Welcome Traders to this new weekly feature where we will check in with all things Commodity-related, specifically focusing on gold, WTI Crude, and the two primary Commodity correlated FX pairs AUD/USD and USD/CAD.

In the weekly updates, we will cover the fundamental drivers moving the markets in the commodity world. We will also use technical takeaways from the charts and sentiment reads from the weekly COT reports culminating in the identification of potential premium trading locations for the week ahead.

Commodity Causality

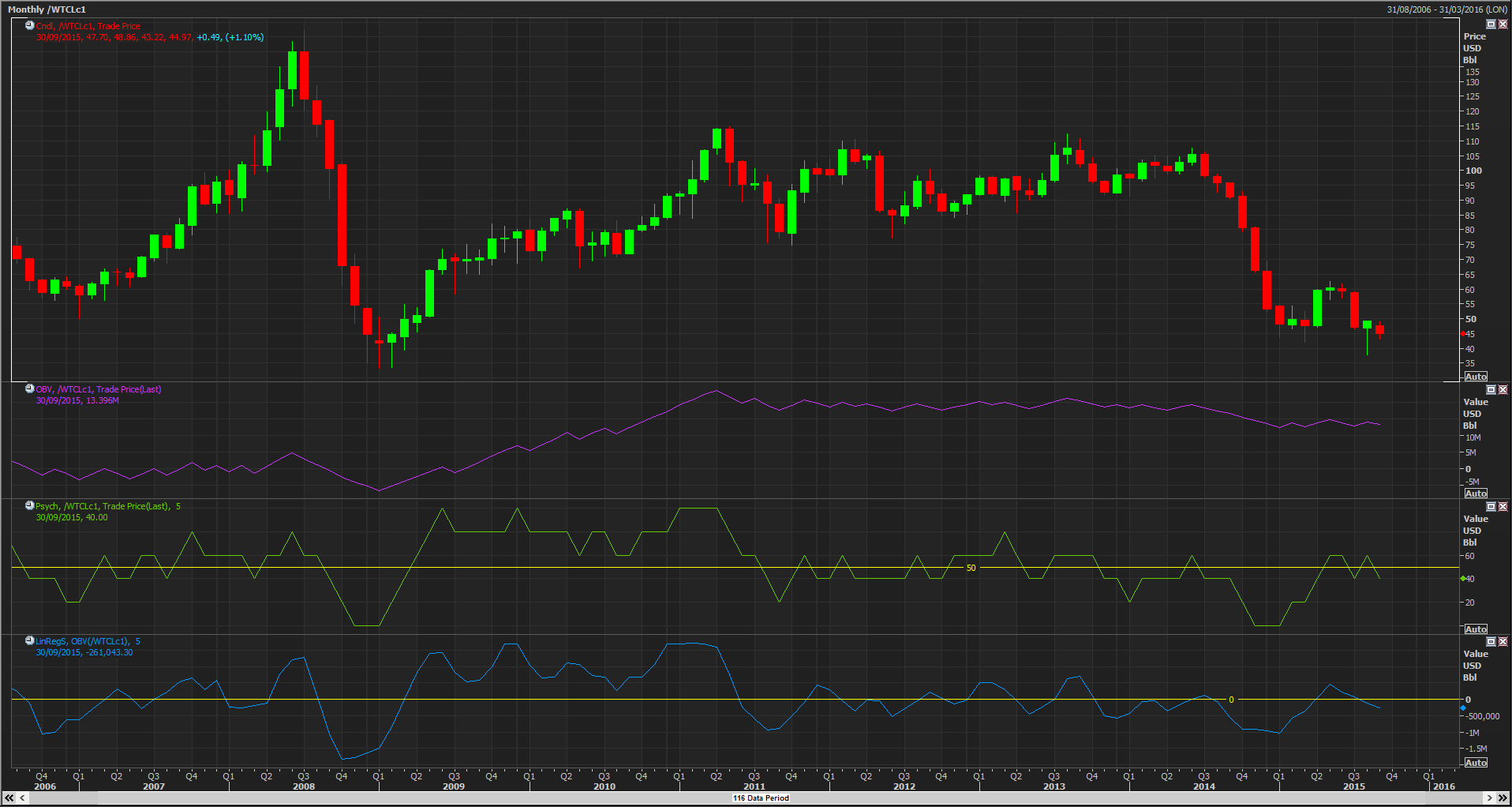

To date, 2015 has witnessed a vicious decline in commodity prices and the related FX pairs AUD and CAD. (Both the Australian and Canadian economies are heavily reliant on commodity production and distribution for a larger percentage of their GDP) The current declines in both gold and crude prices rank among some of the most sizeable bear market moves recorded in the instrument’s history.

