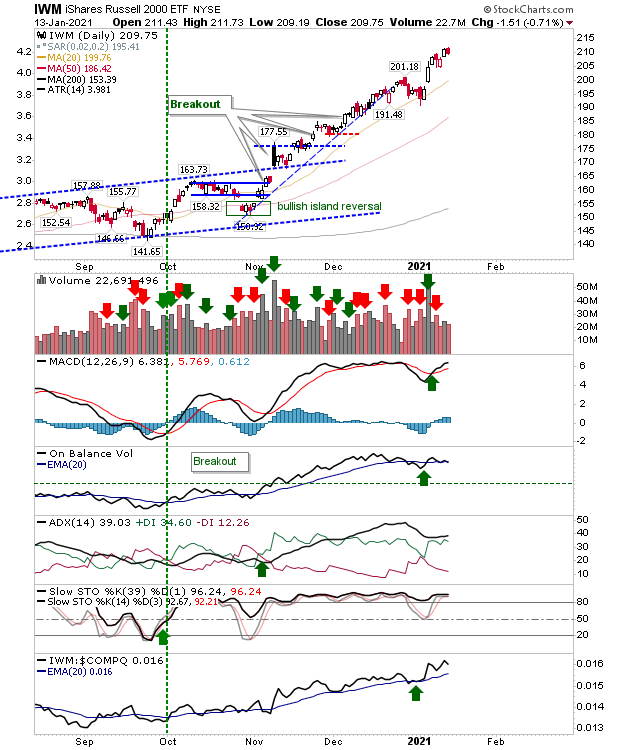

Small Caps (via IWM) experienced light losses which kept things ticking over. There wasn't a whole lot more to say as technicals remained net bullish. The index is very extended and ripe for a correction—but extended markets can trip up the unwary.

A bit of a mixed bag as buyers in Large Caps and Tech ran counterplays to the Russell 2000. Markets are vulnerable because of their extended nature, but buyers still look to have an edge for Large Caps and Tech.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.