Nvidia shares jump after resuming H20 sales in China, announcing new processor

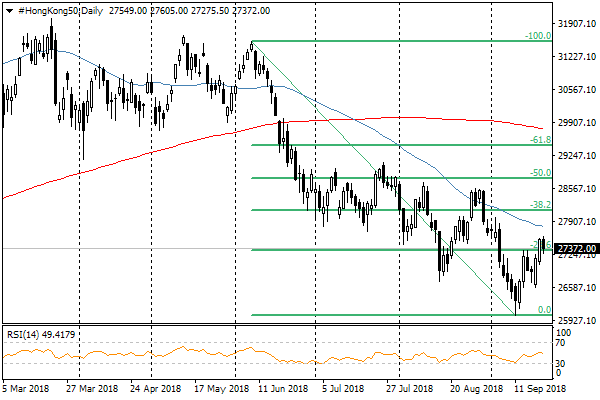

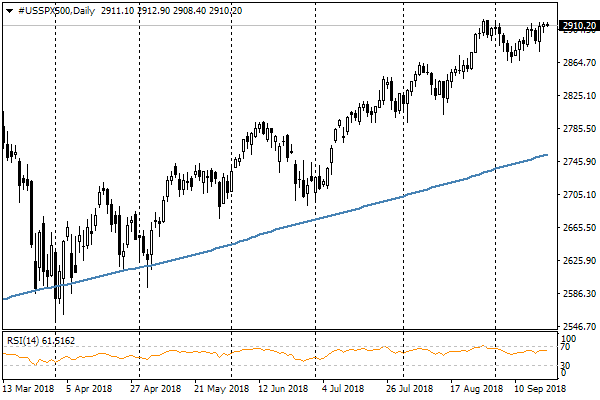

American markets ended trading on Wednesday with a slight increase. Asian bourses also experienced growth at the opening, but it was quickly replaced by increased pressure. As a result, at the time of writing Nikkei 225 loses 0.6%, Hang Seng has fallen by 0.8%. Futures for S&P 500 have lost 0.1% on Thursday morning, being near 2910 level, away from the intraday highs on 2913.

From the technical analysis perspective, the U.S. markets experience difficulties with growth on the approach to an important resistance level, from where the market turned to a correction at the end of August. Economic data also support the defensive tone of risky assets.

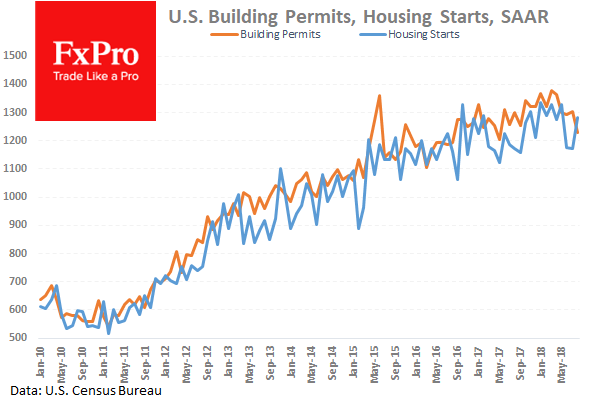

The number of building permits in the U.S. in August fell by 5.7%, and it is 10% lower than the peak levels of January, when the current trend on a decline was marked. The building activity indicators are often considered to be a reliable growth indicator of the consumer sentiment. And this reversal to a decline is a sign of the consumers’ wariness among the rising interest rates environment. It is also worth noting that the current permits volume is about a half of the peak levels of the last-decade construction boom.

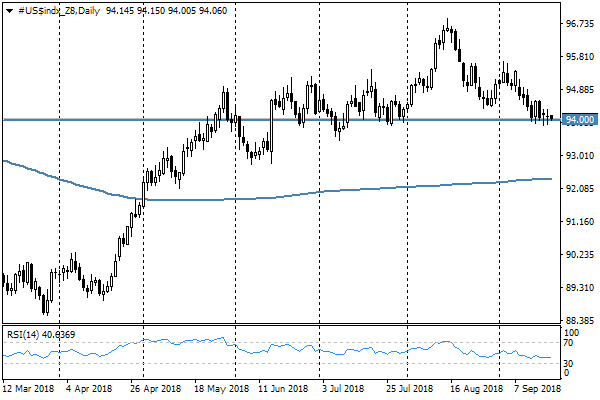

Let us add disappointing inflation rates, despite the rise in energy prices and tariff pressures. Current data does not undercut the possibility of two increases by the end of the year, supporting the dollar from falling. However, next year the Fed will probably have to act much more cautiously.

In the Asian markets, it also seems that the recovery rally has exhausted. After two days of growth, they turned to a decline, returning to the levels of the end of last week.

The housing market in the United States remains a focus of attention with the publication of sales in the secondary housing market, where, as in the construction, there has been a weakening of the indicators for the last few months.

In addition, the negotiations between the EU and Britain on Brexit and retail sales statistics can influence the demand for the risks. Yesterday the pound has gone from 2-month highs after the reports that the first day of the Britain and the EU Summit had passed without progress.

Alexander Kuptsikevich, the FxPro Analyst

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI