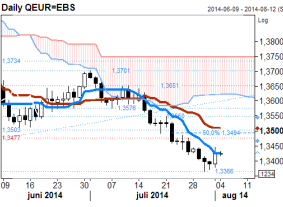

EUR/USD: Could recheck the high-1.34s

Last week ended with a potentially bullish 'Doji' candle for the period. Near-term price action also show some upside impulse and if bullishly distancing the still ascending 8day 'Tenkan-Sen' (1.3425), extension would become more likely towards resistance in the high 1.34s, including the slower 21day 'Kijun-Sen', now at 1.3505. Current intraday stretches are located at 1.3370 & 1.3465.

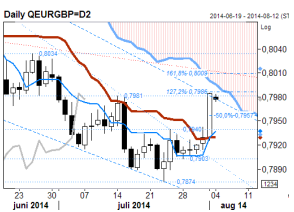

EUR/GBP: Buyers show initiative, targets 0.8034

Buyers showed notable initiative late last week. Fri's mid-body point at 0.7957 should form support and once a cluster of resistance ref around 0.7980/90 is taken out, the bar should be lifted towards a late Jun reaction high at 0.8034 (with some resistance of 0.7996/09 to observe on the way). More support is found at 0.7940/30. Current intraday stretches are located at 0.7940 & 0.8000.

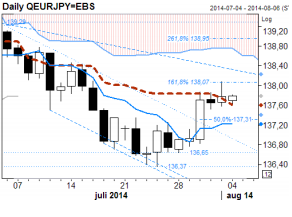

EUR/JPY: Sellers response noted at Fibo level

Sellers responded at at a short-term 161.8 % Fibo projection ref (138.07) Fri. This may inspire some selling first thing, but with presumably good support at 137.31/20 selling shouldn't last long (support already at 137.57/52 could be enough to keep sellers at bay). A move through 138.07 would target 138.95, with refs at 138.30 & 138.75 to observe. Current intraday stretches are located at 137.25 & 138.25.

AUD/USD: Cushioned by the 0.93 support

Current unable to hold on to moves below the 0.9300 support the pair has entered what we label as a minor congestion / correction phase. There is room for some short-term additional gains towards 0.9363 but probably not much more. In the bigger picture the topside failures (above 0.9460) and the monthly bearish engulfing candle clearly impose downside risk.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.