Demand Destruction

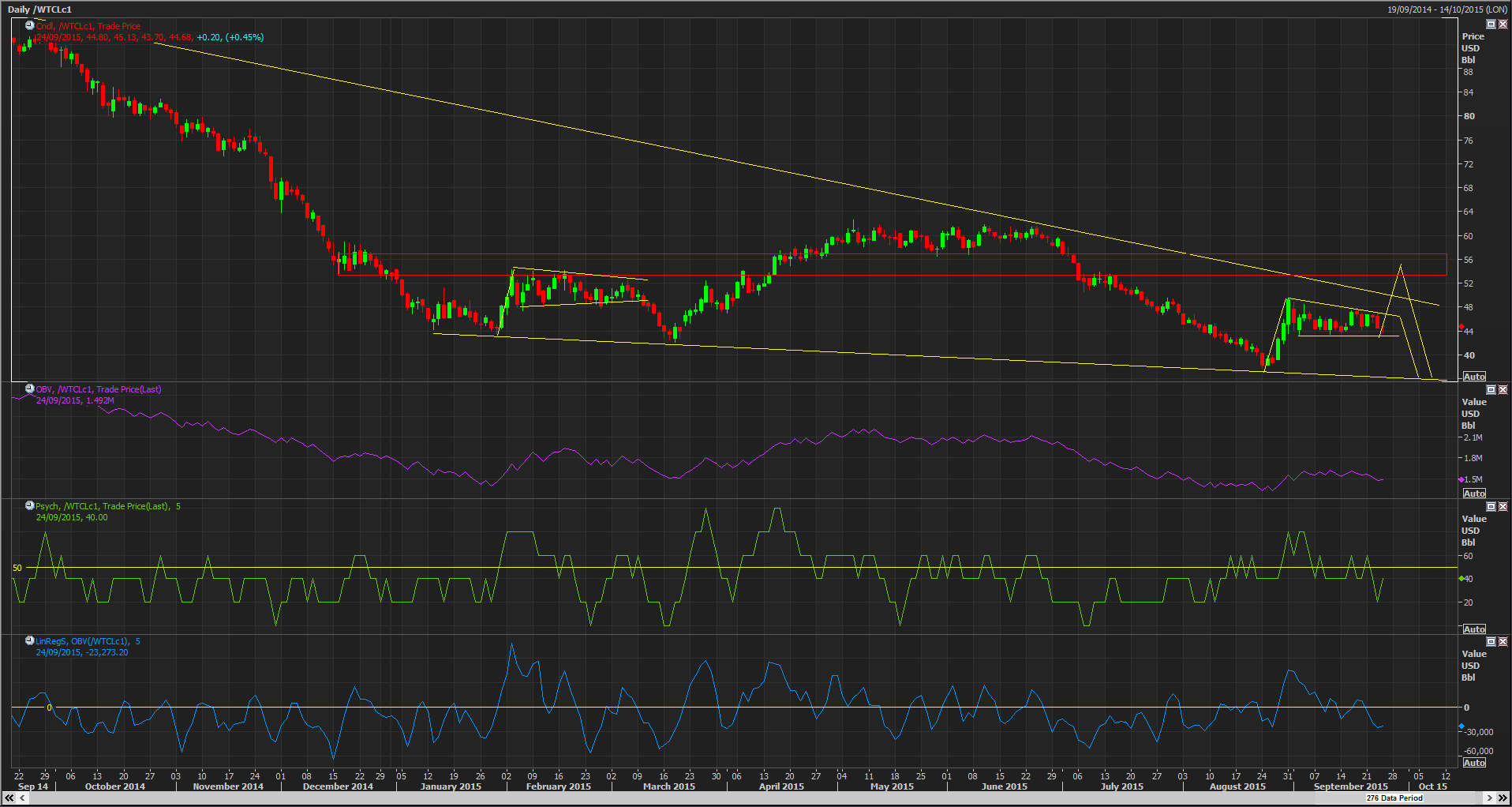

Crude markets have been hammered this year. The primary driver was the emergence of the shale drilling market in the US. The development of this new supply is shifting the market structure from being demand driven to an over supply story. The lack of willingness to act among OPEC nations has underlined the shift in the market structure. Most oil producers are struggling to make profits at current levels but reluctant to act on quota’s, this is indicative of the fact that the swell in supply and over capacity of rig counts leaves the market suffering from the age old cure for lower prices… being more lower prices.

