European stock market: UBS raises conviction as Q2 earnings season approaches

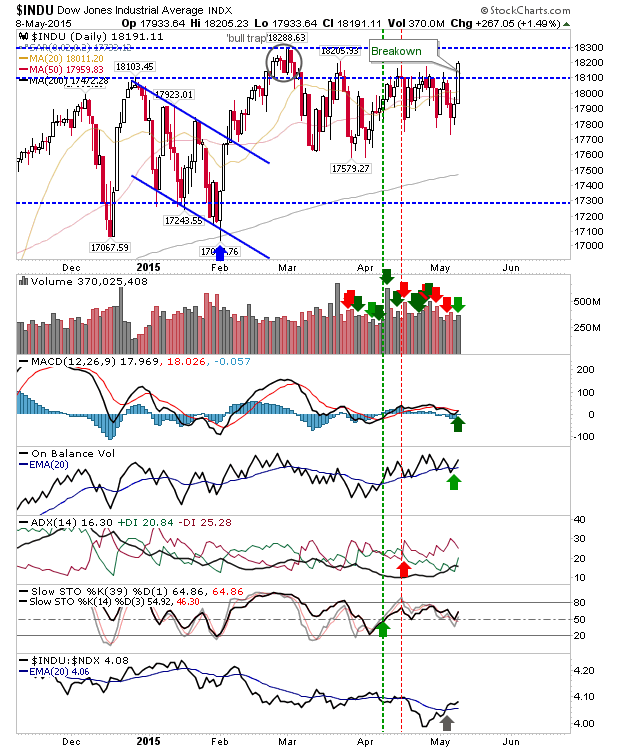

Star of Friday was the Dow Jones Industrial Average as it cleared congestion dating back to March, although there is still the 'bull trap' from February to clear. Volume climbed to register as accumulation, and it came with a MACD trigger 'buy' and On-Balance-Volume 'buy' trigger.

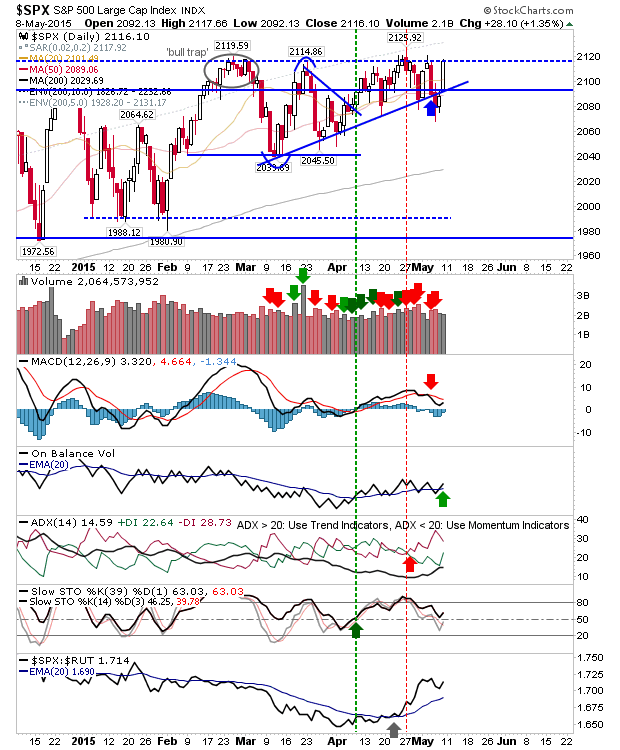

The S&P 500 came close to an all-time breakout, but it finished just below a confirmed break of resistance. Technically, it's still working on MACD trigger 'buy', but it did have an On-Balance-Volume 'buy' to back Friday's action.

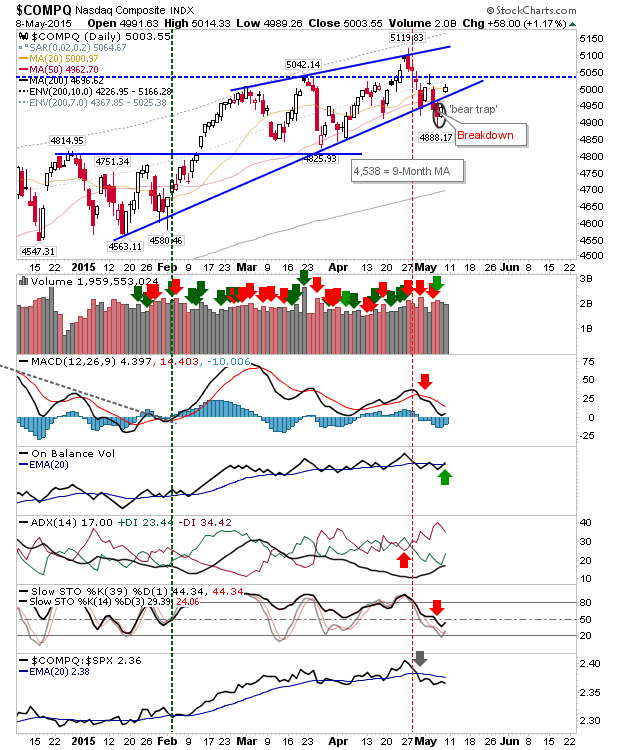

The NASDAQ created a potential 'bear trap', although a move into Friday's gap would not be unreasonable. Ideally, a spike low (i.e. a Monday close near day's high) would confirm bullish strength. Shorts may take a look at 5042/50 as part of a bearish head-and-shoulder pattern.

