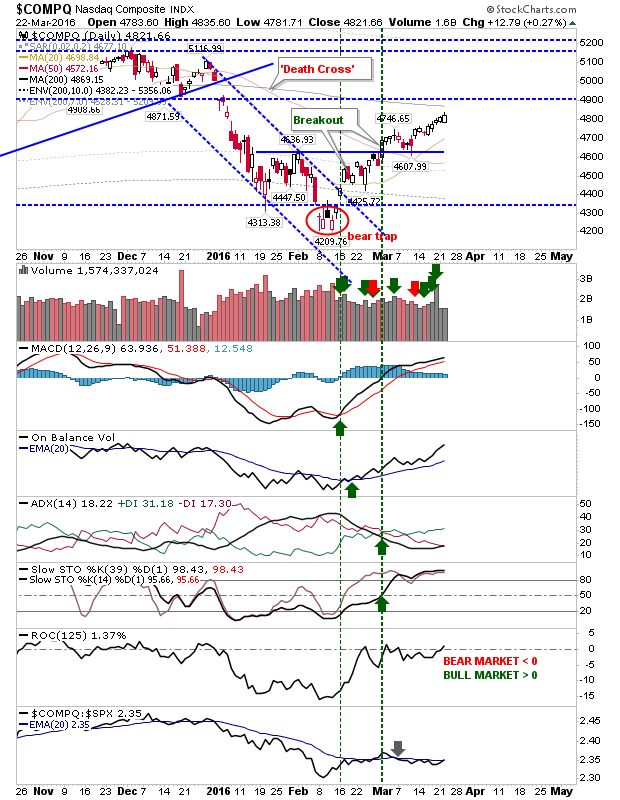

Not a whole lot to say about yesterday's market. The NASDAQ and NASDAQ 100 had the best of the action with further gains bringing these indices closer to their 200-day MAs, Gains and buying volume were modest, so there is little more to add other than yesterday marked the fifth consecutive gain in a row for the NASDAQ.

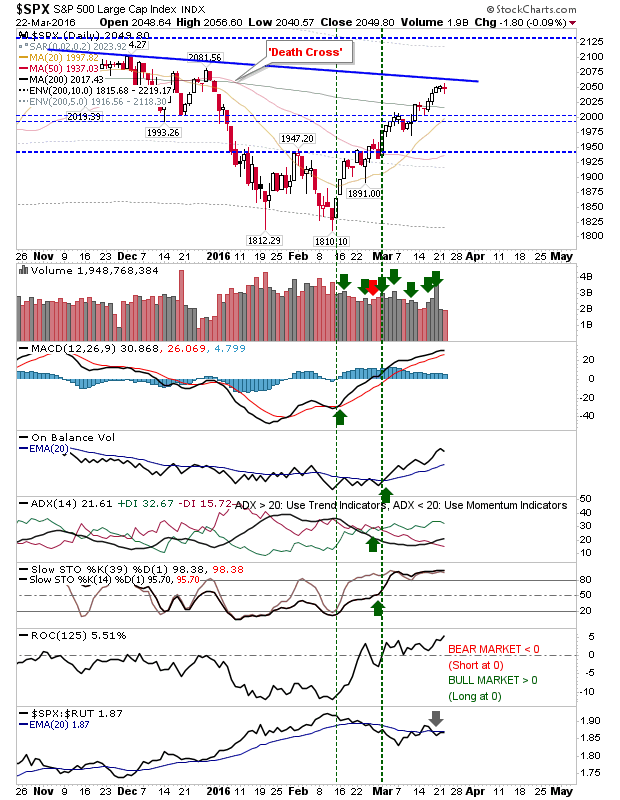

The S&P finished with a neutral doji. The index hasn't yet challenged declining resistance connecting November/December highs and until this happens, shorts will have an angle to work.

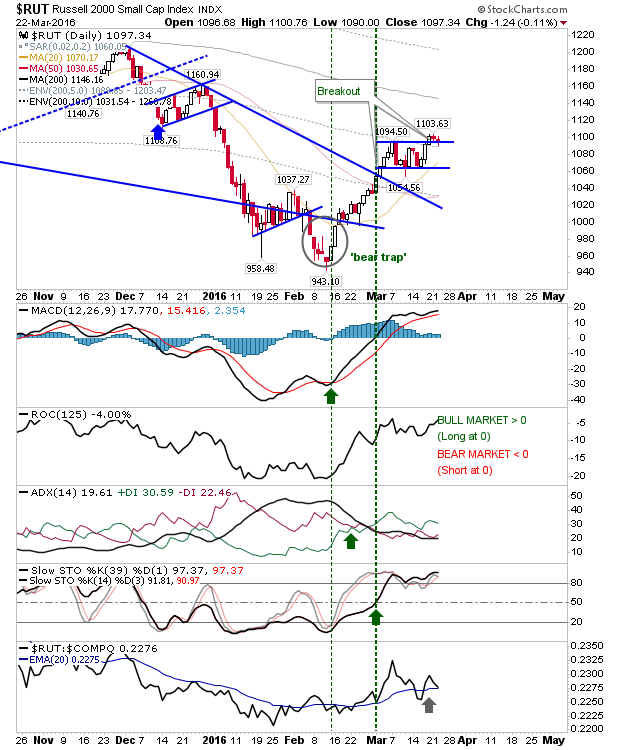

The Russell 2000 is nursing its breakout, and two days of losses haven't done enough to break the back of bulls. ROC is holding to the bear side of the argument and if bulls are to win the long term argument they will need to break the zero line of ROC. Meanwhile, relative performance is shifting back in favour of bears.

Today, ideally, we will see something more positive from speculative Small Caps. Otherwise, bullish action in the Tech indices may not be enough to protect against further losses in Large and Small Cap indices.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.