Anticipation of US interest rate rise

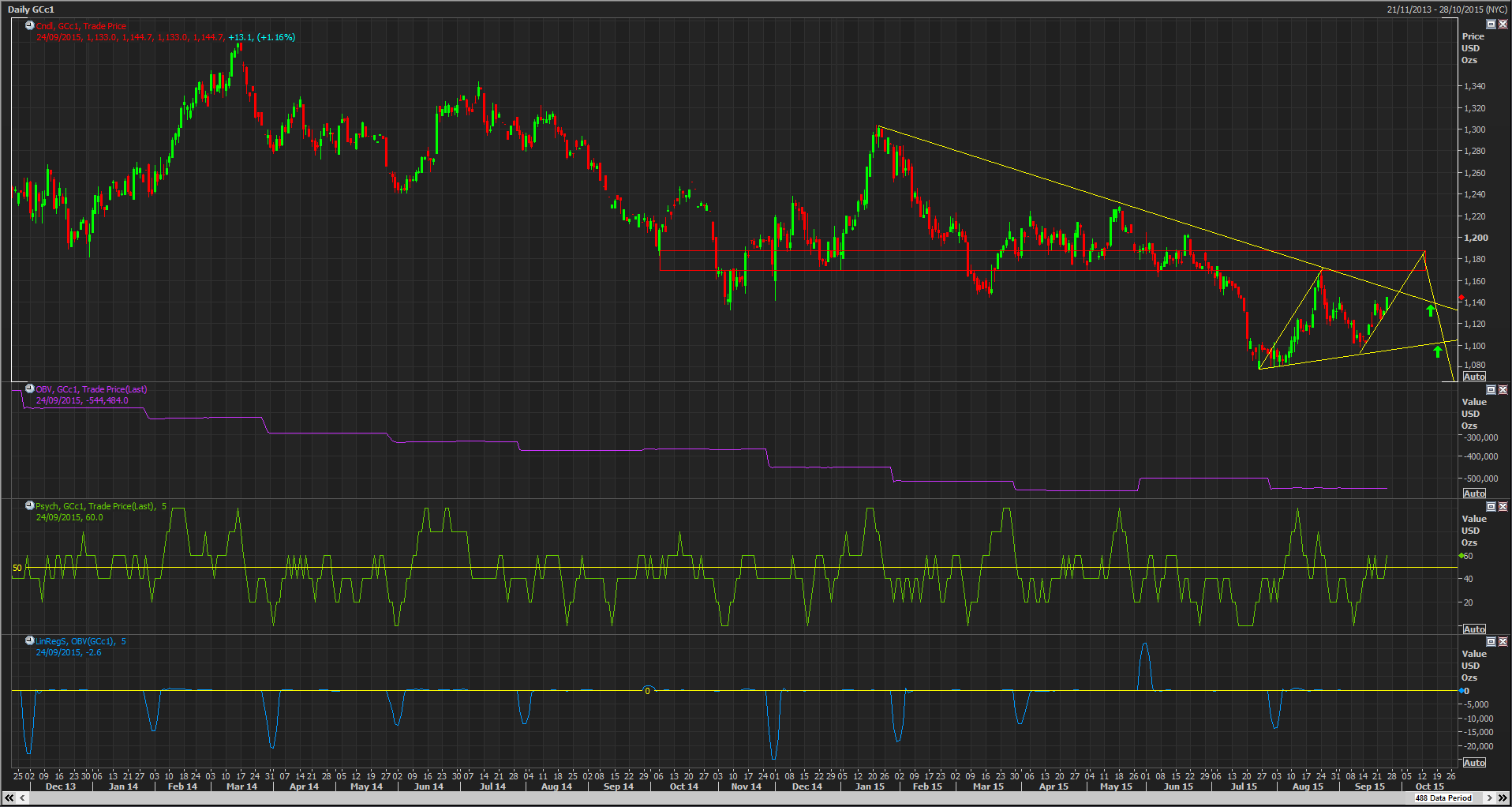

As with most asset markets today the US Federal Reserve is an important factor in the fundamentals of most markets, and gold is certainly a market of note. As interest-rate yields gravitated higher this year, gold prices moved in the opposite direction. With the FED on hold for now and posturing suggesting a significantly lower glide path for rate increases if and when they occur. This environment could see a bid return to the gold market as investors seek less crowded trades and yield advantages sought in alternative safe-haven markets outside of US treasuries.

With both Commodity and Commodity FX prices already taking the brunt of the recent USD bid and with growing anticipation of a US rate move, it is conceivable that any further delay or disappointment could see at least a relief bid return to these markets.

From a positioning perspective COT data suggests that interest in the gold market is significantly reduced and has flipped net bearish in recent months. So with traders positioned short into a market that has already witnessed some sizable declines on a historic basis there is certainly the potential for some stabilization at a minimum.