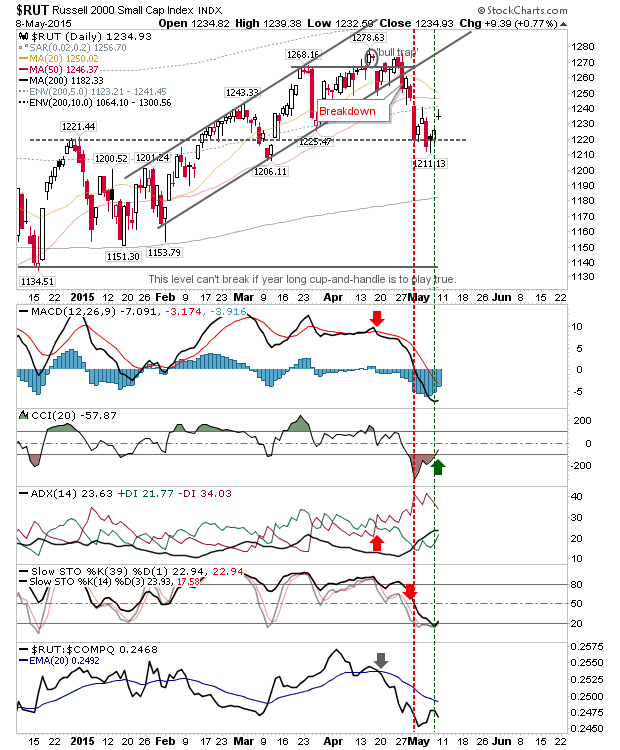

The Russell 2000 remains pegged by 1240 resistance, having failed to build on its opening gap. Shorts may find joy on Monday, particularly if pre-market action is weak. A move to the 200-day MA looks favoured at this time.

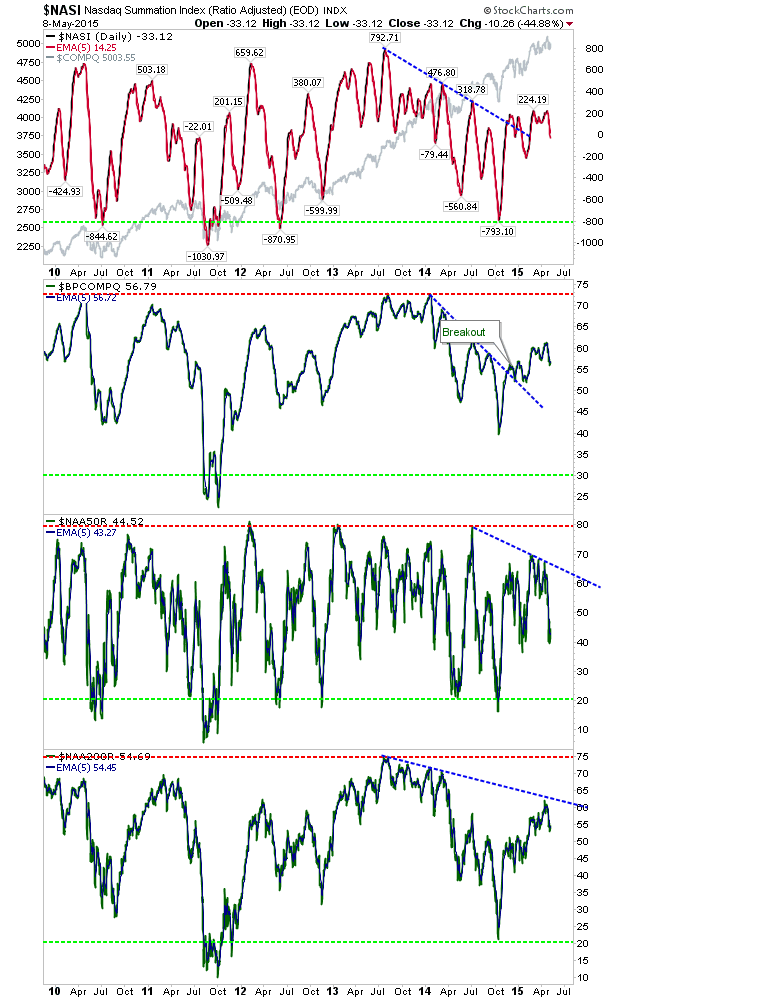

Bulls may need to worry about the negative divergence in breadth. Both Percentage of Nasdaq Stocks above 50-day and 200-day MA are in decline, and attempted breakouts in Nasdaq Summation Index and Bullish Percents have struggled to gain traction (and are well off highs).

For Monday, shorts should watch the Russell 2000 while bulls should watch the S&P - particularly if the Dow is able to maintain its breakout.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.