Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

With interest in the quarterly China GDP announcement at 2:00 GMT tomorrow, we had a look back over the last four years (calendar 2011-2014) to see how markets moved between close of trade the day before release, and release date.

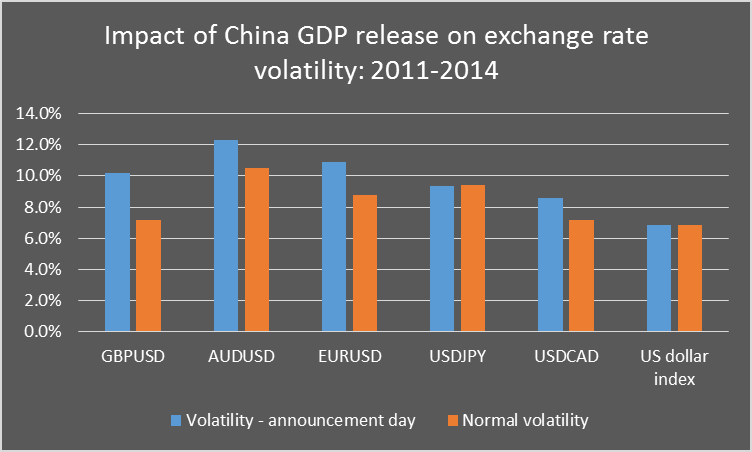

Exchange rate volatility showed a significant increase over the normal level on announcement date for GBP/USD (+40%), AUD/USD, EUR/USD and USD/CAD (each +20%). USD/JPY and the US dollar index showed relatively little change.

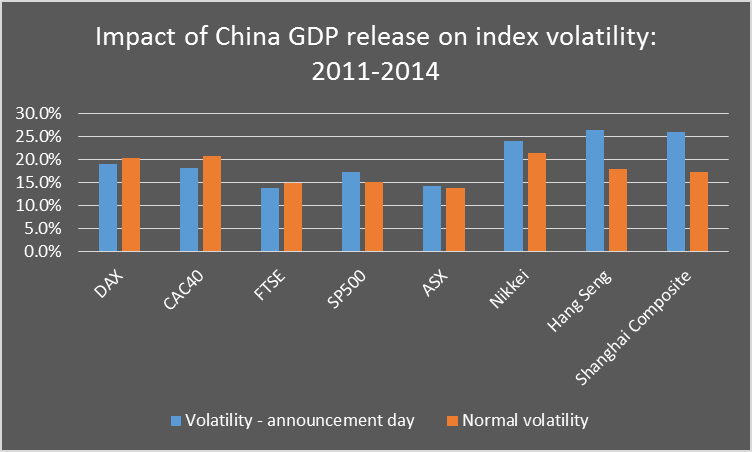

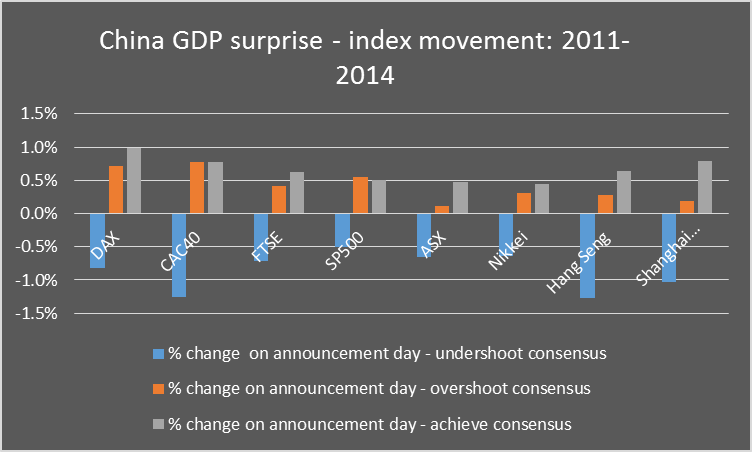

Comparisons for major stock indices follow. Not much impact on the Euro/UK area but watch the S&P 500 and Asia Pacific especially China/Hong Kong-

