Stocks fell on Monday, June’s first day of trading, amid reports that the U.S. government is planning to target a host of big tech companies with antitrust and business practice probes. Shares of Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Apple (NASDAQ:AAPL) all weighed on the market during Monday’s session.

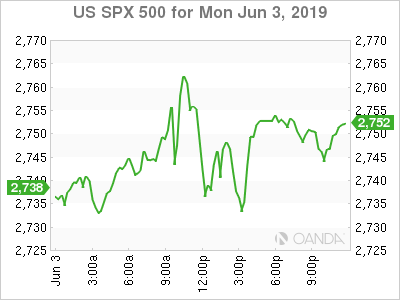

The Nasdaq Composite dropped 1.9% to enter correction territory, trading more than 10% below its record high set in late April. The Dow Jones Industrial Average declined by 100 points, while the S&P 500 slid 0.6%.

Alphabet shares pulled back 6.7% after reports said the Justice Department is preparing to launch an antitrust probe on Google. Meanwhile, Facebook dropped 7.7% after The Wall Street Journal reported the Federal Trade Commission would be able to look into Facebook’s practices and how they impact digital competition.

“The whole component of what’s going on in tech right now goes back to the rhetoric of Sen. Elizabeth Warren threatening to break up tech giants,” said Jeff Kilburg, CEO of KKM Financial. “We thought that was just rhetoric. But now with this news hitting, it’s really impactful.”

Amazon shares fell 5.4% after The Washington Post said an arrangement between the Federal Trade Commission and the Justice Department put the e-commerce giant under the FTC’s microscope. Apple also slipped 1.8% after Reuters reported the Justice Department received jurisdiction to investigate the company’s practices.

Communications services, consumer discretionary and tech were the worst-performing sectors in the S&P 500 on Monday. Communications dropped more than 2.5%, heading for its biggest one-day drop since late October, while consumer and tech both traded more than 1% lower.

“With the trade stuff going on, [big tech] has been a bit of a hiding place,” said Christian Fromhertz, CEO of The Tribeca Trade Group. “You just can’t hide right now.”

Chinese Vice Commerce Minister Wang Shouwen said in a white paper Sunday that Washington would not be able to use pressure to force a trade deal on Beijing. He also refused to say whether the leaders of both countries would meet at the G-20 summit to work out an agreement later this month.

Wang added: “The U.S. has backtracked, and when you give them an inch, they want a yard.”

The remarks from Wang follow a month of heightened trade tensions between the world’s largest economies. The U.S. hiked tariffs on $200 billion worth of Chinese goods in May. China retaliated with higher tariffs on U.S. imports.

“This issue with China continues to be the big elephant in the room,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab (NYSE:SCHW). “If the two sides, China and the U.S., break down on these negotiations, we could see a 10% correction. We’re more than halfway there already and talks haven’t broken down yet.”

“There just aren’t a lot of things out there to drive the market so this issue continues to be the pivotal point,” Frederick said.

Shares of Boeing (NYSE:BA), a trade bellwether of global trade, fell 1.8%.

The benchmark 10-year U.S. note yield fell its lowest level since September 2017. Gold prices climbed to their highest point since late March, breaking above $1,320.

Trade worries also rattled Wall Street last week after President Donald Trump threatened to slap a 5% charge on all imports from Mexico. The threat sent stocks tumbling on Friday.

U.S. manufacturing activity in the U.S. fell last month to its slowest pace of growth since October 2016, according data from the Institute for Supply Management. The pace of expansion also disappointed economists polled by Refinitiv.

St. Louis Federal Reserve President James Bullard said Monday that a rate cut “may be warranted soon ” given the risks of rising trade tensions.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.