As reported by the Australian Bureau of Statistics on Wednesday, the wage index in the second quarter grew by 0.6% and by 2.3% in annual terms. The forecast was + 0.5% and + 2.2%, respectively.

The data were better than expected. However, this is not enough to accelerate inflation. RBA Governor Philip Lowe called slower wage growth and productivity a major economic challenge.

Earlier this month, RBA of Australia left the key interest rate at a record low of 1%, but gave a pessimistic forecast for the economy. RBA managing director Philip Lowe lowered the forecast for Australia's GDP growth in 2019 to 2.5% from 2.75% and added that unemployment is expected to drop to about 5% in the next two years. According to the RBA management, for the growth of salaries and acceleration of inflation to the target range, an unemployment rate of 4.5% or lower is required. Now unemployment is at the level of 5.2% and is gradually growing, but not decreasing, and the return of inflation to the middle of the target range of 2% -3% is not visible even on a distant horizon.

"It is reasonable to expect that a long period of low interest rates will be required to progress towards lowering unemployment and achieve steady progress towards the target inflation rate",

Lowe said after an RBA meeting in August.

On Thursday (01:30 GMT) data from the Australian labor market will be published. Most likely, in July unemployment remained unchanged at 5.2%.

The expectation of further easing of the monetary policy of the RBA puts pressure on the AUD in the direction of its further weakening.

Meanwhile, the US dollar strengthened on Tuesday after the publication of data on consumer inflation in the United States, which turned out to be better than forecast, and after the White House announced that it would postpone the introduction of new tariffs on imports of some Chinese goods until December 15.

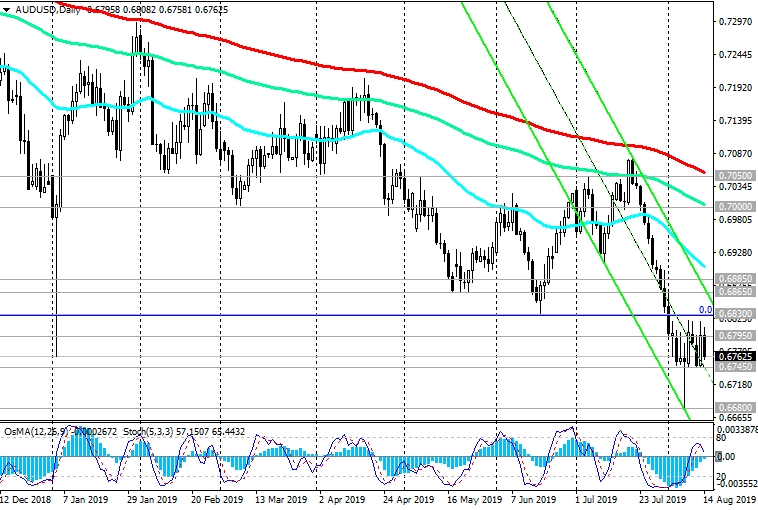

At the beginning of the European session on Wednesday, the pair AUD/USD is trading near the level of 0.6760. Negative dynamics prevail.

Entry into short positions is allowed "by the market". A possible correctional increase to the resistance levels of 0.6795 (ЕМА200 on the 1-hour chart), 0.6830, 0.6865 (May lows), 0.6885 (ЕМА200 on the 4-hour chart) will be an additional opportunity to resume sales of this currency pair.

We can return to the consideration of long positions only after the growth of AUD/USD to the zone above the resistance level of 0.6885 with targets located no higher than the key resistance level of 0.7050 (ЕМА200 on the daily chart).

In case of resumption of decline, the targets will be the support levels 0.6680, 0.6600. The distant target is located at support levels of 0.6260, 0.6000 (lows of 2008 - 2009).

Support Levels: 0.6745, 0.6700, 0.6680, 0.6600, 0.6300

Resistance Levels: 0.6795, 0.6830, 0.6865, 0.6885, 0.7000, 0.7050

Trading Recommendations

Sell by market. Sell-Limit 0.6795, 0.6825. Stop-Loss 0.6840. Take-Profit 0.6700, 0.6680, 0.6600, 0.6300

Buy Stop 0.6840. Stop-Loss 0.6790. Take-Profit .6865, 0.6885, 0.7000, 0.7050

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.