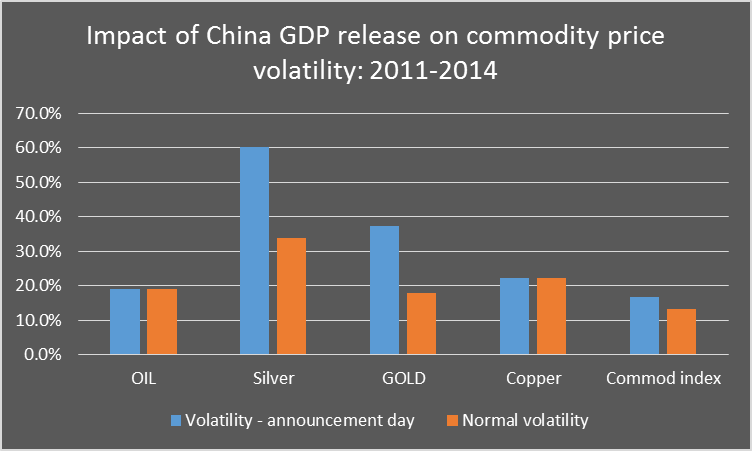

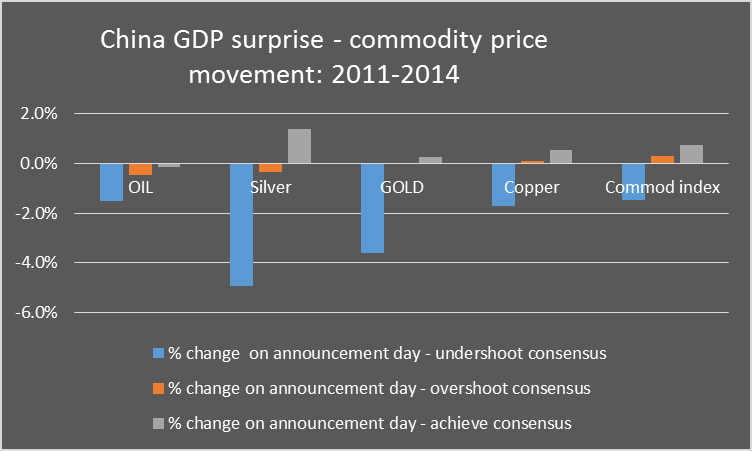

For commodities, we found substantial increases for silver, gold and the DJ UBS Commodity Index:

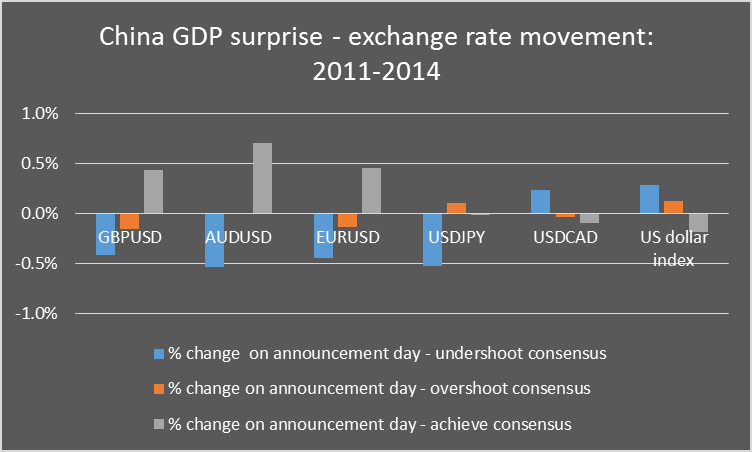

We then looked at the impact of surprises – the price changes applying to an announcement that exceeded consensus vs one that surprised on the downside.

Over the 16 quarters analyzed, eight came in above consensus, three came in below and five came in on consensus.

The outcomes for currencies were as follows. Undershooting consensus was generally favorable for the USD (except for USD/JPY) and a result in line with consensus tended to be unfavorable to the USD. Overshoots seemed to have relatively little impact.

For stock indices, we found:

Directionally the results are as would be expected with results coming in line with or above consensus driving up markets and undershoots pushing markets down. If anything, market outcomes were most favorable when results achieved consensus. Note the tendency for the indices to react more to downside surprises than results in line with or better than consensus.

Commodities reacted far more unfavorably to downside surprises than to in line or overshoot results. As would be expected, major reactions were in the opposite direction to the USD.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI