BofA warns Fed risks policy mistake with early rate cuts

Talking Points:

- US DollarMay Have Counter-Intuitive Response to Dense Data Docket

- Aussie Dollar Down on Risk Aversion, NZ Dollar Upheld by Trade Report

- See Economic News Directly on Your Charts with the DailyFX News App

A relatively quiet European economic calendar seems unlikely to generate much interest, with traders looking ahead to a busy docket of US data releases due later in the session. November’s Durable Goods Orders, New Home Sales, and PCE inflation figures as well as the final revision of the third-quarter GDP reading are on tap. Yesterday’s Existing Homes Sales disappointment notwithstanding, US economic news-flow has improved relative to consensus forecasts over the past month. That opens the door for an upside surprise, which may boost Fed interest rate hike expectations.

Typically, one might suspect that a hawkish shift in investors’ outlook for Fed policy might be supportive for the US Dollar, but that is not necessarily a given in the weeks ahead of the calendar year end. The greenback’s confident advance on the back of looming Fed stimulus withdrawal was one of the defining market themes in 2014. Needless to say, that means the markets have had ample opportunity to price in the evidence available thus far. Meanwhile, worries about the impact of Fed tightening on risk appetite in the year ahead may fuel profit-taking on sentiment-geared positions. If that helps engineer a sizable decline in USDJPY amid short-Yen carry trade liquidation, the move may spill over into broader-based Dollar weakness elsewhere.

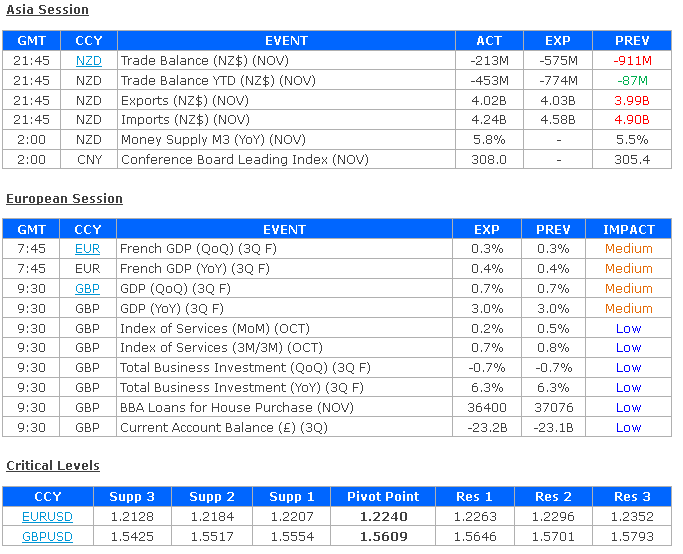

The Australian Dollar underperformed in otherwise quiet overnight trade, falling as much as 0.2 percent against its leading counterparts. A dip in risk appetite may have been the catalyst behind selling pressure. Asian bourses (excluding Japan, where markets are closed for a holiday) fell 0.2 percent on average, putting pressure on the sentiment-sensitive Aussie. The New Zealand Dollar fared better after Trade Balance figures revealed a smaller than expected 12-month deficit of –NZ$453 million. Economists were calling for a –NZ$774 million shortfall ahead of the release.

Which stocks should you consider in your very next trade?

Successful investors know to check multiple angles before making their move. InvestingPro's three powerful features work together to give you that edge:

ProPicks AI runs 80+ stock-picking strategies, including Tech Titans, which doubled the S&P 500's performance in just 18 months!

Fair Value combines 17 proven valuation models to help you spot overpriced stocks and undervalued gems.

And WarrenAI delivers instant insights on any stock. Ask questions, get vetted answers backed by real-time data (unlike ChatGPT).

Our subscribers use all three to identify stocks before double-digit gains and avoid costly mistakes.

But with 50% during our Summer Sale, even if you only use one of these features the value pays for itself. Sale ends soon—don't wait until prices go back up.

Save 50% while you can