Stock market today: S&P 500 slumps as Trump tariff blitz triggers bloodbath

Talking Points:

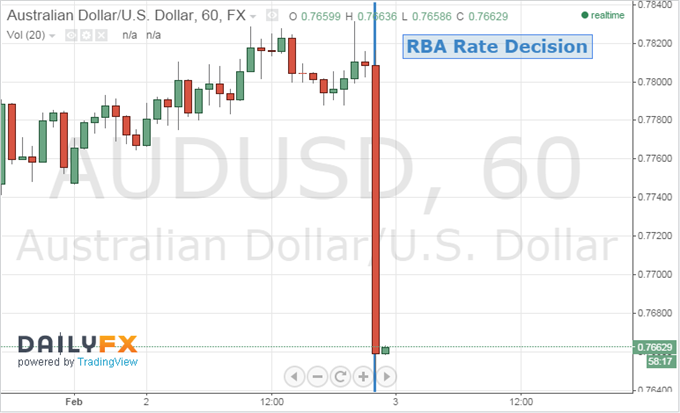

- Aussie Dollar heads for biggest drop since June 2013 at -1.6%

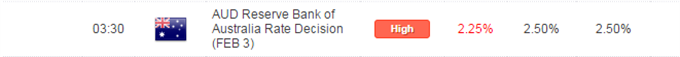

- RBA cuts rates to 2.25% vs 2.50% prior

- RBA says further rate cut was appropriate to achieve balanced growth

The Australian dollar declined over 1.6 percent versus the US dollar after the Reserve Bank cut rates by 25 basis points. Economists were expecting the bank to keep rates unchanged at 2.50 percent. Today’s change in monetary policy marked the first time the bank adjusted rates since August 7 2013, or 15 consecutive meetings.

Despite improving economic data out of Australia relative to forecasts, the Bank’s decision to cut rates was seen as appropriate to achieve balanced growth. There was overall negative sentiment on domestic demand growth, output growth, and unemployment rates from RBA. The board also mentioned that the Australian dollar was seen above most estimates of fundamental value. After the dovish statements made by the bank, market’s are pricing in an almost guaranteed 99% chance of a 25bps rate cut during the next rate decision.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI