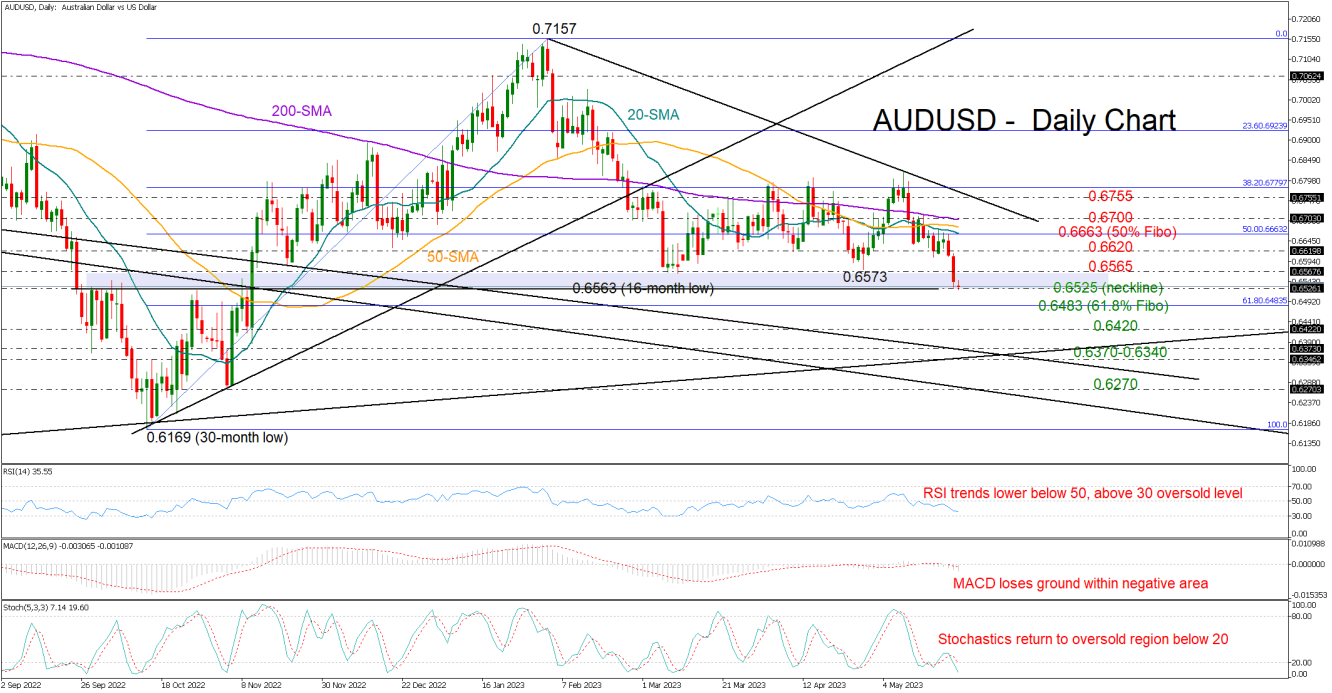

AUDUSD plummeted to a six-month low on Wednesday to find support around the key 0.6525 area, which is the broken neckline of the inverse head and shoulders pattern registered last Autumn.

From a technical perspective, the bearish wave has more room to run as the falling RSI has yet to reach its 30 oversold level, while the Stochastic oscillator has flipped backwards to re-enter the oversold region below 20. The MACD keeps decelerating within the negative zone, sending bearish vibes as well.

Trend signals are also discouraging, with the price having declined below its simple moving averages (SMAs) to violate the 0.6565 floor of the short-term range.

Should sellers claim the 0.6525 base, the pair may initially test the 61.8% Fibonacci retracement of the previous upleg at 0.6483 before falling aggressively towards the 0.6420 region taken from Autumn 2022 and May 2020. Even lower, the 0.6370-0.6340 territory could be of greater importance as the tentative support trendline from 2020 lows intersects the descending line from August 2021 within this zone. If the downfall continues, the next destination could be the 0.6270 bar.

On the upside, the bulls might need to overcome the 0.6565-0.6620 zone in order to challenge the 20-day SMA and the 50% Fibonacci of 0.6663. A decisive close above the 200-day SMA at 0.6700 could provide direct access to the tentative resistance trendline currently seen around 0.6755.

All in all, AUDUSD may experience more selling in the coming sessions, but for that to happen, the 0.6525 floor should collapse.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI