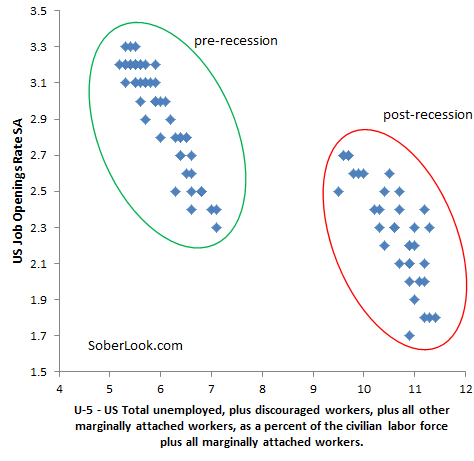

Mike Konczal suggested plotting the Beveridge curve using U-5 unemployment instead of the standard unemployment rate (discussed here) or the employment to population ratio (discussed here). Below is the definition:

U-5 Unemployment Definition: Total unemployed, plus discouraged workers, plus all other marginally attached workers, as a percent of the civilian labor force plus all marginally attached workers. Marginally attached workers are persons who currently are neither working nor looking for work but indicate that they want and are available for a job and have looked for work sometime in the recent past. Discouraged workers, a subset of the marginally attached, have given a job-market related reason for not currently looking for a job. Persons employed part time for economic reasons are those who want and are available for full-time work but have had to settle for a part-time schedule.

The post-recession U5 curve has more slope to it than the employment population ratio. That means the labor markets are responding to new job openings to a great extent by adding "marginally attached" workers. But even with this result, projecting post-recession trend to pre-recession high in job openings rate of 3.3% will result in U-5 of around 9%. The recent pre-recession low U-5 on the other hand was some 5.5%. That's a 3.5% increase in the "natural" U-5 unemployment rate (if such a thing could be defined). This is clearly a structural shift - no matter how one slices it.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.