Commodity FX Casualties

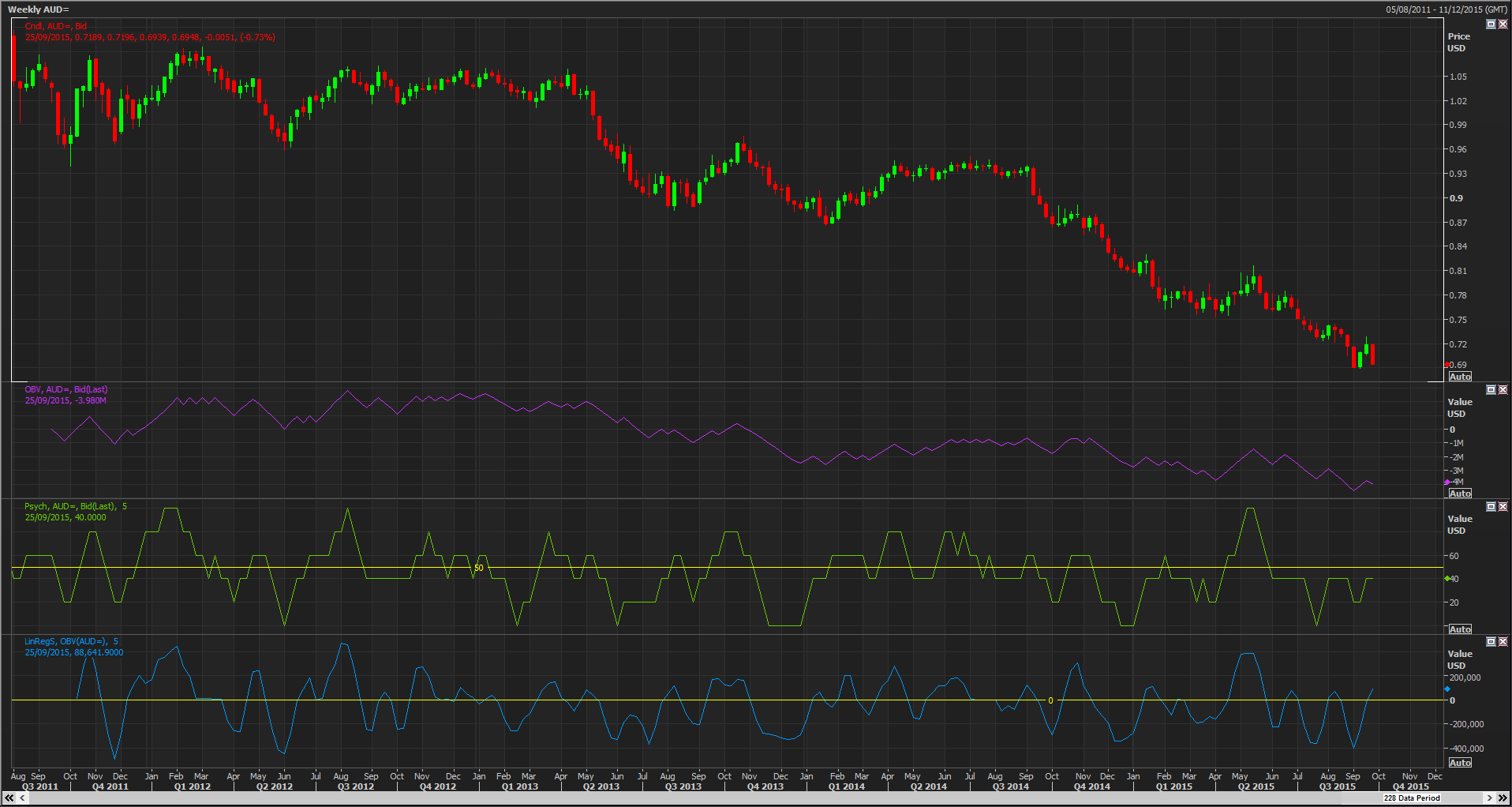

As one can reasonably expect, the precipitous declines in headline Commodities and the subsequent strength in the USD have played havoc in the AUD and CAD markets. With both the AUD and CAD registering respective six-year lows this year.

Aussie, Watch Out DOWN Under

The Aussie has been one way traffic this year as it has faced significant headwinds. Domestically the RBA got the bear ball rolling expressing distinct concerns about the level of the currency. The RBA stated publically on several occasions they would be more comfortable with certain trading levels, initially in the mid 80’s they then suggested the mid 70’s was their preference to help fuel domestic demand and aid exports demand.

As is often the case the market over shoots Central Bank targets, and in this instance the core catalyst for the over shoot has been the dire data out of China sparking global concerns over growth. With the Aussie trading as a China proxy, we have recently taken out the psychological 70 level. As with the Commodity COT data, the Aussie COT report suggests that the market is once again positioning for another leg lower

