Slipping even further below 94c, the inhability to remain flat following positive data from China may not bode well for Aussie going forward.

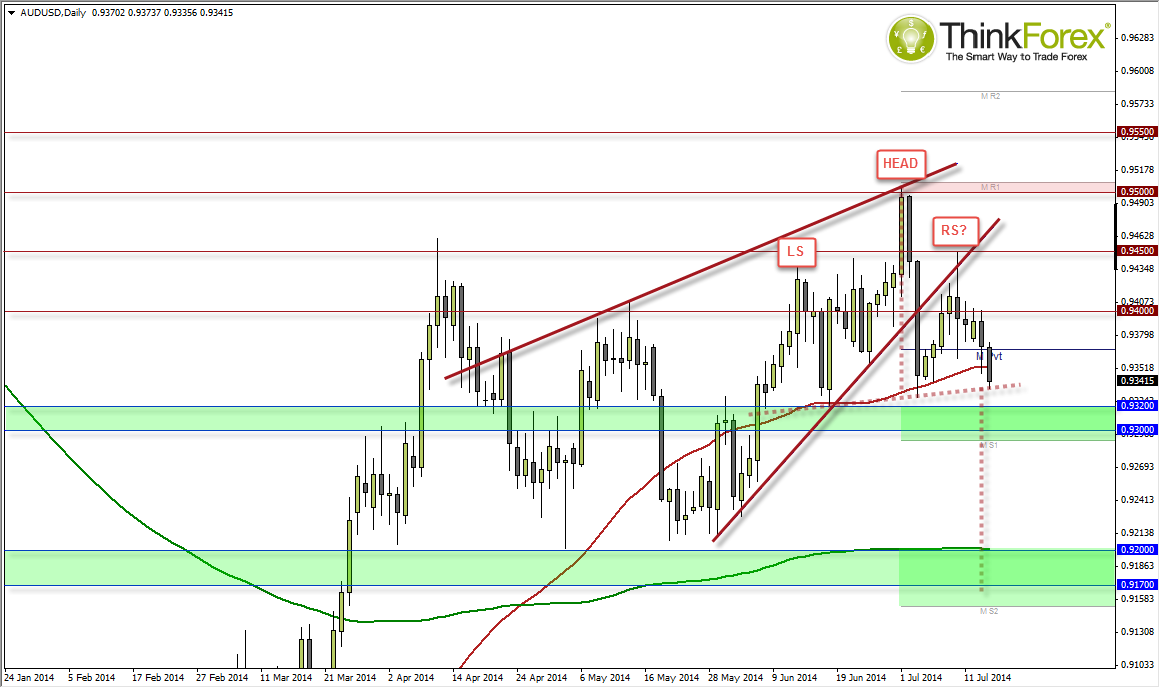

The previous post highlighted two bearish reversal patterns on W1 and D1, with a 3rd on the cusp of being triggered - a Head & Shoulders (H&S) reversal. The H&S projects an approximate target around 0.915. However, the bearish wedge target would come first at 0.917.

Yesterday's testimony commented that interest rates would climb earlier if the US sees continued improvement from employment and inflation. With FED Chair Lady Yellen speaking again tonight, any comments deemed 'not as dovish' as previous testimonies could be construed as 'hawkish enough' and see continued lust for the Greenback, weighing down on the increasingly fragile looking Aussie.

Price has recently crossed below the 50-day eMA and appears set to test 0.9328 and 0.9320. I expect we'll see some profit taking here resulting in the obligatory bounce. However if we break below 0.9320 then 0.930 should be quickly within its sites.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.