With the Australian dollar in free-fall recently, possibly the toughest decision an AUD bear has been faced with is which currency pair to short first?

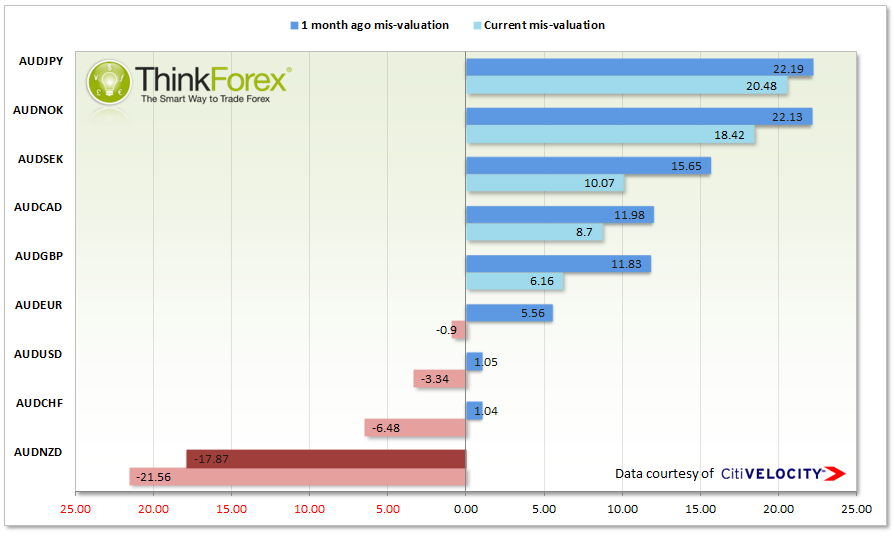

The data below has been taken using Citi Group's WERM (World Exchange Rate Model) and measures long-term fair value in currencies.

Using data derived from CPI-based Real Effective Exchange Rates, commodity terms of trade and net foreign assets over exports, I am yet to see if it is any more accurate than a 200-period moving average (as they look pretty similar when placed upon a chart). However it does provide some sort of benchmark for relative strength and hopefully provide clues for which pair could provide more tradable pips should the AUD continue to fall in value.

JPY, NOK and SEK dominate the 'overvalued' end of the chart, meaning the AUD still has quite some way to fall against these currencies.

However it is interesting to note that AUD/NZD is considered to be around -21.5% below fair value - especially when you consider we are approaching a long term support zone and potential cycle low.

And finally, EUR and USD are considered to be around their 'fair value' against the struggling AUD. This doesn't quite bode so well for my AUD/USD analysis which targets 0.8000 over the coming weeks. But then as the prices change, so will the fair values so I will stick to my technical guns as per usual.

So whilst we can see a very quick comparison for relative strength (or lack of...) let price be your guide.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.