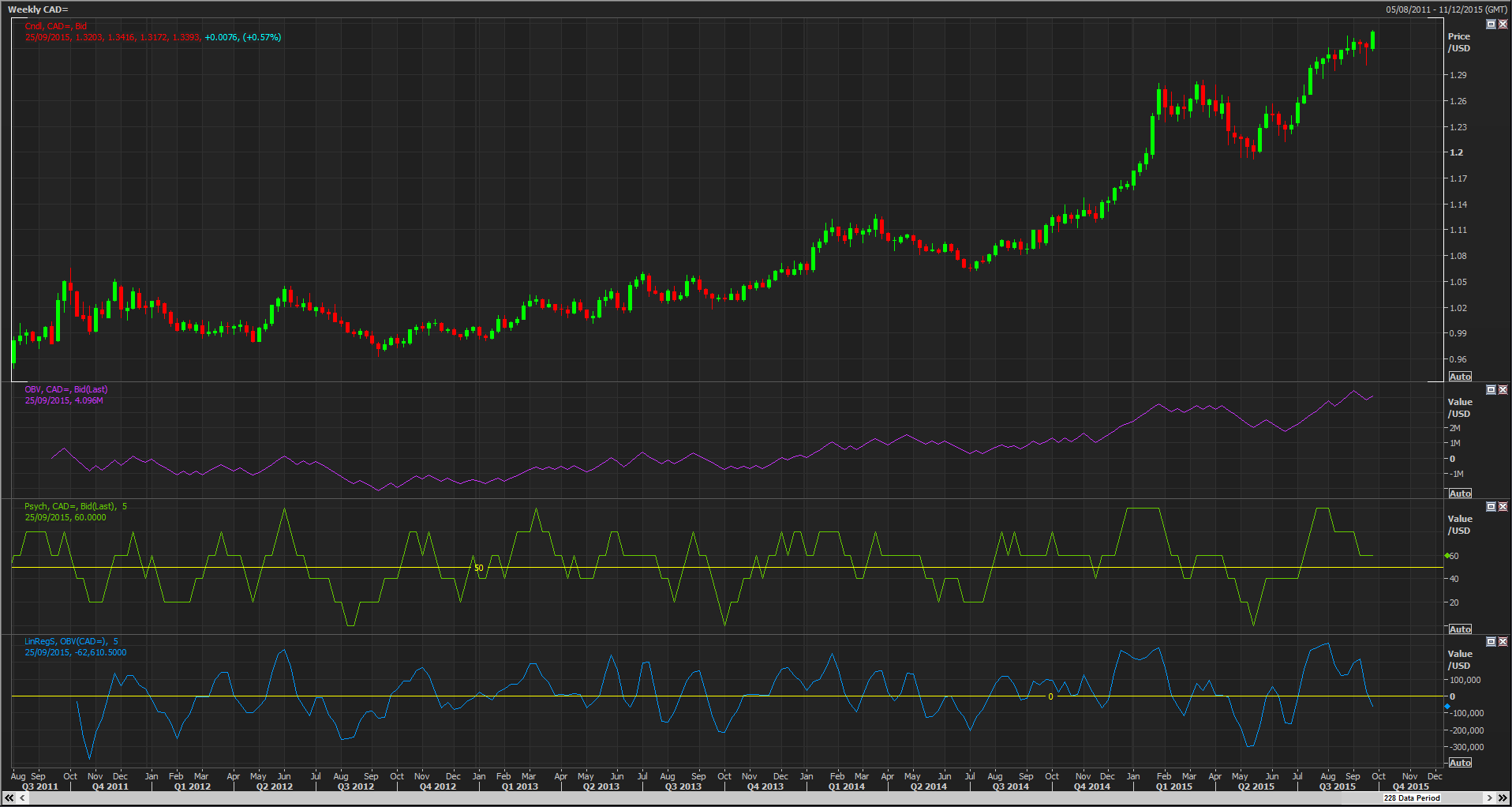

Loonie Losing Its Legs

As with its Antipodean counterpart the Loonie has had a disastrous 2015 especially for those unwittingly trying to fade the CAD decline. The Loonie tends to trade in tandem, although inverse, to the WTI Crude price with the bulk of domestic export trade being Crude and associated energy products. Much like other Oil production dependent nations Canada has fallen foul of the emergence of its America partners as a reliable and abundant energy supplier. The increase in supply has been exacerbated by a lack of demand driven by global growth concerns. The fall out has been widespread leading to the domestic economy falling into a technical recession for the first time since 2009.

The Bank of Canada made a preemptive rate cut earlier in the year that weighed on the CAD. With the recent panic over global growth and the potential impact that will have upon oil demand and pricing, it is conceivable the BOC may be back in play with further multistory rate cuts before year end. As with the Aussie recent COT data suggests that we should see further downside in the CAD.

What’s The Trade?

As we can glean from the high level fundamental review above and recent sentiment data derived from the COT report, we want to look for some trend continuation set ups in these instruments

Taking a look at the gold chart on the daily scale, we can see price made new lows for this cycle down towards 1080. Ithas since made a secondary low towards 1100, we now have the potential for price to make one more corrective high before resuming its downtrend.

- I will be monitoring the symmetry pattern suggested in the chart which would see price retesting the resistance pivot towards 1190. I will watch price action in this area for a reversal pattern to enter shorts targeting a retest of 1140 and then on towards 1100 using a stop above 1210.

Crude

As with its yellow metal counter part, black gold on the daily scale still looks technically weak. The recent breach of 40.00 saw some near term profit taking, you can see similarity in the price action witnessed back in January of this year.

- From a trading perspective I will be watching for a second leg of upside correction to enter short positions against the 55.00 resistance pivot. I will be targeting a retest of the potential broken trend line resistance around 48.00 then a retest of the August lows

Stay tuned for next weeks update, when we will review the recent fundamental and technical developments of the week impacting the Commodity trade. Next week we will take a closer look at technical trade set ups in the AUD/USD and USD/CAD

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.