The moves from Bernanke’s dovish speech on Tuesday evening were slowly retraced for most of Wednesday ahead of the FOMC meeting minutes, but the ECB stole the Fed’s thunder somewhat just ahead of that with reports of a potential negative deposit rate, which caused EUR/USD to tumble sharply. The FOMC meeting notes then showed a change of rhetoric, to include considering a taper in the ‘coming months following better data recently’. Bernanke has been saying for a long time that he expected a taper this year, so this should hardly be news but it seems that the combination of the two fundamental events may have shifted market bias slightly.

Overnight this shift in market sentiment was added to by the BOJ which reaffirmed the massive stimulus program and gave quite a rosy outlook for the economy, which caused a large rally in the Nikkei, weakening the yen at the expense of the dollar.

Thursday sees a raft of European PMI data releases which if excellent could see some retracement of the recent drop for the Euro, although we will have to wait and see if this is the beginning of a more meaningful move.

USD% Index

We have broken out to the upside in the index following the FOMC and ECB fundamental events. We need continuation of this move to confirm a break of trend. It seems strong enough to follow through although the markets have struggled with continuations recently. RSI is above the 100 period moving average which suggests upside I am cautiously bullish USD

USD% Index Resistance (EUR/USD support): EUR/USD 1.3413, 1.3389

USD% Index Support (EUR/USD support): EUR/USD 1.3467, 1.3491, 1.3500

EUR% Index

The threat of a negative deposit rate fromt eh ECB has broken the weak bullish trend although the current low remains intact, as such we need continuation lower to act as confirmation of a break of trend, since it is still possible for this to go either way, particularly if we see a return to form for fundamental data from the Eurozone or some retracement of the recent dollar moves.

I am cautiously bullish EUR while above recent lows

EUR% Index Resistance: EUR/USD 1.3540, 1.3600

EUR% Index Support: EUR/USD 1.3356, 1.3300

JPY% Index

The BOJ Monetary Policy Statement and press conference has triggered a bullish breakout again in USD/JPY and the Nikkei, so further upside continuation is expected, although this is purely a central bank continuation of stimulus move with the fundamentals in Japan still less than impressive, despite the rosy outlook from the BOJ, which makes for jittery bull runs at these elevated levels.

I am bullish JPY

JPY% Index Resistance (USD/JPY Support): USD/JPY 100.32, 100.15, 100.00

JPY% Index Support (USD/JPY Resistance): USD/JPY 101.00, 101.38

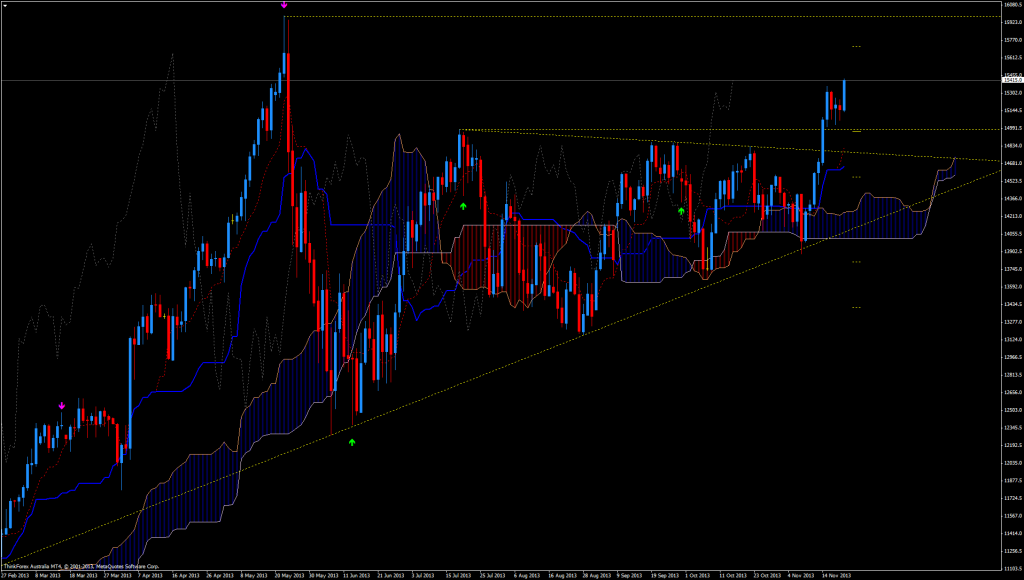

Nikkei 225 Futures

GBP% Index

The pound has broken through the top of the flag formation briefly however this has been very quickly stamped on and has posted quite a bearish daily candle in the process, bringing us back below resistance, which could suggest further downside from here. This could get quite messy though since momentum and sentiment is definitely to the upside still Outlook is neutral GBP

GBP% Index Resistance: GBP/USD 1.6147, 1.6200, 1.6250

GBP% Index Support: GBP/USD 1.6095, 1.6023

AUD% Index

Another failed rally from the Aussie has pushed us back inside the bearish channel. if we see a continuation of dollar strength this down trend will continue. There are further grumbles from the RBA suggesting discontent at the Aussie being so high so a return to dovish policy may be on the cards at the next meeting I am cautiously bearish AUD

AUD% Index Resistance: AUD/USD 0.9337, 0.9389, 0.9400

AUD% Index Support: AUD/USD 0.9300, 0.9266, 0.9255

CHF% Index

Although the Swiss Franc has also fallen in sympathy with the Euro, the drop has not managed to break the wide bullish channel so a recovery from here, perhaps triggered by good Euro PMI data could still be possible. Otherwise, a break of support cold signal a shift to bearish bias. I am cautiously bullish CHF

CHF% Index Resistance (USD/CHF support): USD/CHF 0.9150, 0.9130, 0.91000

CHF% Index Support (USD/CHF resistance): USD/CHF 0.9193, 0.9200

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI