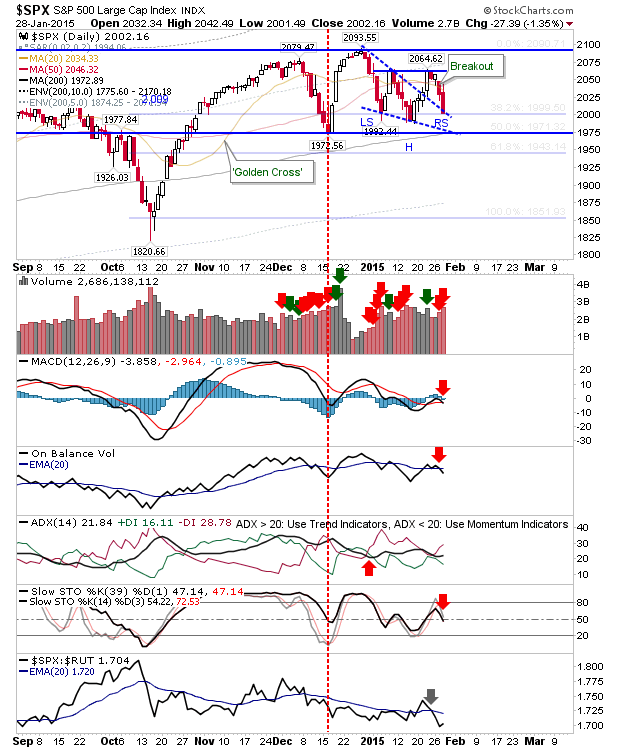

Tuesday's end-of-day losses were disguised by the relatively light declines at the close. Markets opened strong, but were unable to maintain pre-market strength. The consolidations in place since the 'Santa Rally' are holding on, but markets can ill afford additional losses from here on.

Yesterday, the S&P 500 finished on the 38.2% Fib retracement of the 'Santa Rally'. Aggressive longs may view this as a head-and-shoulder reversal; if this proves to be the case then markets have to rally from the open. The S&P is a case in point.

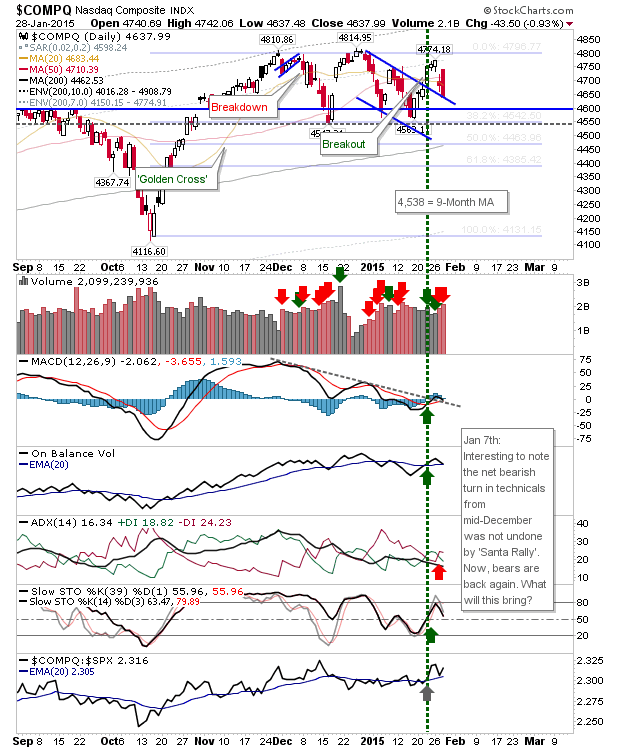

The NASDAQ experienced a very wide day; opening above its 20-day and 50-day MA, but finishing well below these moving averages, and on channel resistance-turned-support. Volume climbed to register distribution.

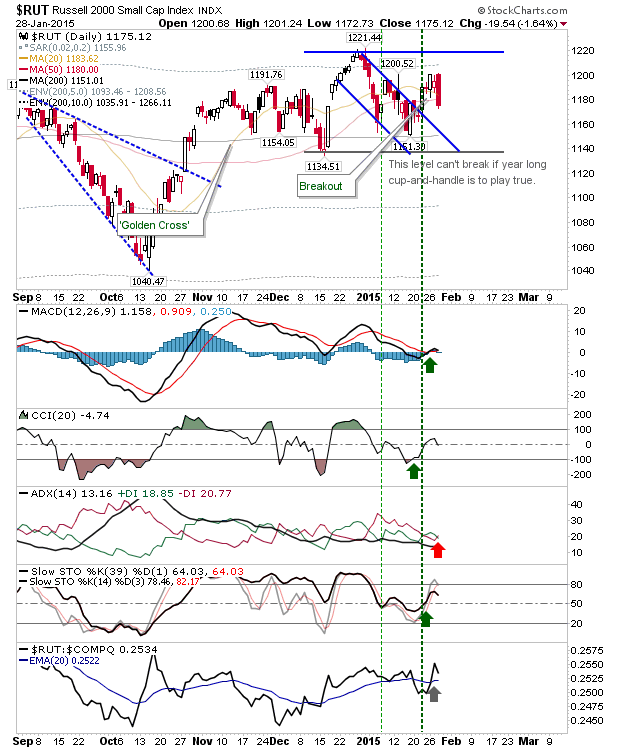

The Russell 2000 experienced perhaps the most challenging loss. In real terms, it didn't change the broader handle, and the individual action for the day was relatively minor, but it did succumb relatively easily to the decline. One to watch.

Keep an eye on these for today. Indices will need a bright start if winter consolidations are to take hold.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.